Items Tagged with 'UPS'

ARTICLES

Move will help businesses take advantage of the Mexican manufacturing boom, UPS says.

Read More

Podcasts

The Logistics Matters podcast: John Lash of e2open on the new White House Council on Supply Chain Resilience | Season 5 Episode 25

Find out why the Biden administration has launched this new task force. Also: Regulations top trucking concerns; a shakeup in freight brokerage.

Read More

UPS sells off Coyote brokerage arm to RXO for $1.025 billion

Deal at a “very reasonable price” will vault RXO from the 8th- to the third-largest freight brokerage in North America.

Read More

Roadie launches same-day delivery for “big and bulky” goods

Service moves products directly from retailers’ distribution centers via cross-dock facilities, UPS unit says.

Read More

PARCEL EXPRESS

Parcel carriers look to turn the page

Faced with slumping demand, parcel carriers are casting their nets wide for new sources of revenue. Some of their strategies—like expanding their returns services and going after new e-commerce players—look promising; others—such as imposing new surcharges and accessorial fees—not so much.

Read More

UPS expands operations in the Phillipines

Investments in Asia Pacific rise to over $250 million since the start of 2023

Read More

UPS gets first class-8 truck with a 15-liter natural gas engine

Kenworth says T680 daycab marks an industry innovation, meets pending CO2 and NOx caps

Read More

Podcasts

The Logistics Matters podcast: Eric Fullerton of project44 updating Red Sea shipping attacks | Season 5 Episode 9

We discuss what shippers can do to mitigate the supply chain constraints in the region. Also: Same-day delivery drives higher revenues; how consumers feel about retail experiences.

Read More

Report: Retailers say same-day delivery drives higher revenue

Prime benefits of adopting same-day delivery include higher customer satisfaction, increased sales, and improved customer retention rates, survey shows.

Read More

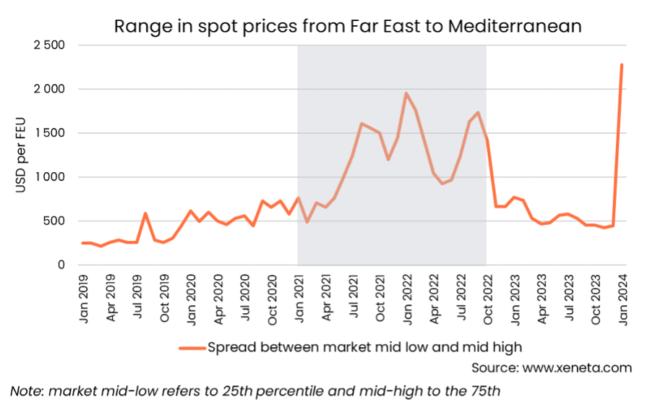

Freight rates and delays continue to climb as Red Sea violence spreads

Impact is sharpest on shipments from Asia and the Indian Subcontinent to Europe and the U.S. East and Gulf Coasts, UPS says

Read More