Truck orders jump in October to highest monthly total since October 2018

Demand driven by “vibrant” consumer retail sales, could rise further if manufacturing starts to rebound, FTR says.

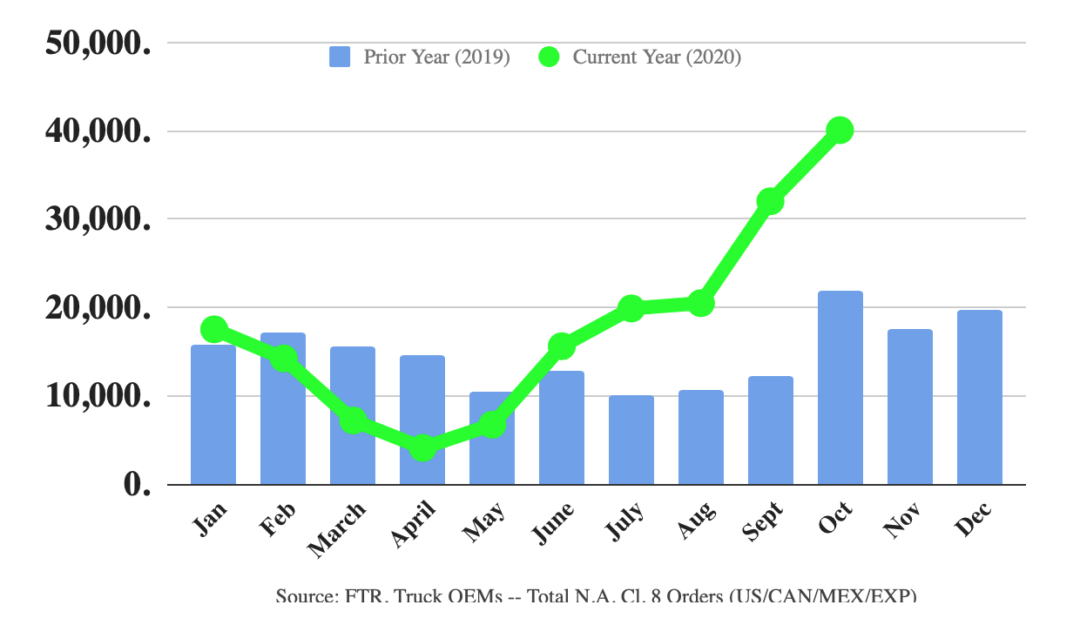

Orders for class 8 trucks in North America rose steeply in October, posting their first monthly total over 40,000 units since October of 2018, as freight markets continue to hold up “surprisingly well” after the initial lockdown stage of the pandemic, according to a transportation industry report released Friday by FTR Transportation Intelligence.

More specifically, Bloomington, Indiana-based FTR said that preliminary North American Class 8 net orders rose in October to 40,100 units, up 26% over the previous month and up 83% over the same month last year.

According to FTR, such hefty order volume indicates that the market is beginning to return to its traditional order cycles. The trend is driven by “vibrant” consumer retail sales, necessitating frequent restocking by stores, which has kept freight rates elevated, capacity tight, and generated the need for more trucks.

FTR’s finding echoes a similar economic report released yesterday, when the October Logistics Manager’s Index (LMI) showed that the logistics industry continues to grow at a rapid pace, driven by accelerating e-commerce activity and rising inventory levels this fall.

“September was the turning point for the Class 8 market. Fleets became much more confident about future freight demand and began placing large orders to replace older units and for expansion purposes, as capacity tightened,” Don Ake, FTR’s vice president of commercial vehicles, said in a release. “In just a few months, the industry has gone from fear, to hope, to optimism. It appears the industry has sluffed off the uncertainties about the pandemic for now.”

While it’s true that some of the current momentum is just pent-up demand from truck manufacturers’ shutdowns in March and April, widespread momentum is also continuing to build from the economic restart, Ake said. That means that truck sales could go even higher if manufacturing starts to rebound and triggers a rise in industrial freight.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing