Hurricane Ida restricts freight flow in southern states

High winds knock out power to millions in Louisiana, adding the latest blow to strike supply chains reeling from disruptions.

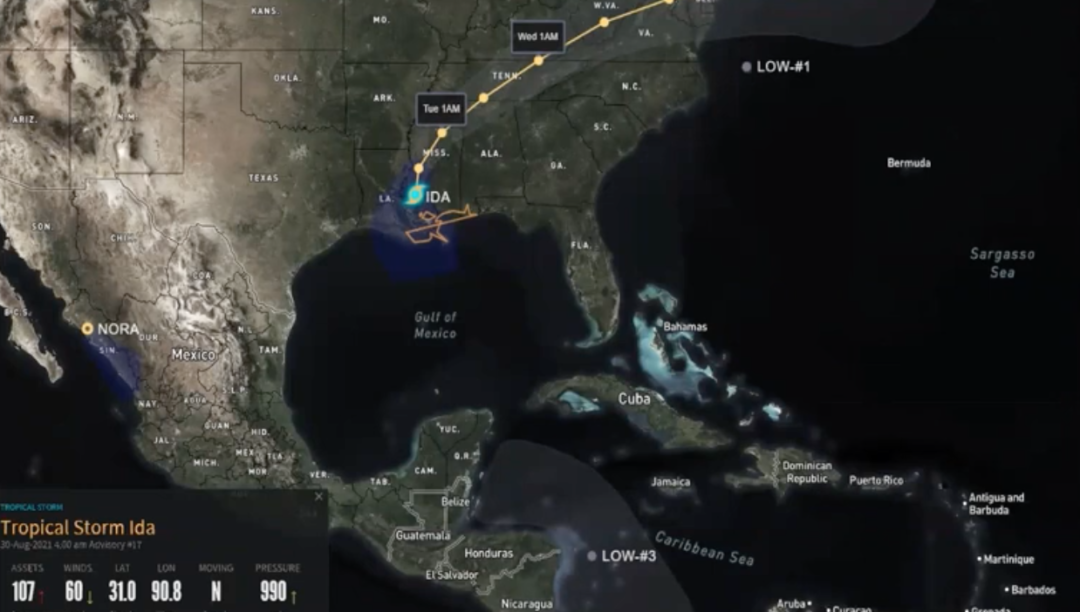

Freight transportation providers across the southern U.S. were operating under restricted conditions on Monday in the wake of widespread power outages caused by the high winds of Hurricane Ida, the category 4 storm that was one of the most powerful hurricanes to ever strike Louisiana.

Although Ida’s howling, 150-mile per hour winds had weakened to a gusty 60 miles per hour by Monday, the event is now in the record books as the second-strongest storm to ever make landfall in Louisiana, tied with Hurricane Laura just one year ago, according to Everstream Analytics.

According to San Marcos, California-based Everstream, the storm’s main impact as of Monday was widespread power outages affecting more than one million customers across Louisiana, and already more than 100,000 in Mississippi, where its full effect was yet to be felt. Those impacts could last for weeks, posing a risk of “major supply chain impacts” in and around the southern region of Louisiana, the firm said.

And looking at the storm’s path over the coming days, it could soon trigger serious flooding as it spins to the northeast, targeting areas seldom struck by hurricanes, such as West Virginia and Pennsylvania, Everstream said.

Following those impacts, the Tennessee-based freight transportation and supply chain management provider Averitt Express said it was running under “limited operations” in the region. “Due to flooding conditions throughout Louisiana and parts of Mississippi and Alabama, and in the interest of the health and safety of our associates, Averitt will have limited operations in some of our locations in the following areas,” the company said.

Specifically, the company today was not accepting shipments destined for New Orleans or Baton Rouge, Louisiana. Its Jackson, Mississippi, office was also closed and it was running under limited service in Mobile, Alabama, and Meridian, Mississippi.

Providing emergency relief services in the wake of the storm was the charitable relief group American Logistics Aid Network (ALAN). For online support, the group offers a free, interactive map tracking the real-time status of roads, ports, and airports in disaster-impacted areas, as well as the latest policy changes at the national, state, local, and county levels. And after the storm passes, ALAN acts as a clearinghouse that monitors the greatest needs throughout affected areas and directs contributed logistics, warehousing, and transportation resources to address them.

As companies look to longer-term recovery from Ida’s impacts, they should examine the recent spate of disruptions that have piled layers of complexity onto an already weary global supply chain, according to Frank Kenney, a former Gartner analyst and current director of market strategy at Cleo, a Rockford, Illinois-based technology consulting firm.

"To understand the potential impact of the situation with Hurricane Ida in Louisiana, look at the impact of the winter storms in Texas and last year’s hurricane season. If you or your organization are surprised by these attentions, you haven’t been paying attention to historical patterns,” Kenney said in an email.

In order to remedy the situation, companies have to anticipate these upsets, order early, have multiple sources, and set expectations with their customers about availability, delays, and costs, he said.

“The problem is that it’s a perfect storm” Kenney said. “Early 2020 issues with closed warehouses, the logistics supply chain particularly as it relates to the United States, moving a container from east to west of the Pacific is significantly more expensive now than it was 18 months ago, there have been extensive delays at the Port of Seattle, Port of Long Beach, and Port of Los Angeles—and now the Port of New Orleans—and companies are having to reserve space on cargo months in advance.”

ALAN has been actively engaged with various humanitarian organizations that are assisting with relief efforts for Hurricane Ida. We expect to receive the first significant wave of post-hurricane relief requests in the next couple of days, so stay tuned. https://t.co/gRC0wbM0C8 pic.twitter.com/nVMmeRO8zH

— ALANAid (@ALANaid) August 30, 2021

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing