Study examines shippers' views on port performance

People tend to equate seaports with static infrastructure. And it's not hard to see why. Ports cannot simply pick up and move the container terminals, bulk handling facilities, or roadways they build. But they do have some flexibility. They can, for example, deepen channels and expand terminal facilities.

Trouble is, these infrastructure improvements typically take many years to complete, while the needs of ports' customers—shippers, carriers, and other port facility users—may change very quickly. And that raises a question: Do ports win and retain business based on their infrastructure and efficiency, or do customers use different measures to evaluate port service quality?

A new research project seeks to answer this and other questions by asking port users just how they evaluate port performance and how well seaports are meeting their needs. Here's a look at what researchers have learned so far, along with information on how you can participate in this groundbreaking study.

The Port Performance Research Network (PPRN) is seeking volunteers to participate in a panel that will evaluate ports on an annual basis. Eligible companies include importers, exporters, forwarders, and third-party logistics service providers that directly purchase ocean transportation services. Panel members will be asked to complete a survey on port performance each year. The data gathered will be used to help ports worldwide improve the service they provide to customers like you.

If you'd like to participate, please contact Mary R. Brooks, William A. Black Chair of Commerce, Dalhousie University School of Business.

Not by efficiency alone

The study is being conducted by the Port Performance Research Network (PPRN), a group of nearly 60 maritime economists from 14 countries. Led by Mary R. Brooks, the William A. Black Chair of Commerce at Dalhousie University's School of Business in Halifax, Nova Scotia, the survey will focus initially on ports in the United States and Canada but will soon expand to other countries.

Most port research to date has focused on efficiency, as measured by container throughput, vessel turn times, labor activities, and equipment utilization. PPRN decided to investigate effectiveness—how well seaports perform in delivering the services their customers want. If they could determine how users evaluate ports' performance, the researchers reasoned, then port management could use that information to better serve customers and make their operations more competitive. This information could also help them prioritize planned improvements in order to make the best use of scarce investment dollars.

It's a subject that merits investigation, because competition is a bigger concern for ports today than it was in the past. Thanks to intermodal networks, most importers and exporters are no longer "captive" to the nearest harbor, and ports on opposite sides of the continent may battle for the same business, Brooks says. Furthermore, today's huge retailers and consumer goods companies have more economic clout than their counterparts did in the past. "In terms of the entire supply chain, they are much more important and powerful now," says Brooks' Dalhousie Business School colleague Tony Schellinck. "They're dictating where goods arrive, and through their need to minimize inventory, they have increased their involvement in the distribution system and have forced changes [that affect ports]." Add in carrier consolidation and the trend toward bigger ships calling on fewer ports, and it's clear that port authorities must work hard to attract and keep customers.

To find out what users really want from seaports—and how well ports are meeting their needs—PPRN has been surveying ports' three main constituencies: cargo interests (importers, exporters, and agents that purchase ocean transportation services), ocean shipping lines, and asset-based warehousing and transportation companies that do business with ports. Researchers asked survey takers in all three categories to rank 12 general evaluation criteria based on their importance in port selection decisions. These criteria covered areas like information, cargo handling, safety and security, and direct and connecting services.

The researchers also asked respondents to rank a second set of criteria that reflected their group's specific concerns. For cargo interests, these included:

- The effectiveness of ports' decision-making process (ability to make requested changes);

- Port authority's responsiveness to requests;

- Terminal operator's responsiveness to requests;

- On-schedule performance;

- Port employees' capability to meet cargo interests' needs;

- Ability to develop/offer tailored services to different market segments;

- Cost of rail/truck/warehousing;

- Availability of rail/truck/warehousing;

- Overall cost of using the port.

Finally, respondents were asked to rate the performance of ports they use against both sets of criteria.

What really matters

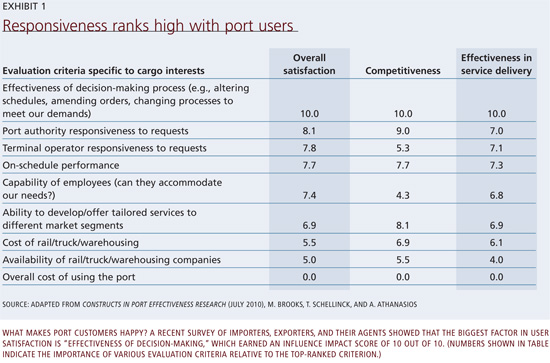

The findings for the cargo interests—our primary concern in this article—were revealing and, in some respects, a little surprising. For one thing, the results indicated that respondents use different yardsticks when selecting a port and when evaluating a port's performance. For example, when asked to rank the nine cargo interest-specific evaluation criteria by their importance in their port selection decisions, cargo interests put "effectiveness of decision-making process" (which encompasses altering schedules, amending orders, and changing processes to meet cargo interests' demands) in seventh place. Yet when asked to identify which of these criteria had the greatest influence on their overall satisfaction with a port's performance and their perception of its service, they put "effectiveness of decision-making process" at the top of the list.

One finding that may come as a surprise to anyone who's negotiated pricing with importers lately is that neither the overall cost of using a particular port nor the cost of hiring local warehousing and transportation services carried much weight with cargo interests. In fact, the cost of using a port essentially had no influence on overall satisfaction, perceived competitiveness, or perceived service quality. One possible reason why, Brooks says, is that cargo interests often don't see port-related expenses broken out from their total transportation bills and may not be fully aware of the cost of doing business with one port versus another.

So, what does matter most to cargo interests? Importers, exporters, and their agents zeroed in on what Brooks and Schellinck categorize as "responsiveness" but could also be termed "relationships." As Exhibit 1 shows, when it comes to overall satisfaction with a port's performance, the most influential factors were the aforementioned effectiveness of decision-making (making changes to accommodate cargo interests' requirements) as well as the responsiveness of the port authority and the terminal operator to requests.

What this indicates for ports is that the key to customer retention is to work closely with cargo interests, accommodating special requirements and helping them solve problems. "If the focus is just on moving boxes and ports don't really care who owns them, what's in them, or the impact of their actions on them, then customers will go somewhere where they get better care," Brooks says. This finding bucks conventional wisdom, suggesting that cargo interests' evaluation of port performance has more to do with responsiveness and management style than with investments in infrastructure. "The things that turn out to have the greatest impact on perceived satisfaction by cargo interests are also probably the easiest for ports to fix," Schellinck observes.

Practical applications

PPRN's research is still in the early stages; researchers plan to continue gathering data both within and outside of North America. (For information on how you can participate, see the sidebar "Your opinion is needed!") But they are already seeing ways both ports and their customers can benefit from practical applications of the survey results.

PPRN plans to develop a global service benchmark that ports can use to measure their performance against their competitors'. And because respondents are evaluating specific ports, researchers will also be able to identify areas in which a particular port may not be meeting customers' expectations, Brooks says. The results will allow individual ports to make targeted investments that will improve port users' satisfaction. "Ultimately, the survey results will help port managers understand how to better meet their customers' needs," Brooks says.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing