Convoy lands $185 million for online trucking marketplace

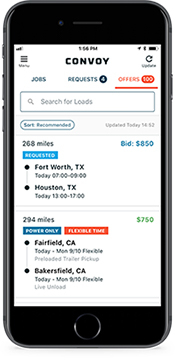

Online truck brokerage Convoy said today it has landed a whopping $185 million in financing for its freight-matching platform, in the latest example of investors betting that small logistics technology startups can displace the entrenched freight brokers who have traditionally moderated between shippers and carriers.

The "series C" funding round was led by CapitalG, the investment arm of Google Inc.'s parent company, Alphabet. Additional funds came from accounts advised by T. Rowe Price Associates Inc. and from Lone Pine Capital, as well as existing investors.

The latest investment follows a 2017 funding round of $62 million led by the high-profile Silicon Valley firm Y Combinator Management LLC. Altogether, Seattle-based Convoy has raised more than more than $265 million in total capital. The firm says it plans to use its new funding to accelerate product innovation in order to meet growing demand from shippers and carriers.

As part of the new investment, David Lawee from CapitalG will join Convoy's board of directors. "Convoy has the potential to transform the trucking industry," Lawee said in a statement. "The team has built a leading tech-enabled marketplace that provides shippers with a more efficient freight solution and truck drivers with increased access to work."

As part of the new investment, David Lawee from CapitalG will join Convoy's board of directors. "Convoy has the potential to transform the trucking industry," Lawee said in a statement. "The team has built a leading tech-enabled marketplace that provides shippers with a more efficient freight solution and truck drivers with increased access to work."

In recent months, investors have continued to pour funding into technology startups that provide smartphone-based freight-matching apps and software platforms they say can disintermediate traditional brokers by connecting shippers and carriers directly. Examples include Cargomatic Inc., which raised $35 million in August, Transfix, which raised $42 million in venture capital in 2017, and Uber Freight, whose parent company Uber Technologies Inc. recently broke it away as a stand-alone business unit and pledged to double its investment over the next year.

Predictably, many freight brokers are skeptical that these new arrivals can deliver the same level of personal service, long-term business relationships, and skilled handling of exceptions and other thorny issues that clients expect.

The brokerage area does grow as freight markets become tight, one industry consultant said, but at its core, the industry still works on contracts with volume commitments, as opposed to instant matches through smartphone apps.

Startup firms with products that match available capacity to loads can provide some utility, but the freight market is not on track for a wholesale change, said Tony Wayda, supply chain practice senior director and principal at Boulder, Colo., consulting firm SCApath."There are still far too many variables that impede the simple matching of loads to capacity—freight type, pickup and delivery locations and times, next load commitment of the truck, payment terms, contractual and insurance terms, driving and safety records..." Wayda said. "I think apps will evolve to help perform 'better' matching but I still do not see any major change in the industry in the near future."

However, Convoy says its technology can improve efficiency in many segments of the trucking industry, such as empty backhaul miles. "Trucks run empty 40 percent of the time, and they often sit idle due to inefficient scheduling," Dan Lewis, Convoy's co-founder and CEO, said in a statement. "This is a drag on the economy, the environment, and the bottom lines of shippers and carriers alike."

Another way that Convoy says its platform can generate value is by helping shippers navigate historically tight capacity conditions that are driving up costs for many retailers. In July, the firm released a software product it says can generate a real-time index of carriers with available capacity, thus helping shippers avoid booking their freight through the volatile and expensive spot market.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing