DHL report: global trade on track for mild decline over next three months

The volume of worldwide trade is on track to post a mild decline in the coming three months, due to prevailing negative sentiment in the private sector and the brewing trade war between the U.S. and China, according to a forecast released Thursday by German transport and logistics giant Deutsche Post DHL Group.

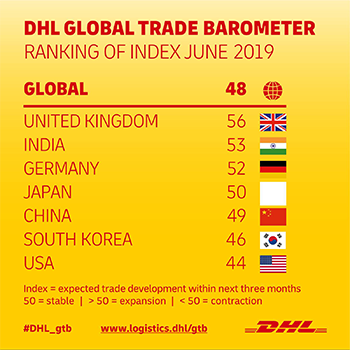

The June version of the quarterly "Global Trade Barometer," (GTB) produced for DHL by the Accenture consulting firm, reports a combined global index value of 48 for the seven nations tracked. Index values above 50 forecast an increase in world trade, so the result predicts that global trade will contract over the next three months.

Compared to the previous report, the number is an eight-point drop, marking the index's first decline since its launch in January 2018, DHL said. The next version of the quarterly report will be released in September.

The latest developments continue a downward trend which the GTB has been recording for several quarters since mid-2018, DHL said. The current contraction is also the first one since 2015, when the GTB - which takes into account historical data from 2013 onwards - measured more than a month-long decline of global trade volumes in the middle of the year.

This decline indicates world trade - forecasted by trade flows in intermediaries and early-cycle commodities - is expected to decline in the coming three months, albeit mildly, the company said. The overall decline was driven by significant losses for both air and containerized ocean trade, which are the GTB's two fundamental constituents. Air trade declined by 6 to 49 points, and containerized ocean trade fell 8 points to 48 index points.

DHL said one significant factor of the slump was the ongoing trade war between the U.S. and China, which has been exacerbated by ratcheting tariffs on international trade between the two nations.

"Amidst rising U.S.-Chinese tensions, the slightly negative outlook for global trade for the third quarter of 2019 does not come as a complete surprise. The latest GTB clearly illustrates why trade disputes create no winners," Tim Scharwath, CEO of DHL Global Forwarding, Freight, said in a release.

"Nevertheless, some major economies such as Germany continue to record positive trade growth," Scharwath said. "And from a year-to-date perspective, world trade growth has still been positive. Hence, we remain confident in our initial prognosis that 2019 will be a year with overall positive, but slower trade growth."

According to DHL's report, the U.S. saw by far the heaviest losses amongst all GTB index countries, with its outlook declining 11 points to 44. As one of the parties involved in the current trade disputes, the U.S. losses were mainly driven by a negative outlook for major export categories. China scored second in terms of losses, declining 7 points to 49 - an index value one point below stagnation. China's negative outlook was primarily driven by declining imports in several categories, combined with just minor overall export growth, DHL said.

As the trade war grinds on, those factors could create uncertainty that dampens consumer demand and business investment, leading to a synchronized slowdown of the world's major economies, trade specialist Eswar S. Prasad said in the report. Prasad is professor of Trade Policy and Economics at Cornell University.

"Growth is weakening in the key drivers of the world economy," Prasad said. "Most macroeconomic and labor market indicators point to a cooling of U.S. growth and financial market sentiment has been hurt by trade tensions. The Chinese government's stimulus measures appeared to be stabilizing growth, but persistent trade tensions are again dragging down growth momentum in China. The German growth revival looks fragile while India's growth has hit the skids, with rising doubts about the prospects of major economic reforms."

#DHL #GlobalTradeBarometer reflects deteriorating global trade due to prevailing negative sentiment in private sector. #GlobalTrade https://t.co/lX5DQh0fXX

— DPDHL News (@DeutschePostDHL) June 27, 2019

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing