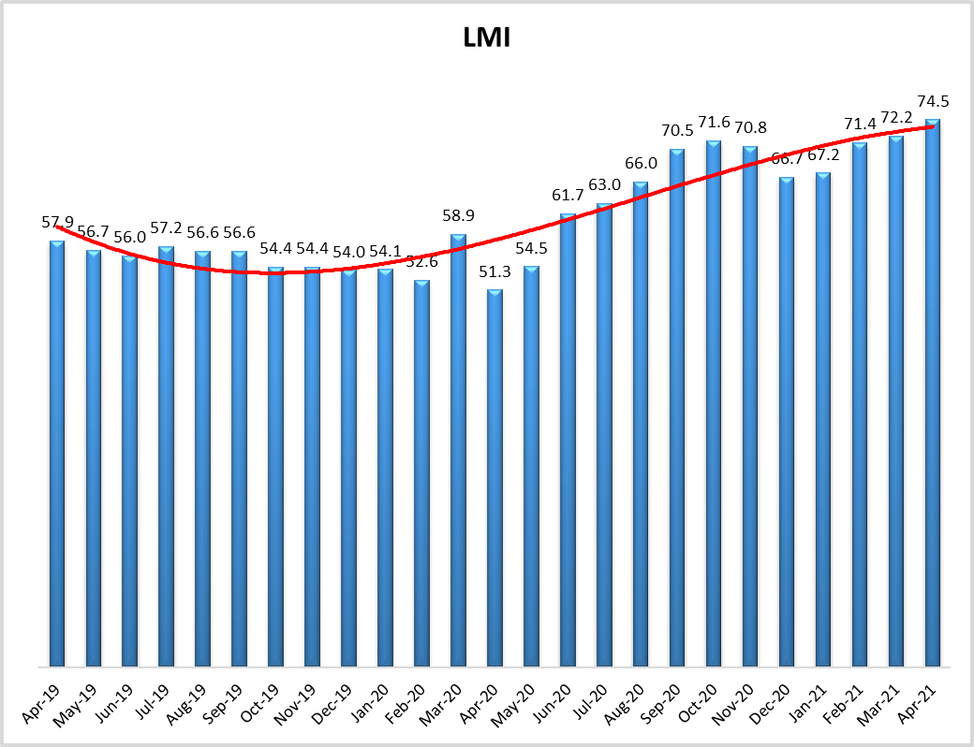

LMI: Tight market conditions persist, with no end in sight

Tight capacity, high prices, and record-high growth in inventory costs drive logistics manager’s index to near all-time high in April.

Tight conditions persisted across the logistics industry in April and the outlook calls for more of the same, according to the latest Logistics Manager’s Index (LMI) report, released today.

The April LMI increased to 74.5 last month, its second-highest all-time reading and well above the market’s pandemic lows of a year ago. The monthly LMI gauges economic activity across the transportation and logistics industry. An LMI above 50 indicates expansion, and a reading below 50 indicates contraction in the market.

The April results were driven largely by tight capacity, high prices for transportation and warehousing, and record-high levels of growth in inventory costs, according to the report. LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University, said the state of the industry this spring is very much “a story of costs,” as warehousing prices, transportation prices, and inventory costs, combined, reached their highest level in the five-year history of the index.

“The cumulative cost metrics have never been higher than they are now,” Rogers said Tuesday, emphasizing a steady growth in inventory over the past year that shows no signs of slowing due to pent-up consumer demand and the supply chain’s efforts to stock up to meet them. “I don’t see a slowdown at all.”

Rogers likened the industry’s position to a runner nearing the end of a marathon—exhausted and ready to reach the finish line.

“The problem is, everything on the horizon says we’re still opening up,” he explained, pointing to expected double-digit increases in imports and strong consumer spending, driven in part by stimulus checks and high levels of savings over the past year. “[The industry] has grown, but it hasn’t stopped. It seems like this may be a double marathon we’re running.”

Logistics-industry companies will have to grit their teeth and endure the higher prices as they “pay to play” in a busy market, Rogers added.

“Normally, with prices this high, there would be a correction on the demand side. But we may not see that,” he said. “Of course, it has to end sometime. I just don’t think it’s this year.”

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing