Upload your press release

CBRE Q3 2019 El Paso Industrial MarketView

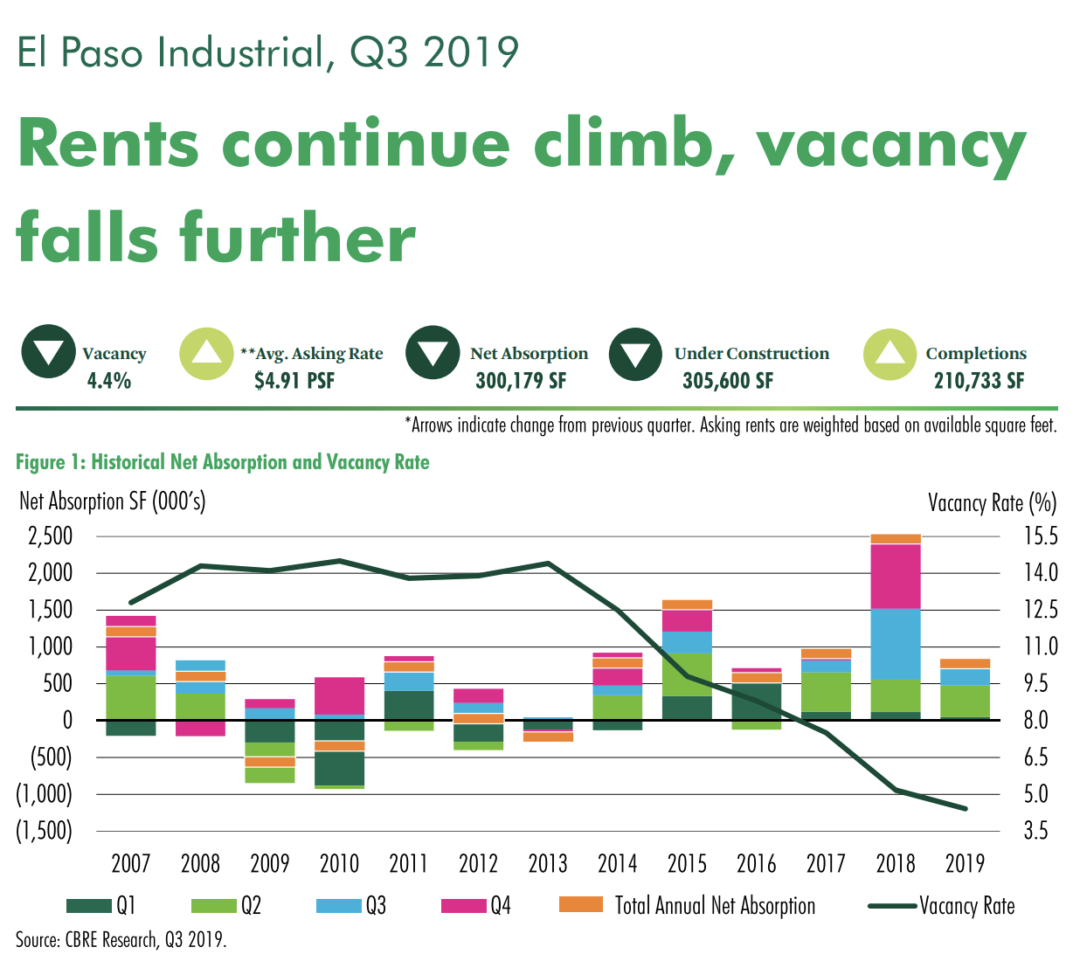

POSITIVE ABSORPTION, VACANCY AT RECORD LOW

Q3 2019 net absorption in the El Paso Industrial Market fell compared to Q2 2019 and Q3 2018, the latter being the largest quarterly absorption seen since CBRE began tracking the market. However, absorption remained above the 50-quarter trailing average and the historical third quarter average.

The market-wide vacancy rate fell 30 basis points (bps) from the record low set in Q2 2019 and by 240 bps compared to the Q3 2018 rate of 6.8%. Class B vacancy fell by 50 bps this quarter and 358 bps year-over-year, also marking a new record low. Class A saw a slight quarterly increase in vacancy due to the delivery of a vacant speculative project.

Two new build-to-suit projects accounted for 90,000 sq. ft. of net absorption this quarter, and the remaining portion resulted from five new Class B and C leases. Renewals, only one of which was Class A, produced 570,000 sq. ft. of market activity.

SPACE SHORTAGE PUSHES RENTS TO NEW HIGHS

The market has seen five and a half years of almost uninterrupted positive net absorption and strong demand for space. These trends, along with record absorption in 2018, two buildings holding half of all market vacancy, and only one new speculative project available, caused a scarcity of space reflected in current record high asking rates.

The Q3 2019 market-wide asking rent pushed past the previous record high set in Q2 2019 by $0.27 per sq. ft. and had a year-over-year growth of $0.73 per sq. ft., a new record high. Class A rents saw significant growth and hit a new high, increasing quarterly by $0.28 per sq. ft and by $0.53 per sq. ft. annually. Class B products had a more muted quarterly increase, $0.12 per sq. ft., but the year-over-year growth of $0.70 per sq. ft. kept up with the market and also marked a record high.

More Info: https://www.cbre.us/research-and-reports/El-Paso-Industrial-MarketView-Q3-2019

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing