Pandemic delivery stress drives demand for digital tools

Supply chain software vendors project44, Flock Freight see jumps in users and funding.

Logistics technology vendor project44 said today it has raised a $51 million round of investment funding, coming as the firm has seen a large jump in demand for its supply chain visibility software despite the restrictions and recessions of the coronavirus pandemic.

The “series C” round follows previous funding events in 2019 and 2018, and was provided by a combination of existing investors and the new participants Sozo Ventures and Underscore.vc. Counting all funding rounds, project44 has now raised a total of $140.5 million, and says it plans to invest in product innovation, rapid scalability of network breadth and depth, and global expansion.

The new backing comes as project44 said it saw a “record-setting” first half of 2020 with a 139% increase in bookings over the same period in 2019. That increase was driven by significant growth coming from global retailers, manufacturers, and distributors in North America and in Europe, the Middle East, and Asia (EMEA), the company said.

“The last six months, when the economy was under immense pressure, have validated that real-time visibility has become an urgent must-have,” Jett McCandless, CEO and founder of project44, said in a release. The company’s platform provides advanced visibility for shippers and logistics service providers (LSPs) through a network of connections to the telematics and electronic logging device (ELD) devices used by truckload and less-than-truckload (LTL) carriers as well as rail, ocean, and air freight modes.

Another logistics tech firm that has seen a spike in demand during the pandemic is Flock Freight, a San Diego-based startup whose software platform combines a number of small shipments that would typically travel in the less than truckload (LTL) mode and "carpools" them to create full truckload cargo.

Backed by a $50 million venture capital round in February and counting tech giant Google Inc. among its investors, the firm has seen a “massive expansion” of users during the pandemic as shippers have rushed to deliver essential goods during the coronavirus crisis, Flock Freight CEO Oren Zaslansky said.

“The crisis itself is a ‘forcing function’ and it’s forcing change, which is something a lot of companies knew they had to do anyway,” Zaslansky said. Trucking fleets are feeling the shock of the pandemic, as some drivers choose to stay home to avoid traveling to regions with high Covid-19 infection rates, truckers that do keep working have seen freight rates crash, and the waiting times for trucks at warehouses have jumped from 30 minutes to six or eight hours, he said.

“The entire supply chain did slow down because of those long delays, and that’s exactly what we didn’t need right now; we have to keep those store shelves stocked,” Zaslansky said. “These types of event drive a lot of innovation.”

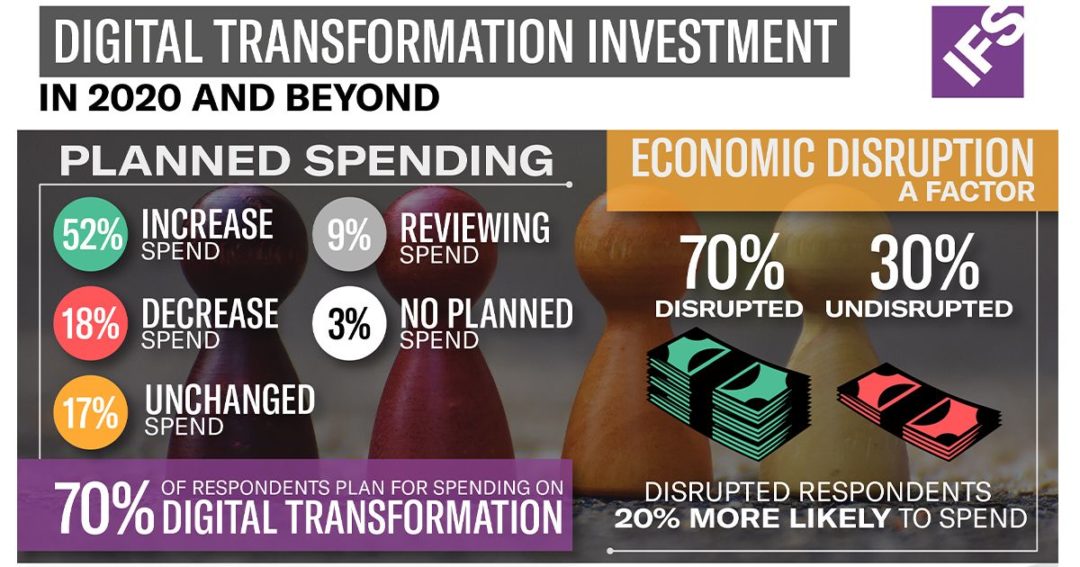

That trend runs parallel to a recent research study from enterprise software vendor IFS, which found that 70% of businesses plan to increase or maintain their digital transformation spending amid the pandemic. That total includes 52% of companies that plan to actually increase that spending, despite the macroeconomic disruption.

The survey data indicates that, during these dynamic times, plans to increase spending on digital transformation track closely with concerns about economic conditions, IFS said. In fact, the survey indicates that people concerned with economic disruption were 20% more likely to plan increased spending on digital transformation.

“The study confirms that many companies are wisely using the global downturn to divert resources to technological renewal and innovation,” Antony Bourne, IFS Industries’ senior vice president, said in a release. “As the majority of businesses are adapting to the anticipated economic recovery, and not permanently scrapping digital transformation initiatives, there is reason to believe that companies with a progressive mindset toward technology investment will be well equipped to rebound.”

Shared truckload, less-than truckload, full truckload – With so many shipping options, it can be hard to know which mode is right for you.

— Flock Freight (@FlockFreight) June 9, 2020

The good news is we offer all of the above. Check out our decision-making chart to determine which of our services meet your business needs. pic.twitter.com/DuKkzBVrMa

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing