Freight market set to favor carriers over shippers in 2020, Coyote says

Freight carriers have had a tough road in 2019, experiencing financial pressures and deflationary markets, but the economic cycles are set to turn in 2020, according to an economic forecast from third party logistics provider (3PL) Coyote Logistics LLC.

The change would mean an end to shippers' easy street in 2019, where many enjoyed reduced transportation spend, thanks to high capacity, primary tender acceptance, and service levels. Instead, shippers can now expect to see spot rates begin to inflate again after six consecutive quarters of steep decline, the Chicago-based firm said in its "Coyote Curve Q4 2019 Market Update & Forecast."

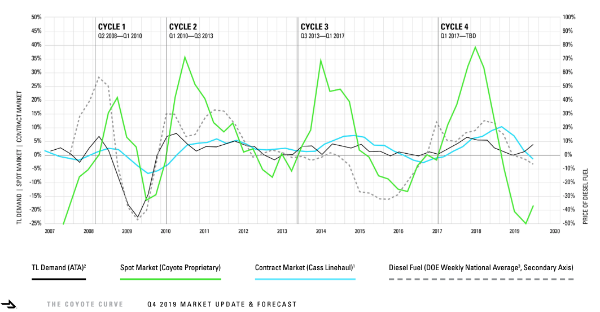

If the forecast holds, it would mark the start of the fifth economic cycle in the past decade, following volatile spikes in spot market rates in 2008, 2010, 2014, and 2018, said Coyote, which is a unit of UPS Inc. Each of those peaks swiftly plunged back into sinking rates, roughly parallel to the movement of truckload demand, contract rates, and diesel fuel prices.

"Looking at the previous market cycles, we can clearly see the continuation of a pattern," Coyote said in a release. "As year-over-year rates inflated to historical highs in 2018, carriers bought a record amount of trucks. The oversupply (relative to demand) drove rates down until enough of the excess capacity was pushed back out of the market. Now year-over-year spot rates are trending back towards equilibrium, which will close out the fourth observed market cycle and begin the fifth."

Although the change is expected, it could still cause headaches for players on both sides of the freight equation, Coyote said.

According to Coyotes's model, neither spot nor contract rates will begin to expand until the first quarter of 2020. In the meantime, carriers could face growing concern over financial stability as their operating margins come under further duress. And shippers may start seeing an erosion of primary tender acceptance erosion rates by the second quarter of 2020, bringing them more unplanned exposure to the spot market.

Despite the turmoil, both shippers and carriers can take steps to account for the busy peak holiday season and to prepare for the challenges of 2020. Companies in both roles will benefit by playing the long game—sticking with trusted providers, prioritizing strategic business relationships, and following "shipper of choice" and "carrier of choice" strategies, Coyote said.

How could a potential recession affect your 2020 planning? Find out in our Q4 U.S. Truckload Market Forecast webinar in four days, featuring actionable procurement tips: https://t.co/3bzo0KuMzJ #CoyoteCurve pic.twitter.com/PGYKG0xN0v

— Coyote Logistics (@CoyoteLogistics) November 15, 2019

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing