Speed readers

As anyone who has tried kanban will tell you, just-in-time production demands up-to-the-minute information on the whereabouts of inbound parts and materials. Because the manufacturer keeps very little inventory on hand in the plant, there's virtually no room for error. Operations managers require assurances that the material needed to keep the factory up and running will be delivered on schedule. And that means full visibility into incoming shipments.

A case in point is Ingersoll Rand, which uses kanban scheduling at a plant operated by its Trane air conditioning and heating systems division in Tyler, Texas. To obtain the necessary visibility, the company three years ago set up an online pOréal to provide a central communication platform with suppliers. Through that digital pOréal, Ingersoll Rand was able to obtain real-time visibility into the inventory on hand at suppliers throughout the world.

But there were still some hiccups in the information flow. For instance, the company had no quick way of determining whether the right materials had been delivered when a truck arrived at the facility. Under the process it had in place, workers had to record the receipt of incoming goods by scanning bar-code labels. It could take as long as 30 minutes to scan all the items in the back of a truck.

Thirty minutes might not seem like a long time, but in a kanban operation, that's a fairly serious delay. The manufacturer began searching for a swifter solution—which it eventually found in radio-frequency identification (RFID).

Better visibility through RFID

A business of Ingersoll Rand Co., Trane makes residential air conditioner and heat pump condensers at the Tyler plant. As part of its operation, it brings in materials such as compressors, electrical components, packaging, plastics, refrigeration units, and raw components from more than 100 suppliers. More than half of those suppliers are based in the United States, while another third are located across the border in Mexico and a small fraction in Asia.

The establishment of the online pOréal in 2008 was an attempt to streamline communications with those suppliers. "Prior to setting that up, we had multiple systems for [exchanging] information with suppliers," says Michael Smith, the multi-site material and supply chain leader for Ingersoll Rand's Tyler operations. "We had spreadsheets, e-mail messages, and EDI [electronic data interchange] systems. We wanted a common communication system."

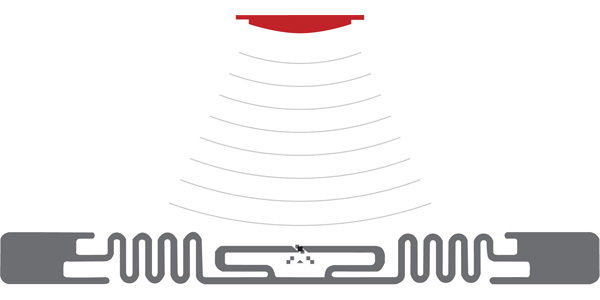

While setting up the pOréal was a step in the right direction, the company expects its new RFID program to take performance to the next level. In June, Ingersoll Rand began working with some key suppliers to place tags on inbound shipments. The tags in this case are passive devices made by Alien Technology of Morgan Hill, Calif.

Now, when a trailer arrives at the Tyler plant, it passes by an antenna that reads the RFID tag. Information encoded in the tag is then uploaded to the electronic pOréal and made available for immediate viewing.

The time savings have been downright impressive. Smith says instead of taking half an hour, it now takes about five minutes to record the arrival of inventory and update the inventory status on the pOréal.

Tag teams

Currently, about 25 of Ingersoll Rand's 110 suppliers are tagging their shipments. These include several local Texas and Mexican suppliers as well as vendors who feed products through a consignment warehouse in Tyler operated by a third-party logistics company (3PL). Under this arrangement, vendors send trailer loads of product to the consignment warehouse, which, in turn, sends smaller lots of parts and components to the factory upon request. Typically, it applies the RFID tags to items just prior to shipping.

Not all of the shipments from these vendors are suitable for tagging, however. Some items—like shipments of metals or components that arrive in metal tubs—aren't being tagged because metal can interfere with the signal transmission. "The tag itself is an antenna, and when you touch metal, you can short out the antenna," Smith explains. Shipments that aren't suitable for tagging are recorded the traditional way—by scanning a bar code. All incoming materials—including those with RFID labels—carry a bar code because Ingersoll Rand requires them for auditing purposes.

As for the project's cost, Ingersoll Rand got off lightly. The company already had antennas on hand that it had purchased for another project but never used. As a result, Smith says, setting up the receiving dock to read RFID tags only cost it $20,000.

The suppliers bear the cost of the tags, which Smith says run to about a dime apiece. So far, none of the suppliers have balked at the requirement, he says. That's because the suppliers have an incentive—prompt payment for their materials. Once the information from the tag gets sent to the pOréal and is reconciled with the invoice, the supplier gets approved for payment. "If the suppliers do the job right with RFID, they get paid on time," Smith says.

Ingersoll Rand is reaping savings as well. For one thing, the automatic recording process has enabled it to reassign two receiving workers to other tasks. Overall, Smith estimates that the RFID implementation will save the company something on the order of $120,000 a year.

More RFID in the future

Next year, Ingersoll Rand plans to extend the use of RFID to all members of its supply base as well as to additional manufacturing plants. It also wants to begin tagging individual items—as opposed to boxes or entire trailerloads—to achieve unit-level visibility. "We want to be able to see each and every component and manage all those components," Smith says.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing