Logistics continues strong growth path in January

Growing inventory levels, tight warehouse capacity keep industry humming, LMI data show.

Economic activity in the logistics industry continued to grow in January, driven by increasing inventory levels throughout the supply chain and tight capacity across warehousing and transportation markets, according to the latest Logistics Manager’s Index (LMI) report, released today.

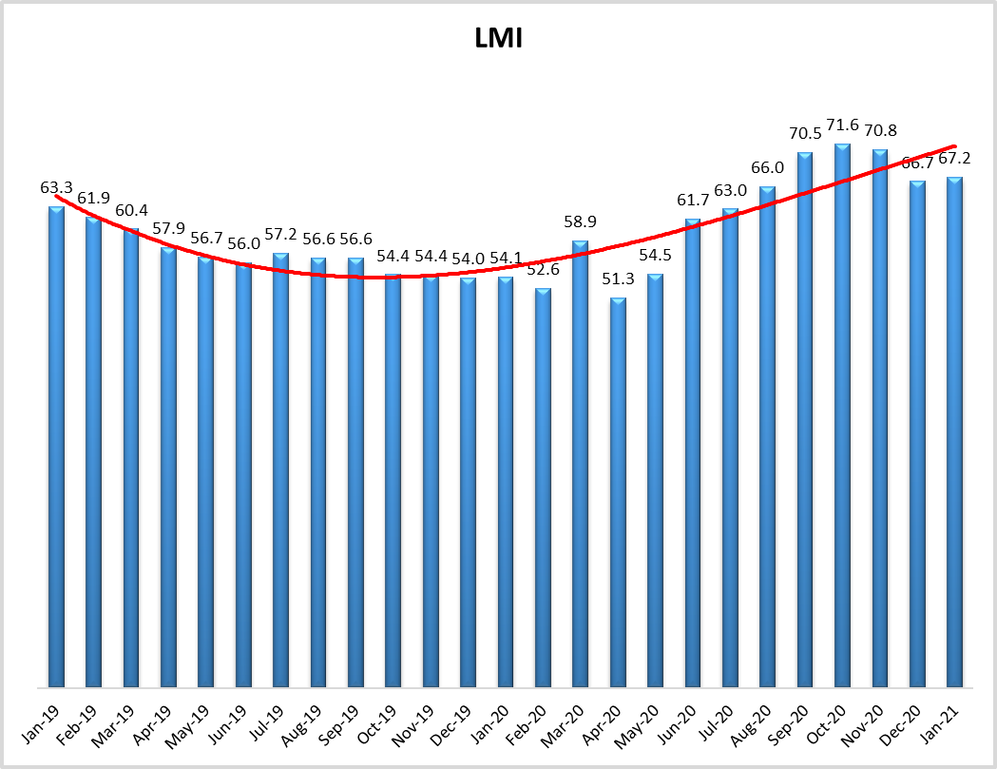

The LMI, which gauges industry growth monthly, registered 67.2 in January, up slightly compared to December but well above the 54.1 reading from a year ago, LMI researchers said. The numbers indicate a continuation of the strong growth the industry has seen since rebounding last summer from lows brought on by the pandemic.

An LMI above 50 indicates growth in the industry; an LMI below 50 indicates contraction.

“Much of the increase in this month’s LMI [is] driven by increases in the rate of growth for the inventory metrics,” LMI researchers wrote. “Due to constricted capacity and high inventory levels, it would appear that as firms increase the amount of inventory they’re holding, the cost of doing so is increasing at an increasing rate. This combined with tight capacity and high prices contribute to the increasing rate of growth detected in this month’s LMI.”

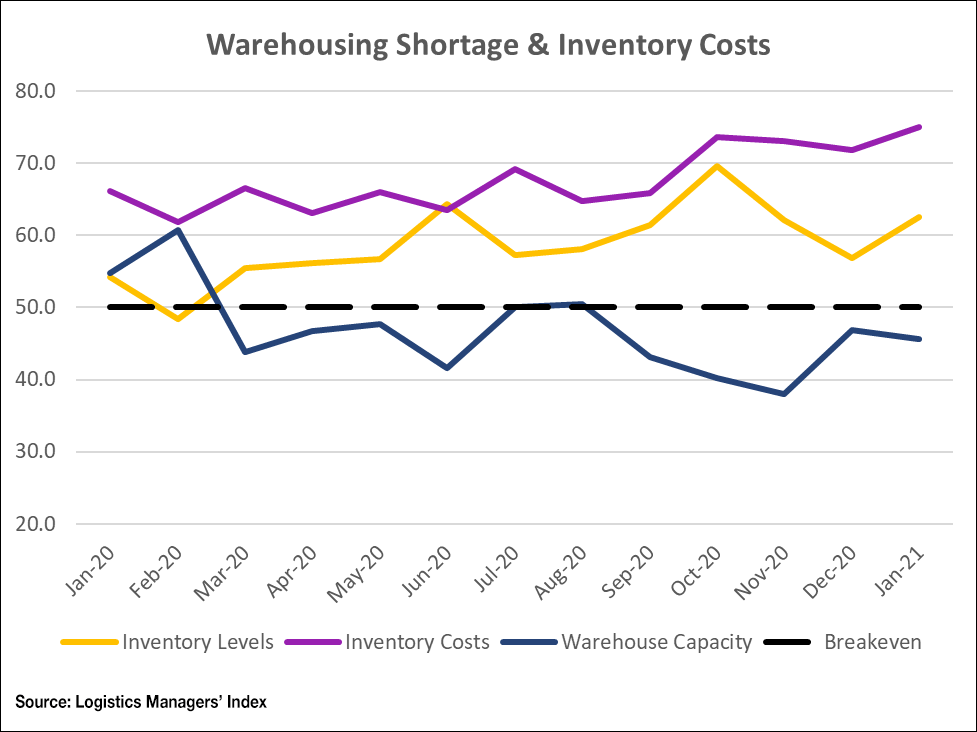

Inventory levels rose nearly six points compared to December and were up eight points compared to a year ago, all while warehousing capacity continued to contract. The warehousing capacity index remained below 50 for the fifth straight month in January, falling 1.3 points compared to December and highlighting an ongoing shortage of warehouse space. Inventory costs rose more than three points during the month and warehousing prices continued to climb as well, rising slightly compared to December but up eight points compared to a year ago.

“With such limited capacity, it’s difficult to find a place to put things,” LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University, said, adding that inventory costs are the highest they’ve been in two years. “It really demonstrates the tightness people are dealing with.”

Transportation capacity increased in January but remained below the 50-point mark at a reading of 46.3, indicating continued contraction in the segment. Transportation capacity has remained below 50 since June.

Looking ahead, the LMI’s future predictions index indicates that prices will continue to grow at high levels across the board. Rogers said respondents are optimistic that a considerable amount of transportation capacity will come online, but are less bullish about movements in new warehousing capacity.

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing