Nearshoring trend shifts trade lanes from China to Mexico, FourKites says

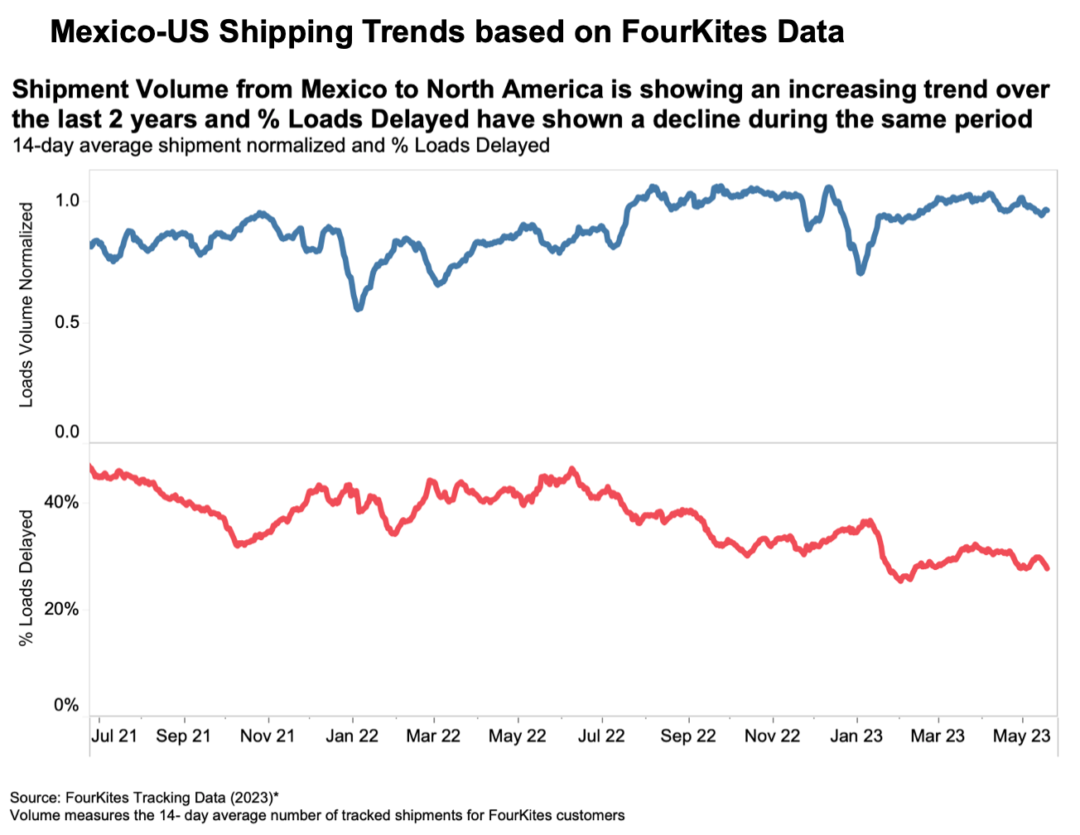

In effort to minimize supply chain disruptions, U.S. companies have driven 20% rise in shipment volumes from Mexico to the U.S. over two years.

Under trade and political tensions with China, a growing number of U.S. based companies are investing in nearshoring as a way of minimizing supply chain disruption, and data from supply chain visibility provider FourKites now shows that trend is already paying off.

Shipment volumes from Mexico to the U.S. are up 20%, and dwell times are down 25%, compared to those levels two years ago, FourKites said. The theme is particularly pronounced in the food & beverage and automotive sectors, according to an email statement from Glenn Koepke, general manager of network collaboration at FourKites.

“While manufacturing and sourcing from Mexico has been an option for companies for decades, evolving global competition and factors such as infrastructure, talent, duties, freight costs, and raw material supplier locations continually influence the decision of where to produce products,” Koepke said.

The nearshoring trend is gaining momentum slowly, as companies take a long-term investment approach to the move, since moving thousands of global suppliers into Mexico isn’t feasible in the short term.

But the move is particularly well matched for food and beverage—where Mexico has long been a source of perishable products that are shipped northbound, such as limes, avocados, and tomatoes—and automotive. In fact, several original equipment manufacturers (OEMs) already ship components south of the border, produce cars in Mexico, and then ship the completed products via rail northbound back to the U.S. Those automotive OEMs have major production operations and a significant scale that draws from the labor pools in each city and attracts other suppliers around them.

Rail is the transportation backbone of that system, so the trend could eventually provide increased business to Canadian Pacific and Kansas City Southern railroads, which finalized a merger in April. The new company, Canadian Pacific Kansas City (CPKC), covers 20,000 miles of rail connecting Canada, the U.S., and Mexico. However, Koepke cautioned that the payoff would not be immediate, since investments and infrastructure improvements often take time to trigger network improvements for capacity and throughput.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing