Fixed robotics vendor ABB moves into mobile robot market with acquisition

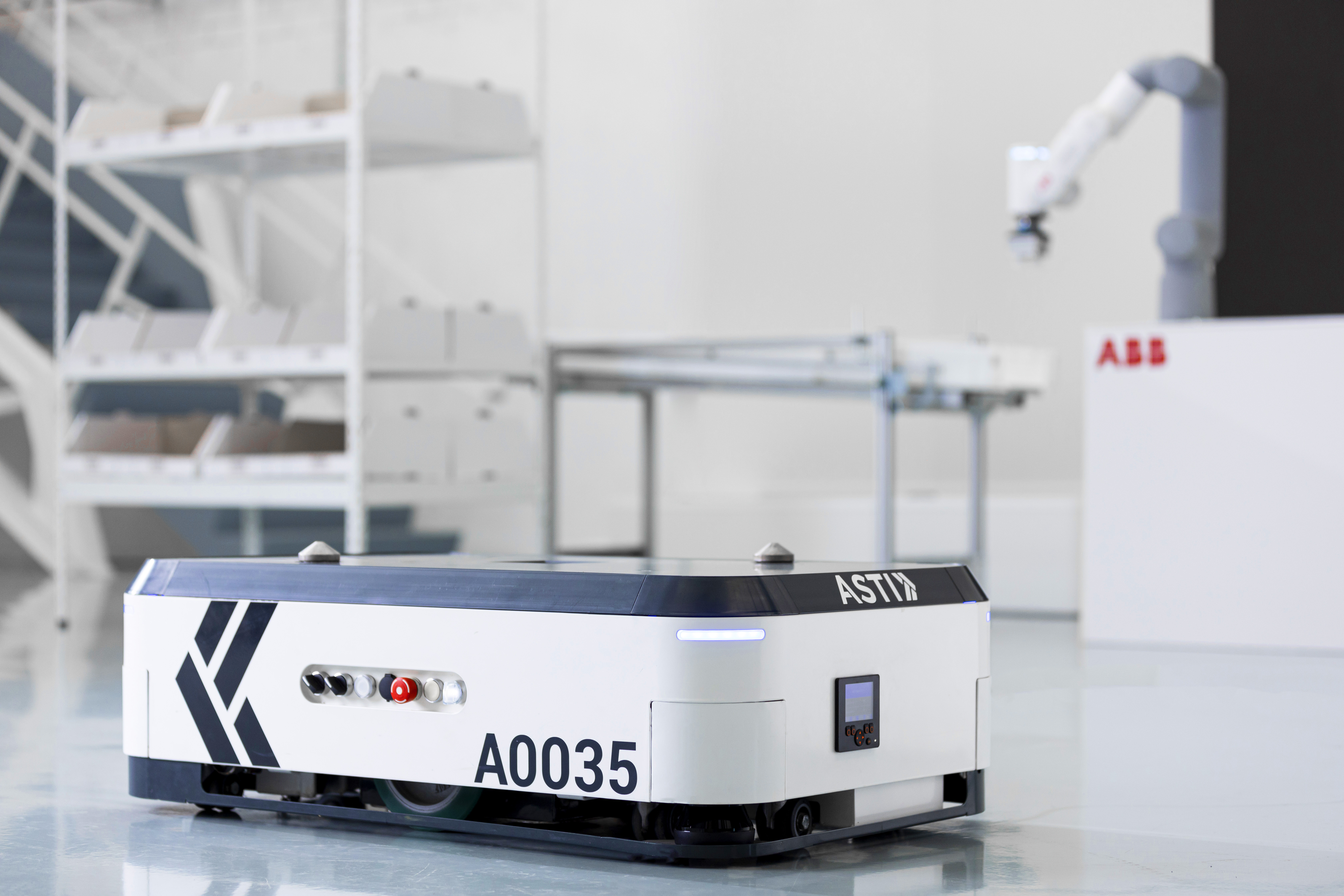

Swiss automation giant buys Spain’s ASTI Mobile Robotics Group and its AMR portfolio of autonomous towing vehicles, goods-to-person solutions, unit carriers, and box movers.

The Swiss industrial robotics vendor ABB will acquire autonomous mobile robot (AMR) vendor ASTI Mobile Robotics Group, saying the combined companies will drive a next generation of flexible automation in factories, logistics centers, laboratories, shops, and hospitals.

Terms of the deal were not disclosed, but ASTI is targeting approximately $50 million in revenue in 2021.

Following the deal, the AMR business headquarters will remain in ASTI’s current location—Burgos, Spain—and be led by the firm’s CEO and majority owner, Veronica Pascual Boé. A new Asia AMR manufacturing hub will open at the ABB Robotics factory in Shanghai, China.

Founded in 1982, ASTI employs over 300 people in Spain, France, and Germany. The firm says it supports one of Europe’s largest installed fleets of AMRs, with a broad customer base in automotive, logistics, food & beverage, and pharmaceuticals in 20 countries.

“With their industry-leading portfolio, comprehensive suite of software and deep domain expertise across growth segments, ASTI is the perfect choice for us as we support our customers with the next generation of flexible automation,” Sami Atiya, president of ABB’s Robotics & Discrete Automation business, said in a release. “With this acquisition, ABB will be the only company to offer a full automation portfolio of AMRs, robots and machine automation solutions, from production to logistics to point of consumption. This is a gamechanger for our customers as they adapt to the individualized consumer and seize opportunities presented by significant changes in consumer demand.”

ABB currently offers a portfolio of robots, machine automation, modular solutions, and software suites. It now plans to integrate ASTI’s platforms into that catalog, including an AMR portfolio of autonomous towing vehicles, goods-to-person solutions, unit carriers, and box movers. In addition, ASTI’s software covers vehicle navigation and control, fleet and order management, and cloud-based traceability systems.

ABB’s move to acquire a mobile robot vendor is not surprising, since major customers are rapidly adopting mobile robotics to augment their production line automation, and flexible manufacturing necessitates the use of mobile robots for material flow, said Ash Sharma, managing director of the market intelligence company Interact Analysis.

“ABB is the 3rd largest vendor of industrial (fixed) robots in the world but until now (like most other industrial robot vendors) had no play in mobile robotics,” Sharma said in an email. “ASTI has enjoyed >25% growth in recent years and is now ranked as the 4th largest vendor of mobile robots in Europe by revenue.”

#ABB to acquire ASTI Mobile Robotics Group to drive the next generation of flexible #automation with Autonomous Mobile #Robots.

— ABB (@ABBgroupnews) July 20, 2021

Discover more: https://t.co/7PYCDKhg8v #Robotics pic.twitter.com/6JTNxnLA4Q

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing