The digital disconnect

How far along are you on adopting digital technology into your supply chain? Survey results show the C-suite has a very different answer to that question than operational leaders.

Digital continues to be a strategic imperative for most supply chain organizations, according to Gartner’s “Supply Chain Technology User Wants and Needs Survey.” But how far along they are in implementing that strategy seems to be a matter of debate.

For 13 years Gartner has surveyed supply chain business users about their information technology (IT) goals, priorities, maturity, and investment strategies. In the 2019 survey, “digital” was identified as a core strategy and focal point as supply chain organizations looked to advance their supply chain maturity and business performance. (We recognize that the term “digital” has different connotations, depending on the focus of the discussion. In the context of the survey, digitization is defined as applying digital technologies to improve supply chain performance.)

A difference of opinion

The survey represented a variety of viewpoints. A bit over 45% of respondents were senior supply chain leadership with the rest being members of operational management, including vice presidents, directors, and managers.

When we compared the responses of senior-level leadership to those of the front-line, mid-level management respondents, we observed an interesting dichotomy. Throughout the study, senior leadership had an overly optimistic view of their organization’s capabilities and commitments to supply chain IT. This inflated exuberance at the top likely causes companies to overstate their real abilities, which could have negative ramifications for their performance.

For example, respondents were asked to select which statement most closely describes their organization’s current state as it pursues digital supply chain initiatives. They had to choose between: “We struggle to fully understand and define how digital supply chain will affect our business and what investments we will need to make to be successful” and “We have a clear vision, plan, and road map driving our digital initiatives.” Almost unbelievably, 97% of C-suite respondents said they had a clear vision, plan, and road map. Even more surprising is how strong this sentiment was with 66% saying they had moderately to very strong digital competencies; a statement which is not supported by the hundreds of calls Gartner takes each year during which customers seek our guidance on developing digital strategies and road maps. This suggests that respondents are overestimating and overstating their abilities.

In contrast, 81% of respondents who were in operational management felt they had strong digital strategies. So while operational management was still optimistic, there was a 17-percentage point drop from the C-suite. Additionally, those respondents who felt they had moderately high to high levels of competency dropped from 66% for C-suite respondents to 41% for operational management respondents. Again, this highlights a notable disconnect between the beliefs of top supply chain leadership and those of operational management. This misalignment can cause many issues for organizations from frustrations due to differing views of reality, unrealistic expectations, and misallocation of resources.

Emerging tech: A status check

A notable way to advance a company’s supply chain digital maturity is to exploit emerging technologies that offer compelling value propositions. Promising supply chain management technologies can help transform a company’s operations. To explore this, the study asked respondents to rate the importance of and their investment plans for 10 emerging technologies, including artificial intelligence/machine learning (AI/ML), the Internet of Things (IoT), robotic process automation (RPA), and augmented reality/virtual reality (AR/VR).

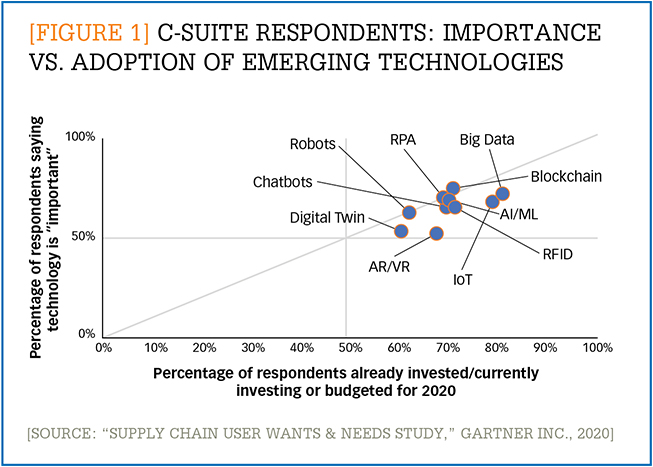

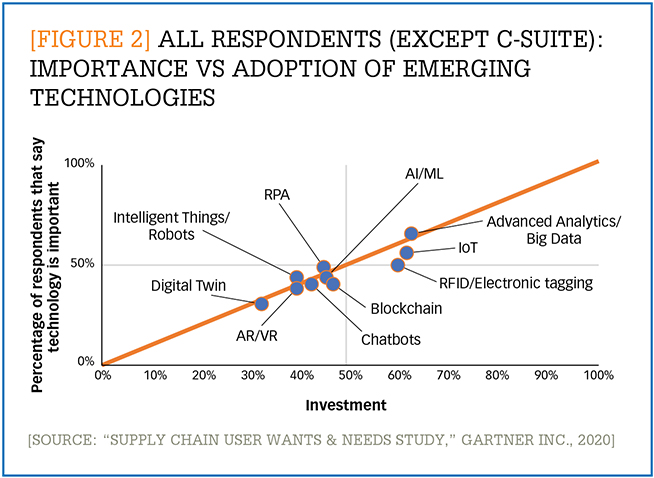

The data again found a significant disconnect between what senior leadership believes to be true and what operational, front-line management perceives to be true. Figures 1 and 2 explore how respondents rated the importance of key emerging supply chain technologies and where they are currently investing or planning to invest. The reason we asked these two questions in this way is because we wanted to know if companies were “putting their money where their mouth is.” This would be like asking people if they believe it is important to save for retirement, and then asking them how much they are actually saving. If the data finds that companies consider something to be important, but they are not investing in it, then this indicates they might not see it as important as they say.

Figure 1 shows the responses for C-level supply chain executives, and it shows an overly dense clustering across all the emerging technologies. This clustering indicates that in executives’ minds, these technologies are all equally important and that they are investing significantly in all of these without prioritizing one or the other. This belief is unrealistic and unsupported by anecdotal evidence from Gartner client interactions, which find that companies are selectively investing in a smaller number of these technologies that offer the greatest near-term business value.

[Figure 1] C-suite respondents: Importance vs. Adoption of Emerging Technologies

Enlarge this image

Figure 2 shows the responses for all respondents excluding C-level executives. It shows a much more realistic distribution of responses, with some more mature emerging technologies like big data, RFID, and IoT showing the most investment and the greatest importance and the remaining technologies scattered more evenly. This a more realistic view is supported by anecdotal evidence from Gartner client interactions.

[Figure 2] All respondents (except C-suite): Importance vs. Adoption of Emerging Technologies

Enlarge this image

We find about 20% of companies identify as early adopters of technologies, and these are the most likely to have pilot programs in multiple emerging technology areas. Around 55% of respondents self-identify as mainstream adopters of technologies. These organizations are much more selective in choosing where to invest, and they typically wait for emerging technologies to mature somewhat before they enter the market for packaged solutions that exploit the emerging technology.

For example, an early adopter might purchase an IoT development platform and build its own predictive maintenance system, while a mainstream adopter would look to buy a predictive maintenance system that leverages IoT. This would align with the position of technologies like big data, RFID, and IoT maturing faster than some other technologies like digital twins or blockchain.

Digital will remain critical to supply chain success. But the study highlights the possible disconnect between senior executives’ digital ambitions and beliefs about their organization and their organization’s actual capability to meet those lofty expectations. No one is served if these two perceptions are not reconciled.

Senior supply chain leadership should admit that they might have overly lofty goals and that the organization cannot “go to college and major in everything” (to quote a CEO I used to work for). Instead, they need to educate themselves on what each of the technologies can do for their supply chain, and then work with their organization, at all levels, to realistically map out their current and desired capabilities.

Related Articles

Recent Articles by Dwight Klappich

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing