Logistics economy expanded in September

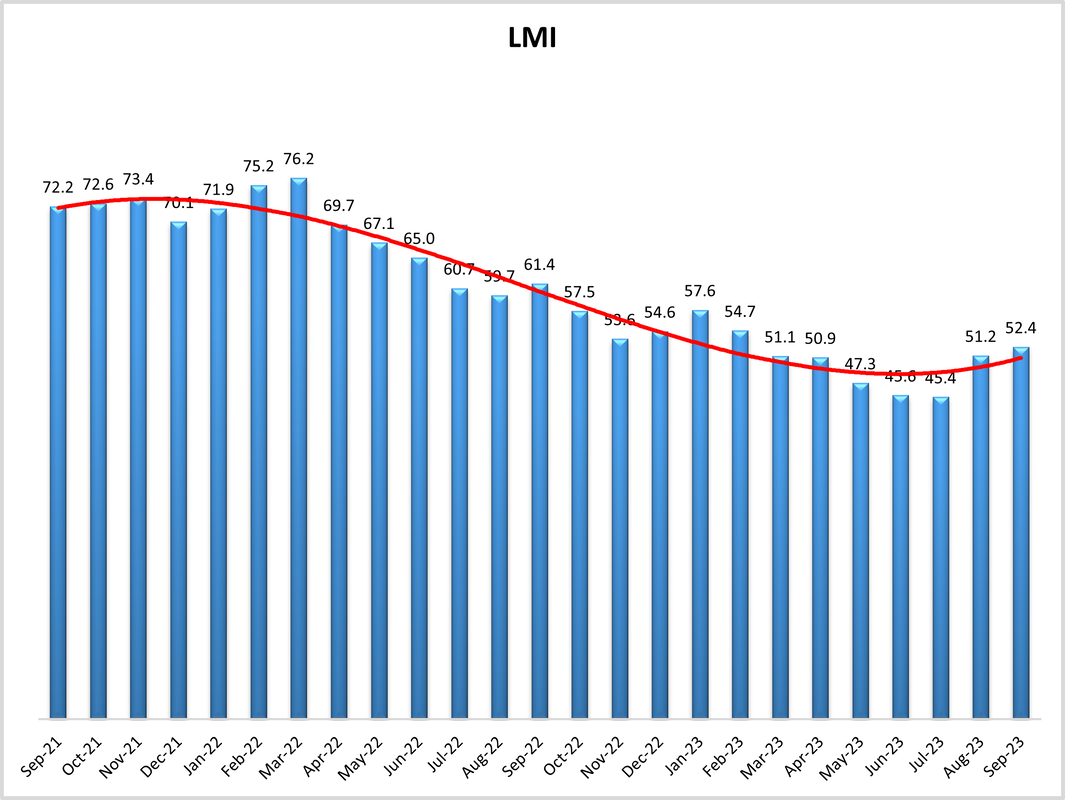

Monthly LMI index shows second straight month of moderate economic growth following three months of declines.

Economic activity in the logistics industry expanded in September, marking the second straight month of growth following a summer of contraction, according to the latest monthly Logistics Managers’ Index (LMI), released this week.

The LMI score came in at 52.4 for the month, up slightly from August’s reading of 51.2 The index had dipped below the 50-point mark indicating growth in May and stayed there in June and July before rebounding nearly 6 percentage points in August. The September reading is the fastest rate of expansion since early 2023.

Despite the growth, the index remains below its all-time average reading of 62.9. An LMI above 50 indicates expansion and a reading below 50 indicates contraction; readings in the 60 to 70 range indicate strong growth across the industry.

“While this is the fastest rate of expansion since February, a reading of 52.4 is still well below the all-time average of 62.9 and represents a very moderate level of expansion,” the LMI researchers wrote in a report summarizing the results of the monthly survey, which polls logistics managers from across the country.

The moderate results may indicate a return to more sustainable levels of expansion in the industry following two years of record-high demand for logistics services during and immediately following the Covid-19 pandemic, according to the report.

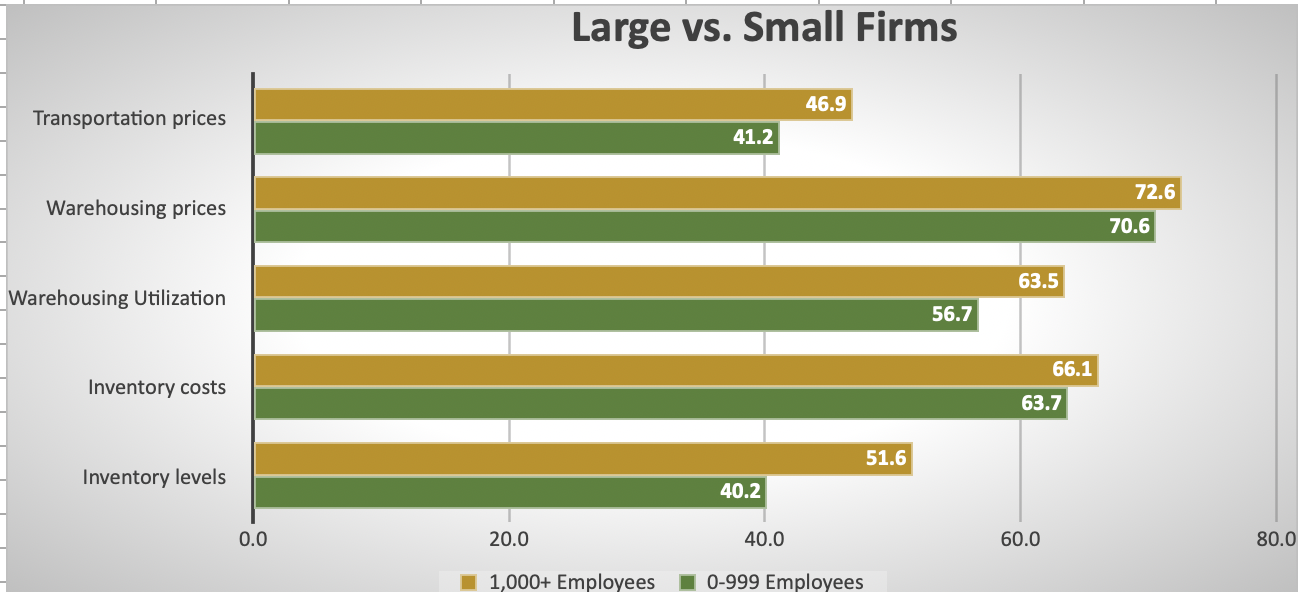

The September data show strength in warehousing, in particular. Warehousing capacity continued to expand in September, although at slower rates compared to June and July, but utilization rates and pricing climbed higher during the month, with the pricing index expanding nearly 8 percentage points.

“We’re seeing a lot of resilience in warehousing,” LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University, said in a separate interview about the report. “We’ve seen a lot of capacity come on in the last few months, but pricing isn’t coming down and we’re seeing higher utilization rates, [especially among] big companies and downstream firms,” such as retailers.

Rogers said those results point to a “haves and have nots” situation, in which larger firms with greater access to capital are able to absorb higher prices and still plan for future growth. Inventory levels are growing for larger firms–those with 1,000 or more employees–despite the high-price environment, while smaller firms reported contraction during September.

“This suggests that it is the larger downstream retailers, and their larger upstream suppliers and logistics service providers, that are currently driving the move back towards growth in the logistics industry,” according to the report.

The LMI is a monthly survey of logistics managers from across the country. It tracks industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing