Freight sector blip insufficient to change gloomy long-term forecast, firms say

Market conditions in the freight sector softened slightly in the past month, but the change was not enough to offset the fundamental imbalances that still auger rough sledding in the coming months, two recent reports have found.

Economic reports over the past month have more often risen above consensus than fallen below it, but it is premature to declare an end to freight market weakness, the Coloumbus, Indiana-based analyst and forecasting firm ACT Research said.

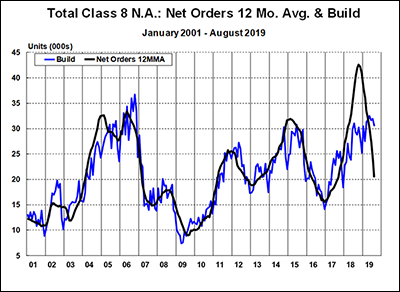

"Data points indicating increased economic activity represent the essential first steps in the process of increasing demand to rebalance the heavy freight markets. However, as in any commodity market, it is not just demand, but supply, and until the supply-side of the market is addressed, the disequilibrium story will continue to weigh on freight rates and by extension the heavy vehicle industry," Kenny Vieth, ACT Research's president and senior analyst, said in ACT's latest "State of the Industry: Classes 5-8 Report."

"While the data are starting to suggest 'less bad,' reports suggesting recovery are premature, as key freight metrics continues to trend negative in the latest round of data releases," Vieth said.

That conclusion echoed another report released this week, which found that trucking conditions ticked slightly upwards in July—the latest month for which figures are available—but that the long term outlook remains gloomy. Bloomington, Ind.-based industry consulting firm FTR said that its Trucking Conditions Index (TCI) for July improved slightly to a just-above-neutral reading of 0.28, marking its first trip into positive territory since January.

The index was powered by lower diesel prices that offset the effects of lower capacity utilization, a trend that may continue to generate some positive readings over the next year, but will not be sufficient to change the overall outlook of "primarily negative to neutral" readings, the firm said in the September issue of "FTR's Trucking Update."

FTR's index tracks five major conditions in the U.S. truck market, including freight volumes, freight rates, fleet capacity, fuel price, and financing. The firm combines those statistics single index number, where positive numbers mean strong conditions for carriers—and high freight prices for shippers—while a zero reading indicates that truck supply and demand are roughly in balance.

"Although it has become common to hear dire warnings about the state of the trucking industry, the truck freight market as a whole is hardly collapsing," Avery Vise, FTR's vice president of trucking, said in a release. "Rapid cooling from last year's extraordinarily strong market certainly has left many weak carriers exposed, but freight volume and rates are holding up reasonably well - certainly if viewed in a longer-term context. Still, most of the near-term risks to our outlook are on the downside."

Economic reports over the past month have more often risen above consensus than fallen below it, but freight markets remain in disequilibrium. #HeavyDuty, #Class8 #Freight https://t.co/SMRo5xbPDl pic.twitter.com/RAUBJcla5L

— ACT Research (@actresearch) September 19, 2019

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing