Reverse logistics startup G2 gains $9.6 million seed funding

Founded by former Genco executives, company is backed by Dell Technologies Capital

The product returns platform startup G2 Reverse Logistics today announced it has raised $9.6 million in seed funding in a round led by Dell Technologies Capital, and will use the backing to boost its sales and marketing efforts.

Although founded just four years ago in 2020, Pittsburgh-based G2 has the benefit of experienced leadership, having been founded by the creators of Genco, the returns management platform acquired in 2015 by FedEx Corp. for $1.6 billion.

G2 says its new technology is designed to maximize the net recovery of value from returned items, tackling the “trillion-dollar problem” of retail and business returns. Despite that enormous value, many companies are over-investing in the product returns process and not getting return on investment (ROI) from their effort, G2 CEO Tom Perry said in an interview. G2’s technology can help retailers—whether omnichannel, big box, or e-commerce—to tackle complex returns processes and generate ROI from high-value products or the components inside returned goods, he said.

The platform achieves that by helping companies decide quickly between making a returned product resellable in a secondary market, repairing it, harvesting its components, or simply recycling it. By making that decision early in the process, retailers can avoid “needless and wasteful” steps like transporting goods to the wrong site or moving it multiple times. According to Perry, that strategy of avoiding excess steps follows the advice of management consultant Peter Drucker who is quoted as saying “There is nothing quite so useless as doing with great efficiency something that should not be done at all.”

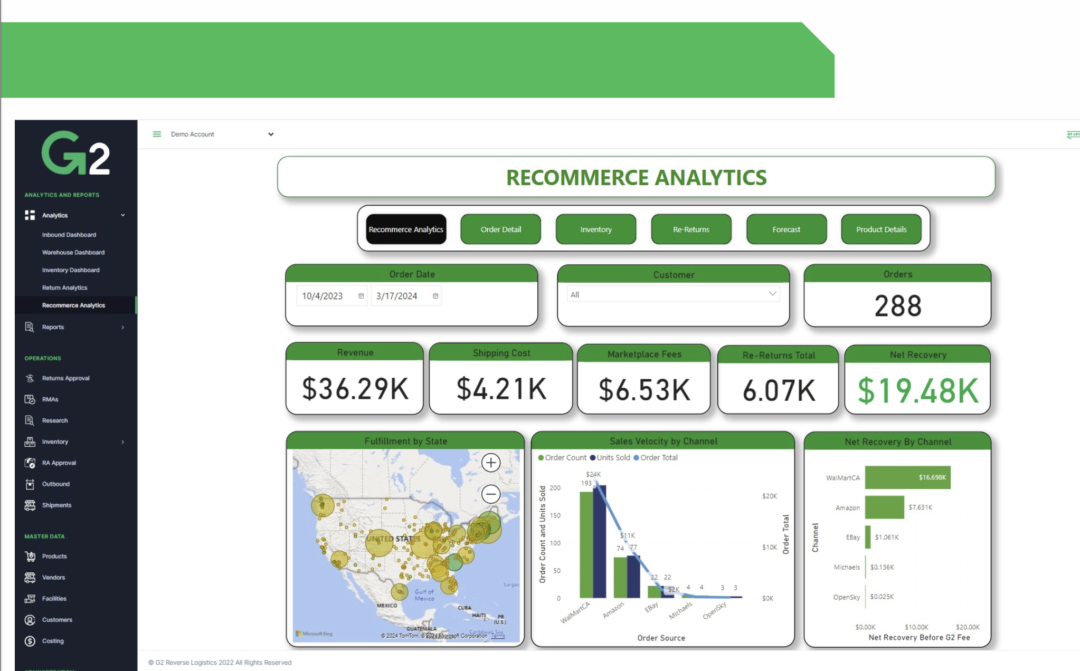

G2 says its platform guides that process by applying a prescriptive analytics engine to more than 30 variables, such as historical patterns, supply and demand for specific goods, shortages of specific parts, or processing time requirements. The firm’s technology weighs those inputs and produces decisions calculated to maximize “net value capture” and convert more assets into cash, Perry said.

The firm will operate in a fast-growing sector that has seen several new entrants and rising investment in recent years, with firms such as Loop, FloorFound, ReverseLogix, Optoro, Returnly, and Happy Returns, which was acquired last year by UPS. Other examples include Blue Yonder’s acquisition of Doddle and the National Retail Federation’s acquisition of the Reverse Logistics Association.

However, G2 enjoys a vote of confidence from Dell Technologies Capital, an investment firm funded by the personal computer retailer Michael Dell that has backed a number of other firms in the logistics sector, including the French warehouse robotics and high-density storage startup Exotec.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing