Upload your press release

CBRE El Paso Industrial MarketView Q4 2018

2018 closes with new record highs and lows

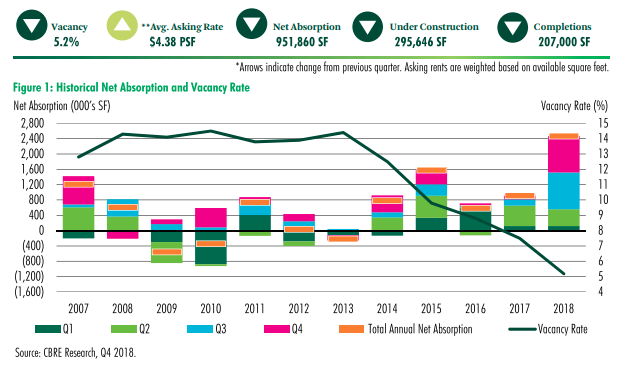

RECORD ABSORPTION, VACANCY HITS NEW LOW

The year closed with the highest annual net absorption recorded for the El Paso Industrial Market since CBRE began tracking it. 2018 registered 2.5 million sq. ft. of net absorption, nearly 1.0 million sq. ft. larger than the previous high seen in 2015. Q4 2018 absorption fell just 13,000 sq. ft. short of the record high quarterly net absorption seen in Q3 2018. The market-wide vacancy rate fell by 160 basis points (bps) quarter-over-quarter and by 230 bps year-over-year, making it the lowest vacancy rate recorded since CBRE began tracking the market. Class A product saw the most significant year-over-year decline, falling from 14.1% in Q4 2017 to 8.7%.

LARGE TRANSACTIONS DRIVE MARKET ACTIVITY

The market registered over 1.7 million sq. ft. of activity across 28 transactions during the quarter. New leases and users sales accounted for 75% of activity. Two big-box vacancies (spaces larger than 200,000 sq. ft.) were leased or sold during Q4 2018 and pushed market-wide and Class A vacancy rates down. The market also saw three leases above 100,000 sq. ft. and three deals above 50,000 sq. ft.

ASKING RENTS CLIMB HIGHER AS VACANCY FALLS

Average asking rents saw quarterly and annual increases in all classes and submarkets. Marketwide rates grew by $0.20 per sq. ft. quarter-over quarter and by $0.35 per sq. ft. year-over-year. Class A product had the highest growth rate, increasing by $0.21 per sq. ft. since Q3 2018 and by $0.39 per sq. ft. year-over-year. Asking rates are experiencing upward pressure as available space continues to decline, with only one speculative project under construction. Vacancy rate compression occurred across all submarkets which, except for the West submarket, marked or approached new record low vacancy rates in Q4 2018.

More Info: https://www.cbre.us/research-and-reports/El-Paso-Industrial-MarketView-Q4-2018

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing