Freight rates and delays continue to climb as Red Sea violence spreads

Impact is sharpest on shipments from Asia and the Indian Subcontinent to Europe and the U.S. East and Gulf Coasts, UPS says

Shippers should plan further ahead and consider alternative delivery modes as many ocean freight carriers continue to avoid the Red Sea and the Suez Canal in an effort to protect their employees and their assets from regional violence rippling out from Israel’s war with Hamas and Palestine, supply chain solution provider UPS Inc. said.

In recent weeks, ocean vessels entering the Red Sea in route to the Suez Canal have been the target of missile, drone and small vessel attacks by the Yemen-based Houthi Militia. In response, most carriers are avoiding the Red Sea entirely, thus disrupting an already fragile global supply chain.

The impact of those events has been sharpest on shipments from Asia and the Indian Subcontinent to Europe and the U.S. East and Gulf Coasts, UPS said.

For example, spot rates for container shipments from the Far East to the Mediterranean, a trade heavily affected by the Red Sea crisis, took another step upwards in mid-January, rising by $1,630 per forty-foot equivalent unit (FEU) between January 14 and 18. This leaves the average spot rate 157% higher than a month ago, now at $6,050 per FEU, according to a report from Xeneta.

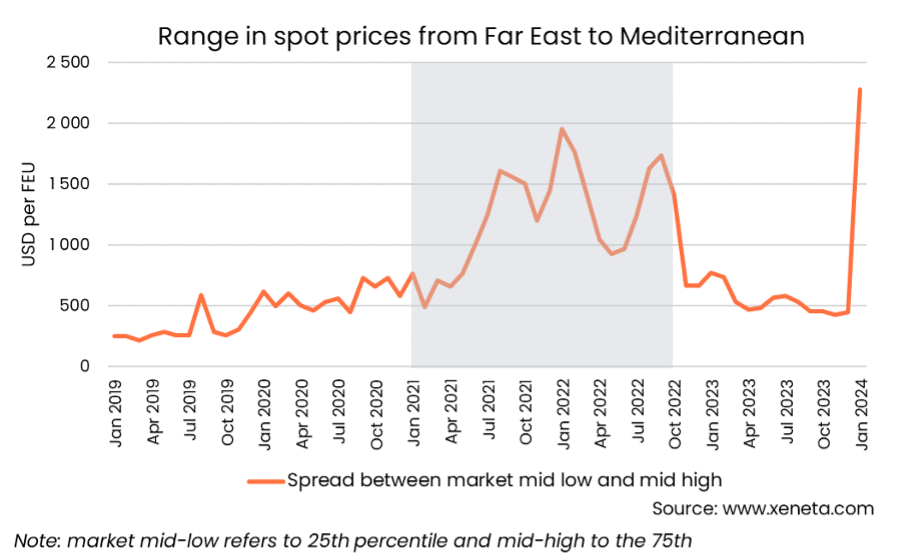

While today’s spot rates on that trade route are still far below where they peaked in 2022, they are still causing turmoil in the markets, the Xeneta report said. That’s because they are now at an all-time record for the difference between what shippers on the mid-low (25th percentile) are paying--$4,175 per FEU—compared to those on the mid-high (75th percentile)—$6,910 per FEU.

“Rates have not yet hit anywhere near the levels we saw during Covid-19, but the sudden nature of the Red Sea crisis has brought delays and disruption much quicker than the early months of the pandemic. That means we have also seen a much more rapid increase in rates,” Xeneta Analyst Emily Stausbøll said in the report.

The speed at which spot rates have increased, and the spread between the mid-low and mid-high, illustrates the turmoil faced by shippers, Stausbøll said. It also demonstrates how quickly the market has shifted from being plagued by overcapacity and carriers having extra ships on their hands, to capacity suddenly being in short supply through increased transit times and carriers having to find available ships to fill the holes from delayed repositioning.

In addition to higher rates, shipments are also requiring longer shipping times to reach their destinations, UPS said. Many ships are avoiding the Red Sea by choosing a far longer route around the Cape of Good Hope on the southern tip of Africa, leading to problems like:

- shipping delays/ significantly longer transit times

- disrupted vessel schedules

- space tightening and equipment shortage

- higher costs for carriers and shippers

In response, UPS offered a list of best shipping practices for Suez Canal challenges. They include:

- Act intentionally and don't panic. Whenever possible, plan early and remain flexible. While it's easier said than done, allocating extra time and remaining flexible when booking your shipments can help you stay prepared when unplanned situations like this arise.

- Identify urgent shipments and utilize alternative shipping modes. Some products in your shipment may require faster transit times than others. If that's the case, consider separating your urgent goods and utilizing air freight to move them in a timelier manner.

- Have a contingency plan. Shipments could be delayed or disrupted and having a contingency plan is important to ensure business continuity.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing