Upload your press release

U.S. Bank Freight Payment Index sees high Q3 shipment and spend levels, shows some deceleration

The U.S. Bank Freight Payment Index™ - a tool designed to assess the current state of the freight industry in the U.S. - showed declines in the third quarter compared with the second quarter in 2018.

The changes between quarters were driven by several factors according to Bob Costello, a freight industry analyst and chief economist for American Trucking Associations, including a moderating U.S. economy compared with the previous quarter and other factors like Hurricane Florence and potential early signs of tariff impacts. On a year-over-year basis, however, the overall freight spend increased by double-digits despite lower freight shipment volumes, which reflects higher average freight transaction prices.

"Linked quarter declines in both freight shipment volume and spend are in line with the deceleration many expected in third quarter gross domestic product growth," said Costello. "As trucking often leads the broader economy, the decreases seen in the U.S. Bank Freight Payment Index suggest economic growth may have peaked and may decelerate in the fourth quarter and beyond. Despite the sequential decreases in freight shipments and spending last quarter, the national truck market remains solid and capacity tight."

Costello also said it is difficult to ascertain the exact impact that Hurricane Florence had in the Southeast region during the third quarter, but undoubtedly it was negative. However, there will eventually be a freight bump associated with hurricane rebuilding efforts. Costello also noted, while still very early in implementation, U.S. tariffs on some foreign products - as well as retaliatory tariffs on some U.S. goods - likely had at least a slight negative impact on the quarter.

Freight shipments

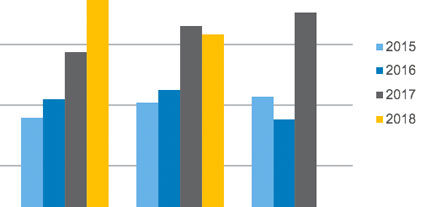

U.S. freight shipment volume in Q3 decreased 5.2 percent from the second quarter and is down 1.1 percent from the same period last year.

Spend

The amount spent on U.S. freight costs in Q3 decreased 1.2 percent from the second quarter, but is up 13.5 percent from the same period last year. This is driven in large part by the constrained trucking capacity in the U.S.

About the U.S. Bank Freight Payment Index

"The U.S. Bank Freight Payment Index helps our clients make better decisions when planning and forecasting for their businesses," said John Hardin, U.S. Bank Global Transportation General Manager. "It also helps shippers and carriers understand regional variability."

The U.S. Bank Freight Payment Index measures quantitative changes in freight shipments and spend activity based on data from transactions processed through U.S. Bank Freight Payment. These transactions are made on behalf of clients across a range of industries, including automotive, manufacturing, food and retail.

A pioneer in automated freight audit and payment, U.S. Bank Freight Payment is celebrating its 20th year of facilitating transactions between shippers and carriers. The business processed more than $24.5 billion in global freight payments in 2017 for some of the world's largest corporations and government agencies. For more information and to subscribe to the Index, visit www.freight.usbank.com.

Activity by U.S. Region

All regions saw freight shipments contract from the second to third quarters this year, ranging from a 3.4 percent decline in the West to an 8.6 percent decline in the Southwest. These results are in line with contractions from the second to third quarters in both spot market and contract truck freight volumes.

Conversely, on a year-over-year basis, all regions witnessed solid gains in spending. Despite a sequential drop in freight shipments across all regions, truck capacity remained constrained enough for all regions to witness robust year-over-year gains in spending.

Regional highlights of the Q3 2018 U.S. Bank Freight Payment Index include:

West Region

The West region had the best third quarter among all five regions as volumes contracted the least over the second quarter and it was the only region to post a gain in spending.

Softer trade volumes at West Coast ports - especially in July and August - had a negative impact on volumes in Q3, as did new housing starts, which were also weaker in this region.

Despite the reductions in freight shipments, freight spend increased 1.4 percent over the last quarter and 7.4 percent over Q3 last year.

Southwest Region

Freight shipments and spending in the Southwest region fell more than any other region compared with the second quarter.

The Southwest regional economy continues to be one of the strongest in the country. Truck volumes and spending, while moderating in the third quarter, will remain at high levels there.

Midwest Region

The freight shipment index in the Midwest region fell by 6.4 percent during the third quarter, which was the largest sequential drop since 2010.

One of the factors hurting this region in the third quarter was weak home construction.

Northeast Region

The Northeast freight shipment volume and spend fell by similar levels from the second to third quarters.

A third quarter drag in the region was softness in home construction, especially in multi-family units, like apartment buildings.

Despite the soft third quarter, going forward, the Northeast region should benefit from better factory activity and a solid holiday spending season.

Southeast Region

Hurricane Florence had a negative impact in the Southeast region during the third quarter. However, there will eventually be a freight bump associated with hurricane rebuilding effort.

Not only was this the first sequential decline in freight shipments since the final quarter in 2016, it was the largest since 2010.

The Southeast region will likely benefit from solid factory output in the quarters ahead, as well as strong household consumption.

More Info: https://freight.usbank.com/?es=a142&a=20

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing