Truckload spot rates may have hit bottom of cycle, DAT says

June contract rates also fell to their lowest points in almost two years, as spot/contract gap is narrowest since April 2022.

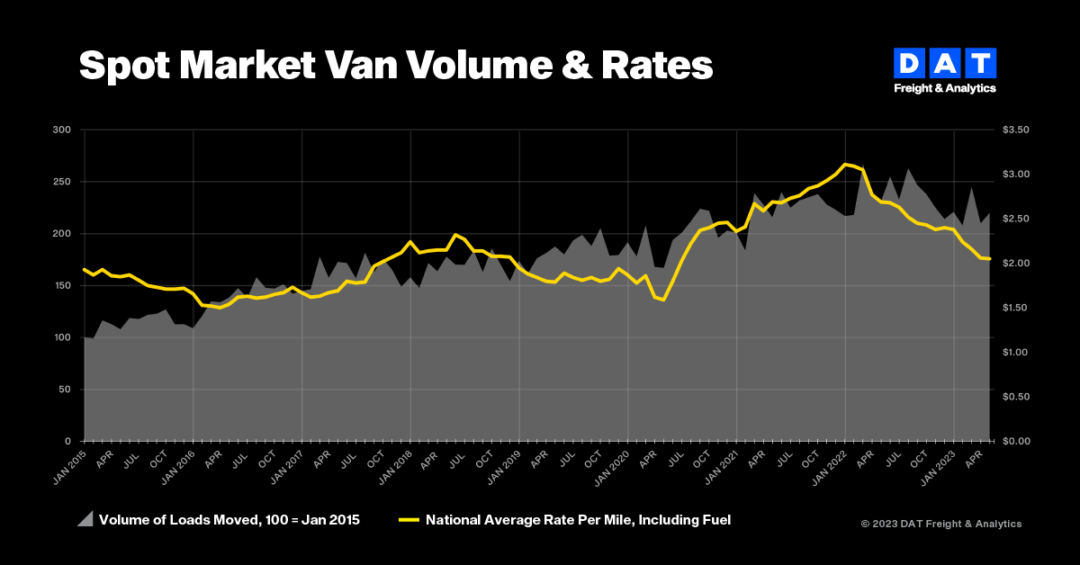

Spot rates in the truckload freight sector may have hit the bottom of their slump cycle, according to data from online freight marketplace operator DAT Freight & Analytics.

Both truckload freight volumes and spot rates held firm in June while contract rates fell to their lowest points in almost two years, according to DAT Freight & Analytics and DAT’s iQ data analytics service.

“The gap between spot and contract rates was the narrowest since April 2022,” Ken Adamo, DAT Chief of Analytics, said in a release. “Rates for van and refrigerated freight increased for the third straight month, and volumes were almost unchanged from May. These are signs that spot truckload prices have reached the bottom of the current freight cycle.”

The third party logistics provider (3PL) Coyote Logistics reached a similar conclusion based on Q2 truckload market data, today saying that rate deflation has bottomed out and the firm’s “Coyote Curve” index is sloping upward once again. “For shippers, this doesn’t necessarily indicate higher rates in your immediate future, but it does mean it’s time to start planning for an inflationary rate environment coming up in the next several quarters,” Coyote said in its "Q3 Truckload Market Guide."

One wildcard factor that could influence the sector is the continued threat of a strike by the Teamsters Union against parcel giant UPS Inc., DAT said. The two parties agreed on Wednesday to return to the negotiating table to find a last-minute labor solution before the current contract expires on Aug. 1 for the union’s 330,000 drivers and warehouse workers. But a final solution is not yet in place.

“Demand for truckload services typically slows at this time of year, but this could change quickly given the threat of strikes in the parcel and less-than-truckload sectors,” Adamo said. “Shippers are putting contingency plans in place and would look to freight brokers and carriers on the spot market to keep their line haul operations moving. Demand for trucks would jump, especially around Louisville, Memphis, Indianapolis, Dallas, and other major parcel hubs.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing