Freight shipments, spending end 2019 on soft note

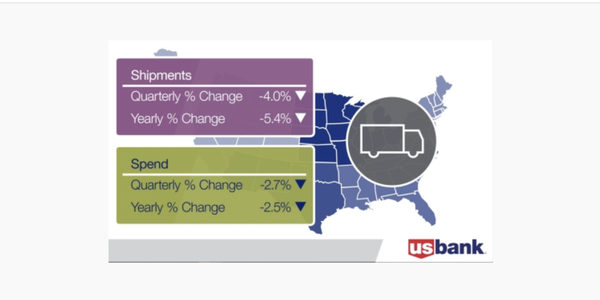

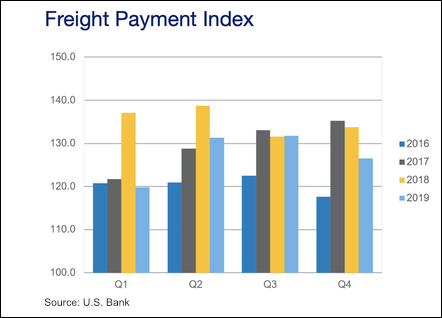

The freight market slowed in the fourth quarter, as U.S. companies' shipment volumes and spending fell sequentially and year-over-year, according to the latest U.S. Bank Freight Payment Index, released Wednesday. Despite the declines, overall spending in 2019 rose 3.4% compared to 2018, the company said.

The freight market slowed in the fourth quarter, as U.S. companies' shipment volumes and spending fell sequentially and year-over-year, according to the latest U.S. Bank Freight Payment Index, released Wednesday. Despite the declines, overall spending in 2019 rose 3.4% compared to 2018, the company said.

Minneapolis-based U.S. Bank said the softer quarter was due to weaker economic activity and difficult comparisons to a strong fourth quarter in 2018. The report followed the release of the American Trucking Associations' (ATA) preliminary 2019 Truck Tonnage Index results earlier this week, which showed an increase in for-hire trucking in 2019, although at half the growth level seen a year ago.

The U.S. Bank National Shipment Index fell 4% in the fourth quarter after increasing a total of 10% in the second and third quarters, U.S. Bank said, citing the international trade environment, which contributed to irregular trade volumes that hurt freight. Lower factory output, falling imports from China, and excess truck inventory were key factors, and the researchers said they expect freight levels to remain sluggish in 2020.

Fourth-quarter spending was lower compared to the third quarter and to 2018, falling 2.7% year-over-year and 2.5% compared to Q3 2019, according to the National Spend Index. The group cited tough comparisons to Q4 2018, when spending rose more than 7%, combined with lower contract rates and lower spot market pricing for freight.

"... shippers didn't need to ship as many truckloads of goods and asked for rate decreases from truckers (and therefore spent less)," the researchers wrote. "The combination of fewer shipments and less spending to ship those goods resulted in the decline in the spending index."

There are bright spots despite the choppy environment, however.

"I think it's remarkable that overall spend was up on a full-year basis for 2019," said Bob Costello, ATA senior vice president and chief economist, commenting on the U.S. Bank index. "It shows great resiliency given the challenging freight environment. Even though the U.S. economy is not in a recession, the factory sector is, and it's absolutely impacting truck freight volumes and spending. But there are some bright spots. The U.S. has taken the first steps of an agreement with China, and spending is up in some parts of the U.S. due to a surge in construction activity."

Bobby Holland, U.S. Bank vice president and director of Freight Data Solutions, echoed those sentiments.

"Although we've seen some slowdown, we will be looking for inventory levels to even out and the trucking supply to come back into balance," Holland said.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing