Annual "State of Logistics Report" shows a transportation market resetting itself

In spite of market softening, U.S. business logistics costs rose by 19.6% year-over-year due to inflation and strong labor market.

Three years after the Covid pandemic hit and completely disrupted transportation networks, conditions are finally resetting and rebalancing themselves, according to the “34th Annual Council of Supply Chain Management Professionals (CSCMP) State of Logistics Report,” released today.

The past few years saw high demand and tight capacity, putting carriers in the proverbial driver’s seat. But as demand leveled off and inventory rose, the market has swung back in favor of shippers. After being burned by sky-high rates and some carriers failing to live up to prior agreements, many shippers are rethinking the annual bidding process and are looking at other options to lock down transportation capacity, according to the report. These include shorter deals, greater use of the spot market, and mini-bids.

“We believe that the second half of 2022, and what we are seeing in 2023 so far, has been all about getting back in sync with the fundamental change in the equation between shippers and carriers,” said report lead author Balika Sonthalia, partner at the consulting company Kearney. “And in addition to that, we are also seeing that supply chain executives are being more thoughtful and seizing the moment to address structural costs and strengthen the foundation.”

Every year, the State of Logistics Report seeks to detail all costs associated with moving freight through the U.S. supply chain. This year’s report—which was prepared by Kearney for the industry association CSCMP—studies the calendar year 2022 and the first few months of 2023. It also provides an analysis of the state of the economy and looks ahead at key logistics trends to watch. The report is sponsored by Penske Logistics.

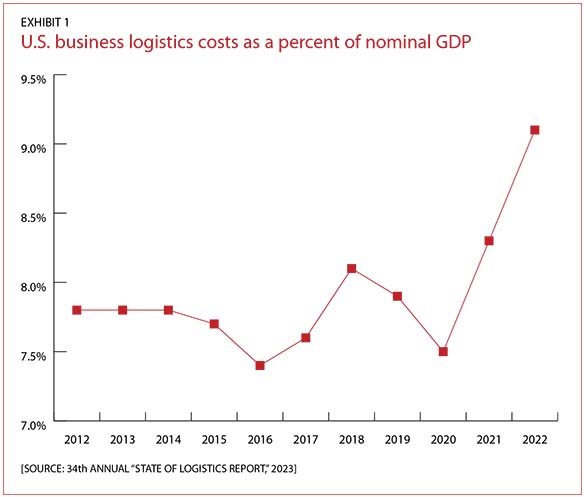

In spite of a softening in the overall logistics and transportation market over the past year, U.S. business logistics costs continued to rise, due in a large part to the effects of inflation and a hot labor market. In 2022, U.S. business logistics costs (USBLC) reached $2.3 trillion, a 19.6% rise over 2021. As a result, logistics costs represented 9.1% of U.S. gross domestic product in 2022. (See Exhibit 1.) Sonthalia, however, expects to see these numbers drop in succeeding years.

[EXHIBIT 1] U.S. business logistics costs as a percent of nominal GDP

“I believe with all the corrections that are taking place between all the transportation categories, we expect to see a significant return to the levels we are used to seeing of USBLC as a percentage of GDP,” said Sonthalia. “However, with the lingering shadow of inflation, we see prices remain elevated in certain categories and on certain routes. A lot will depend on the monetary policy, even with the [recent] pause in the interest rate hikes.”

The report stresses that to succeed going forward, shippers and carriers will need to reset their relationships to be less transactional or adversarial and more strategic and collaborative. “If the past years have taught us anything, it is that uncertainty is now a near constant in the global economy, and the smartest way to respond in good times is to gather resources for when conditions suddenly shift again,” says the report.

Logistics trends that shippers and carriers will have to work together to address include increasingly complex order fulfillment requirements due e-commerce growth, reshoring, geopolitical upheaval, and climate change, according to the report.

ANALYSIS BY MODE

The report takes a close look at each of the main logistics sectors and transportation modes, including the following:

- Air: Rates for air cargo dropped 33% from January to December 2022, as demand fell, customers increased their use of ocean freight, and capacity increased as passenger travel returned to pre-pandemic levels. Worldwide air cargo revenue is expected to be $150 billion for 2023, a 25% drop from 2022.

- Parcel and last mile: As e-commerce growth eased, parcel volumes dropped by 2% in 2022. Revenue, however, rose as the major companies increased rates. The U.S. parcel market grew 4.7% year over year to $217 billion in 2022.

- Water/ports: The major ocean freight companies saw combined operating profits of $215 billion in 2022 due to the strength of the early months of the year. But in the back half of 2022 and into 2023, demand fell, and ships and containers became more available. As a result, 2023 profits are projected to drop by 80% year over year.

- Motor freight: Demand for over-the-road transportation stayed basically the same in 2022, while capacity increased. This shift has driven down rates significantly. Spot market rates for dry van, for example, fell 23% from the early months of 2022 to the early months of 2023.

- Rail: Rate increases helped Class I railroads see operating income increase by 8% and total revenue by 14% from 2021 to 2022. The rail sector, however, suffered from severe service-related issues in 2022, including congestion, slow network speeds, and increased terminal dwell time.

- Warehousing: In 2022, historically low warehouse vacancy rates of 2.9% pushed rents higher and encouraged robust construction of new facilities. But instead of moving into these new facilities, many companies are focusing on trimming inventory and better using existing space. As a result, pricing and availability is expected to be more favorable to shippers in 2023.

In spite of the rebalancing occurring the market, Sonthalia stressed that this phenomenon should not be interpreted as a return to normal.

“We call it the ‘great reset’ for a reason,” she said. “We did not call it ‘return to normal.’ There will not be a ‘new normal.’ The way to think about the reset is simply bringing back the balance. [In 2021] everything was imbalanced more in the favor of one player and there was another player that was losing. We saw over the course of last year and going into this year, the playing field is a bit more leveled. That is another way to think about the reset which gives everyone—shippers, carriers, alike—an opportunity to think through how to become better moving forward.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing