E-commerce patterns shift as retailers offer easy return policies

Consumers' continuing love affair with e-commerce is making an impact on national logistics patterns, as the year's biggest package shipping spike will likely migrate to Dec. 19, its earliest date yet, UPS Inc. said today.

Atlanta-based UPS tracks the parcel peaks in its system every year, and this "National Returns Day" typically occurs in early January, as waves of consumers return retail gifts that are the wrong shape, size, or style.

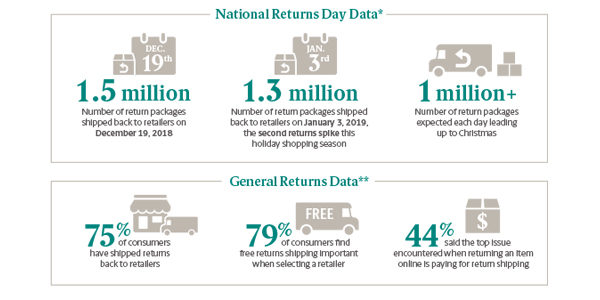

However, shoppers in 2018 have gotten a jump on their online shopping in the days before Black Friday, and are expected to begin returning more than 1 million packages per day in December, jumpstarting the holiday returns season earlier than ever, UPS said.

That trend will create a jump in parcel volume to 1.5 million on Dec. 19, and then a second peak of 1.3 million packages on Jan. 3, UPS says. Those figures will contribute to the estimated 800 million total packages the company forecasts delivering this holiday season.

Retailers have triggered the change in shopping patterns as they continue to compete ruthlessly for shoppers' dollars by offering increasingly comprehensive returns services, UPS said. This has led to offers like express shipping for deliveries and returns, simplified returns processes, advanced re-stocking and management systems, and a spike in self-gifting due to retailer promotions, the company said.

According to the company's "Pulse of the Online Shopper" study, consumers say that top elements of a "great returns experience" include an easy-to-return online experience and a no-questions-asked policy. The survey showed that 79 percent of e-commerce shoppers surveyed said free shipping on returns is important when selecting an online retailer, 75 percent of consumers have shipped returns back to a retailer, and 44 percent said the top issue encountered when returning an item online is paying for return shipping.

The value of those returns continues to rise apace, growing from $32 billion in online returns last year to an estimated $37 billion this year, according to the real estate services and investment firm CBRE Group Inc.

CBRE based its calculation on the high return rate for e-commerce goods—ranging from 15 percent to 30 percent depending on merchandise category, compared to just eight percent for goods purchased in stores.

Multiplied by industry estimates of $123 billion of online sales in this year's November-December period, that rejection rate will trigger a rising flood of returns, forcing retailers to lease additional warehouse space to handle their complex reverse logistics operations, CBRE said.

"The speed and efficiency with which a company can process and resell or dispose of online returns can be the difference between making money or losing it on their holiday e-commerce sales," David Egan, CBRE's global head of industrial & logistics research, said in a release. "The most effective retailers and shippers have built their supply chain to handle a reverse flow of merchandise, or they have hired the right partners to handle that for them."

Number Of Packages Returned Expected To Peak Before Christmas, Reflecting E-Commerce Shift - https://t.co/uAvNWdVPAv @UPS #UPSNews pic.twitter.com/uK5IsdWHQ6

— UPS News (@UPS_News) December 19, 2018

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing