LMI: Strong growth persists across logistics market

Supply chains continue to feel the pinch of higher prices as demand for transportation, logistics services continues at a strong pace.

Tight market conditions continued across the logistics industry in May, as supply chain companies worked to meet sustained consumer demand in the wake of the pandemic, according to the latest Logistics Managers' Index (LMI) report, released Tuesday.

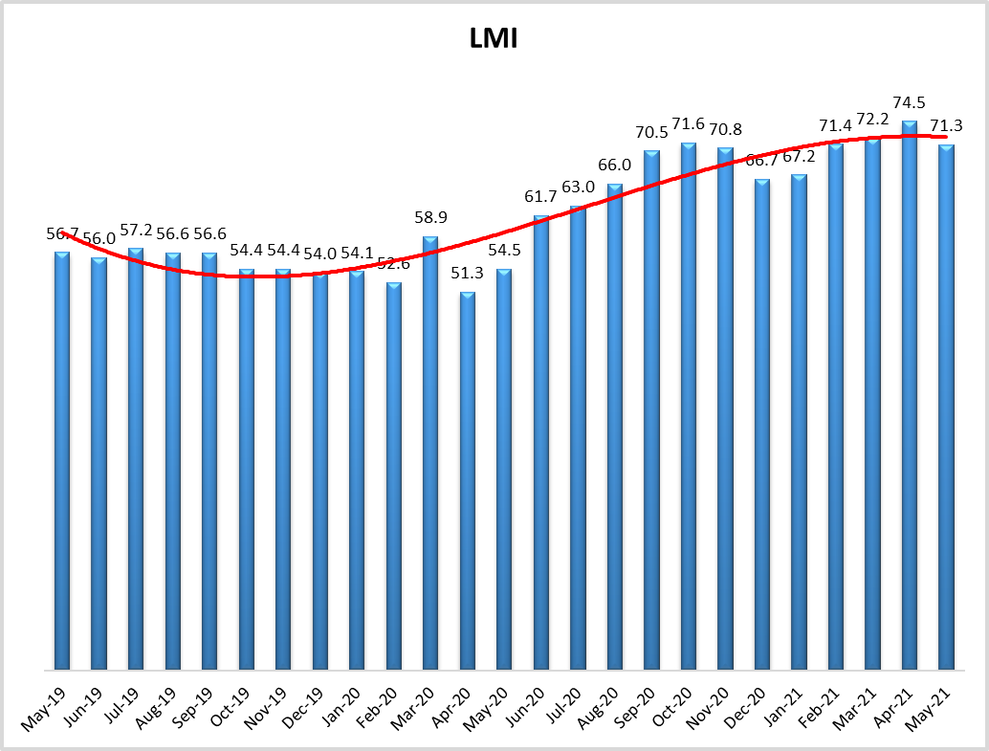

The LMI registered 71.3 in May, down 3.2 points from April’s reading but still well above the 50-point mark indicating growth in the industry. The sharp rebound in logistics that began last summer continues unabated, and companies continue to fight capacity challenges and rising prices, according to LMI researchers.

“This is a far cry from this time last year, when available capacity was high, prices were low, and the LMI registered in at 54.5,” the researchers wrote Tuesday. “This hard shift in economic activity is akin to going from standing still to a full sprint, and as would be expected, it has put tremendous pressure on supply chains. Many supply networks are currently suffering from the phenomenon known as the ‘bullwhip effect’ in which smaller variations in demand at the consumer level lead to wild swings further up the chain. The effects of this are apparent in the ongoing lack of warehouse capacity reported by respondents in May, as inventory rushes in and retailers struggle to keep products on shelves.”

Warehousing capacity declined for the ninth straight month in May, reaching an index level of 48.3, while pricing remained high, reaching 83.1. The same story was true in transportation, where capacity remained at historic lows during the month and upward pressure on pricing continued; the transportation capacity index was 32.7 and the pricing index was 91.2 in May. Combined, the capacity and pricing metrics continue to get further apart, placing even more pressure on supply chains, according to LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University.

“We’re getting to this point where costs have just kept going up for so long, yet demand hasn’t dropped,” Rogers said, noting that the LMI inventory costs metric remained high in May as well, at 83.8. He added that there is no relief in sight, as the LMI’s future predictions index points to more of the same over the next 12 months. Looking ahead, logistics professionals surveyed for the monthly report said they expect inventory costs, warehousing prices, and transportation pricing to remain firmly in growth territory, registering 88.9, 87.2, and 87.3, respectively, on the LMI scale.

“We’ve never had inventory or warehousing future predictions this high … it’s our highest predicted cost growth,” Rogers also said. “Supply won't catch up with demand for a while. Tight capacity, and [high] prices will remain over the next year.”

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP). An LMI above 50 indicates expansion in the market; an LMI below 50 indicates contraction.

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing