California wildfires threaten logistics and transportation activities

Fierce blazes compound threat of coronavirus pandemic, heatwave, and electricity blackouts, Resilience360 report says.

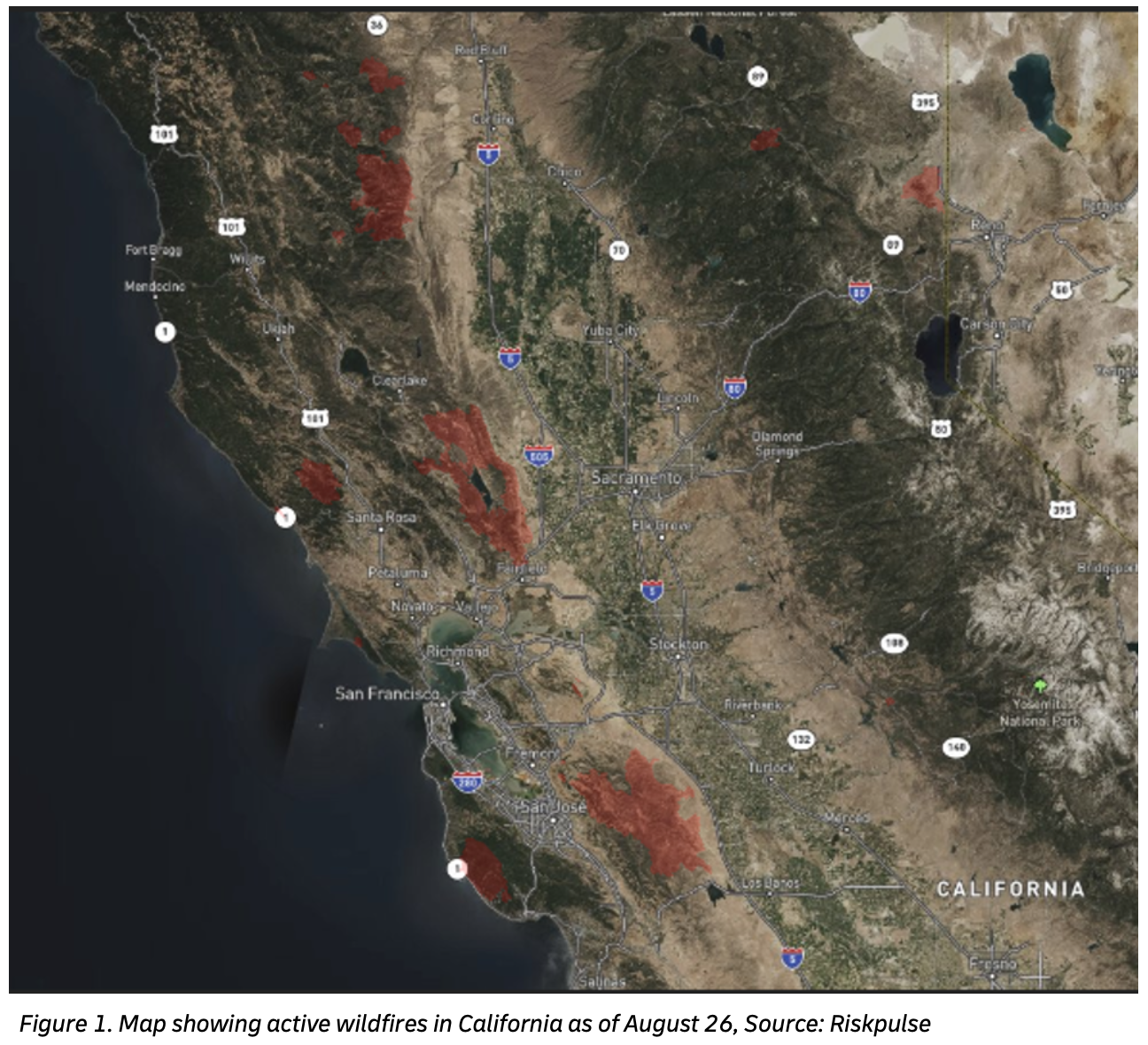

West coast shippers and retailers face a rising risk of transportation disruptions as the 2020 California wildfire season has escalated significantly in recent days to include at least five fire systems now burning in the central and northern part of the state, according to the supply chain data and analytics firm Resilience360.

The blazes represent the latest challenge to strike the region, coming as the Covid-19 pandemic continues to spread and as the state last week imposed rolling electricity blackouts in order to counter excessive demand for electricity during a record heatwave, according to Resilience360, a former unit of Deutsche Post DHL Group that was acquired in January by Columbia Capital.

The worst affected areas include a fire near Santa Cruz, another one east of Silicon Valley, and the third in Napa Valley, which together have put 20,000 infrastructures at risk, Germany-based Resilience360 said. While no businesses have yet reported disruptions due to the wildfires, there is potential for rolling blackouts to threaten the manufacturing sector, while road closures across different counties may affect logistics and transportation activities.

“The typical fire season in California during the dry period normally runs from May to October, with the peak activity occurring from August to October. There are at least two more months left where the risk of new fires will continue to grow until fall rains arrive,” Daniel Boccio, risk intelligence analyst, Americas, for Resilience360, said in a release. “The weather in California will remain favorable for continued expansion of ongoing fires, with a high risk of possible new fires due to the lack of rainfall for the next two weeks and beyond, combined with high temperatures.”

As of August 30, the California wildfires had burned over 1.66 million acres, which has surpassed the total acres charred by the wildfires of 2019, the firm said.

“If this risk materializes, an over-utilization of Cal Fire resources may leave businesses imperiled, and ongoing evacuations and road closures may impede shippers’ ability to move goods,” Boccio said. “The ongoing persistence of the wildfires will undoubtedly pose challenges for businesses throughout the remainder of the season. Customers are advised to keep abreast of the latest developments and should establish and communicate emergency response and contingency procedures throughout their supply chains accordingly.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing