Logistics activity continues strong pace

Industry growth slowed in December but remained above historic averages, the monthly Logistics Managers Index shows.

Economic activity in the logistics industry grew in December, although at a slower pace than during the run-up to the peak holiday shipping season, when activity across transportation and warehousing markets hit record levels. The slower growth remained above historic rates however, and the industry is expected to keep up the pace early in the New Year, according to the latest Logistics Managers Index (LMI) report, released today.

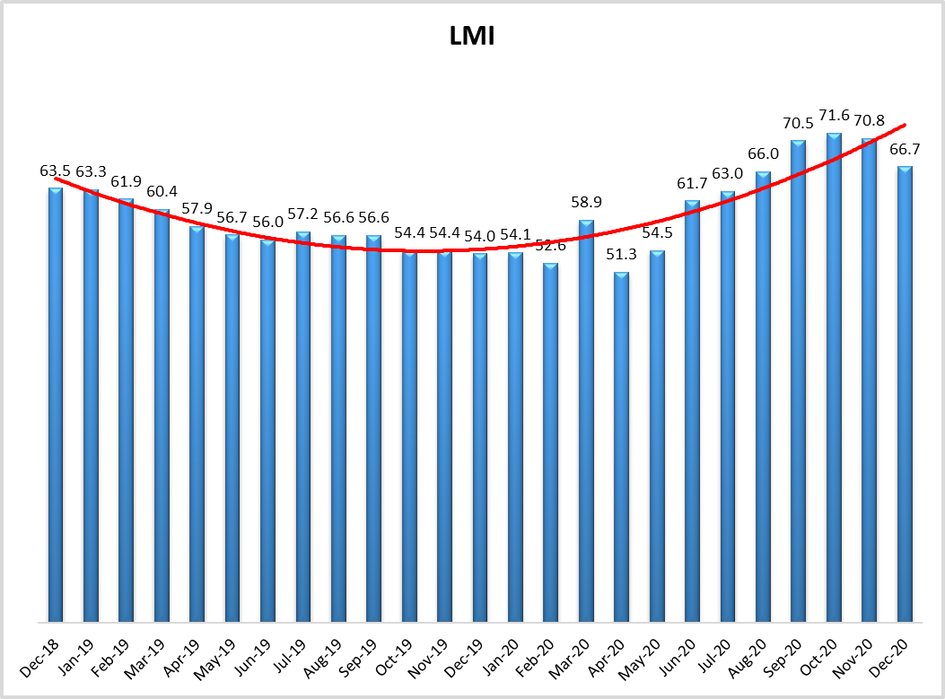

The December LMI registered 66.7, down four points compared to November and breaking a three-month streak of readings above 70. An LMI above 50 represents growth in the industry; an LMI below 50 indicates contraction. The LMI hit an all-time low reading of 51.3 in April and has been on an upward swing since, remaining above the 60-point mark since June.

“[Business] is still growing—just at slightly reduced rates,” said LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University. Rogers added that it would have been difficult to maintain the record growth of earlier this fall, when pent-up demand, pandemic-related buying, and holiday shopping collided to create one of the busiest shipping seasons on record.

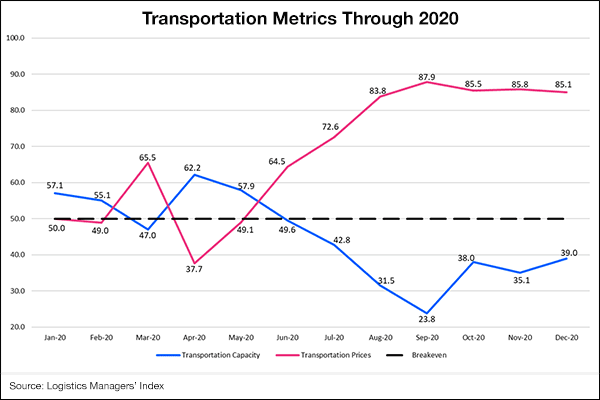

Despite the December slowdown, activity remains well above year-ago levels. December’s LMI reading is up nearly 13 points compared to December 2019, and key metrics such as pricing continue to rise as the industry tries to keep pace with accelerated e-commerce activity and related delivery demands. Both warehousing and transportation prices remained near record-high levels, registering 76.9 and 85.1, respectively during the month, while capacity continued to contract. Warehousing capacity registered 46.9 and transportation capacity registered 39 during the month.

As January unfolds, accelerated online ordering continues and is compounded by record levels of returns, vaccine distribution challenges, and a backlog of imports from China and elsewhere that are clogging the nation’s ports and squeezing capacity, Rogers said.

“We’re not having the normal slowdown we’d expect to see,” Rogers said, noting that inventory levels remained elevated in December, registering 56.8 compared to a reading of 42 a year ago.

Looking ahead, survey respondents predict much of the same in 2021.

“Respondents predict that prices will continue to grow, but at decreased rates from what we presently observe,” the researchers wrote. “This does not necessarily suggest that relief is around the corner however, as they also predict a strong level of continued growth in both inventory levels and prices. While more capacity is predicted to come online, particularly transportation capacity, it seems unlikely that it is enough to significantly bring down prices over the next year.”

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing