North American manufacturers outperformed rest of world in November

Manufacturing sector in Europe and Asia is enduring recessionary conditions

The North American manufacturing sector appears to have rebounded from an economic rut, even as manufacturers in other regions of the world continue to be mired in weak conditions, according to a report from the New Jersey-based procurement and supply chain solutions provider GEP.

Weakness in demand for raw materials, components and commodities continued in November, although the global slump in purchasing activity did ease, primarily because of North America, which seems to be well past the peak of its manufacturing industry downturn, GEP said. In fact, output and new orders at intermediate goods makers in the U.S. — which includes chemicals, metals, electronic components and electrical equipment manufacturers — improved in November.

On the other hand, Europe's slump in demand remained severe, reflecting recessionary conditions. And capacity at Asia's suppliers went underutilized to one of the greatest degrees in the post-pandemic era, boding ill for the near-term outlook of global manufacturing. Slight improvements in global item supply, easing transport cost pressures, and destocking, as seen in GEP's November data, provide additional evidence of continuing weakness across the global economy.

"This persistent, month-after-month, excess vendor capacity means that the end to the global manufacturing recession is still some way off," Todd Bremer, vice president, consulting, GEP, said in a release. "North America continues to buck the global economic headwinds. Continuing excess supplier capacity in Asia gives manufacturers greater leverage to drive down prices in 2024."

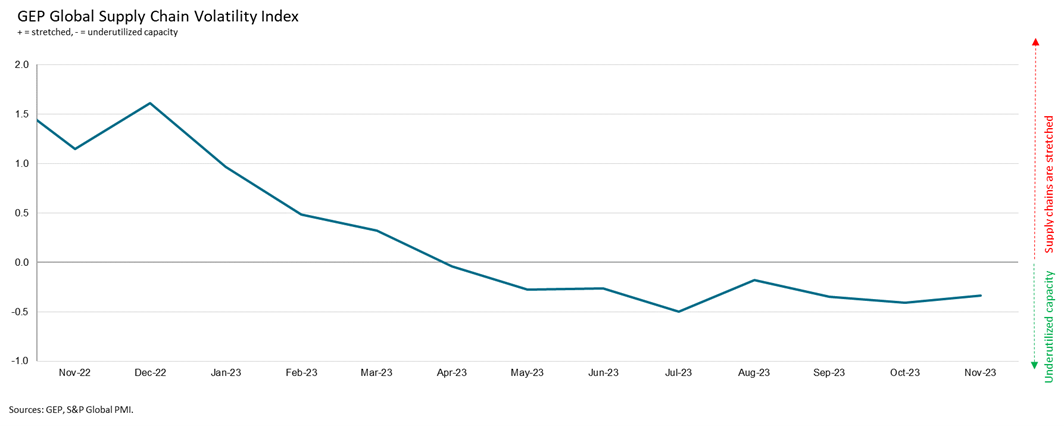

Those conclusions come from data in the firm’s GEP Global Supply Chain Volatility Index, which tracks demand conditions, shortages, transportation costs, inventories, and backlogs based on a monthly survey of 27,000 businesses. The index was once again in negative territory at -0.34 in November, compared to -0.41 in October, indicating an eighth successive month of spare capacity across global supply chains.

The index is derived from S&P Global's PMI surveys, sent to companies in over 40 countries, and represents a weighted sum of six sub-indices. A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing, while values below 0 indicate that supply chain capacity is being underutilized, reducing supply chain volatility.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing