Global trade growth to slow in early 2019, DHL study forecasts

The volume of containerized international trade will continue to expand for the next three months, but its growth rate will shrink in the face of political challenges like U.S. tariffs on Chinese goods and the U.K.'s pending exit from the European Union, according to a forecast released today by German transport and logistics giant Deutsche Post DHL Group.

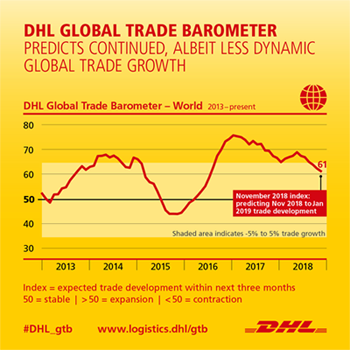

The November version of the quarterly "Global Trade Barometer," produced for DHL by the Accenture consulting firm, reports a combined global index value of 61 for the seven nations tracked. Index values above 50 forecast an increase in world trade, so the result predicts that global trade will continue to grow over the next three months.

The study is based on large amounts of logistics data that are evaluated with the help of artificial intelligence (AI), DHL says. Judging by the results, the indices for all seven countries that constitute the index are above 50 points, although those numbers have each shrunk since the forecast's previous release in September. Those figures forecast that expected trade development over the next three months will be highest in India (with an index of 75), followed by South Korea (64) and the U.S. (61). The other countries tracked are China (58), Japan (58), Germany (56), and the U.K. (53).

"The DHL Global Trade Barometer clearly shows that the state of global trade remains solid. Both air and ocean trade continue to grow around the world," Tim Scharwath, CEO of DHL Global Forwarding, Freight, said in a release. "However, given the smoldering trade conflicts, especially between the U.S. and China, and economists' expectations that the global economy could cool down, it is not entirely surprising that trade momentum has weakened slightly."

1 year on, the #DHL Global Trade Barometer accurately predicts #trade growth on a global scale - and for the world's top 7 trading nations. Full report here: https://t.co/VSMOGVPMMC #DHL_gtb pic.twitter.com/ifw6pfexPK

— DPDHL News (@DeutschePostDHL) November 28, 2018

The tempered forecast tracks similar results from other recent economic forecasts presented at industry conferences in Dallas and Orlando, indicating that economic signs suggest the U.S. could be headed for a moderate recession in 2020.

According to the latest DHL report, the predicted deceleration of worldwide trade growth is attributable to declines in both containerized ocean freight and international air trade, as markets retreat from an exceptionally busy year in 2017.

"At the end of the day, we'll still have growth, but temperatures are getting back to normal in a way," Scharwath said in an interview. "Global trade has been quite extraordinary in several quarters over the past two years, but businesses like it better when that growth is spread evenly across multiple quarters, rather than having spikes up and down."

DHL first launched the index in January, saying the tool could help both DHL and its customers to save money by predicting changes in freight volume, then adjusting to economic trends by applying changes in prices, transportation modes, and trade routes.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing