Logistics industry growth continued in June

Strong demand for warehousing and transportation keeps industry humming as the latest Logistics Manager’s Index reaches second all-time high reading.

Economic activity in the logistics industry increased in June, driven by strong consumer demand that continues to put pressure on warehousing and transportation networks.

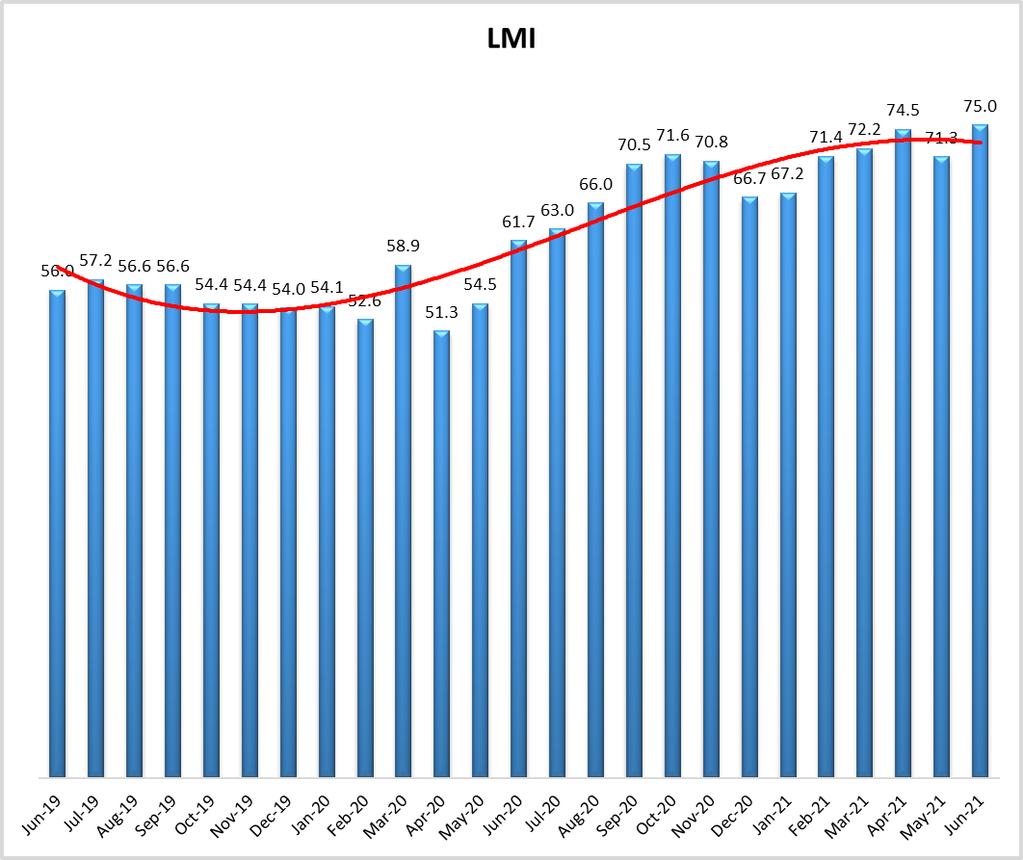

The Logistics Manager’s Index registered 75 in June, up nearly four percentage points to reach the second-highest level in the history of the five-year index. The quarterly three-month moving average also reached a record level this spring, indicating second-quarter growth as the fastest in the history of the index as well, according to LMI researchers.

The LMI gauges monthly business activity in the logistics industry; a reading above 50 indicates growth and a reading below 50 indicates contraction.

Inventory is moving through supply chains quickly, and tight capacity and high costs remain throughout the channel, the researchers said. Inventory levels and costs continued to grow in June, rising 9 points and more than 5 points, respectively. At the same time, warehousing and transportation capacity continued to contract, registering 40.7 and 34.5.

“The combined lack of capacity makes it difficult to meet consumer expectations. The mismatch between supply and demand has driven logistics costs up, despite the fact that inventory is flowing quickly,” according to the report. “Essentially, the changes to logistics demand over the last year mean that it has become significantly more expensive for supply chains to hold and move each unit of inventory, even in cases where they have less inventory than they did before. This will continue until supply chain networks, which are still configured for pre-pandemic business cycles, can be adjusted to better reflect our post-pandemic reality.”

Looking ahead, respondents predicted a 12-month future growth rate of nearly 70, indicating strong growth and continued tight industry conditions as 2021 unfolds, according to the researchers.

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP). An LMI above 50 indicates expansion in the market; an LMI below 50 indicates contraction.

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing