Consumer sector and e-commerce to drive warehouse space demand in 2020

Consumer shopping habits are continuing to drive the industrial real estate market, as warehouse leasing demand in 2020 will be driven by both traditional and online retailers and by third-party logistics providers (3PLs) making efforts to meet demand for e-commerce fulfillment, according to the Chicago-based realty firm Cushman and Wakefield.

In its "North American Industrial Forecast Report," the firm said that some of the hottest facility types in the industrial world this year will include: cold-storage facilities, in-fill/last-mile facilities, and multistory warehouses.

The continued strength of industrial real estate in the coming years comes on the heels of a strong close to 2019, as the firm described in another recent report, its "Q4 U.S. Industrial MarketBeat."

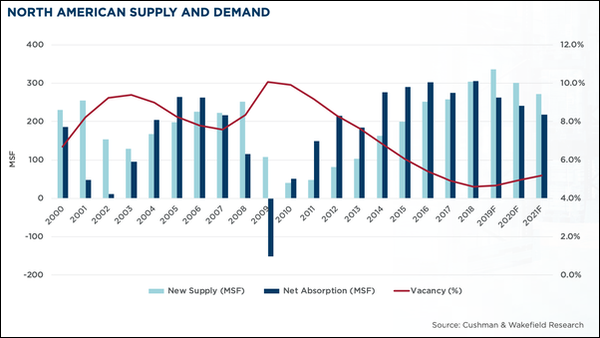

In one highlight, new supply of industrial space outpaced demand in 2019, registering 336.3 million square feet compared to 262.1 million square feet. However, because 2018 was a record year for industrial absorption, absorption numbers for 2019 appeared low compared to the past few years, and much-needed industrial supply finally caught up to tenant demand, Cushman and Wakefield said.

Conditions are now forecast to remain strong in the industrial occupancy and rent growth sectors across North America, driven by a combination of strong consumer confidence, wage inflation, low unemployment, and an anticipated increase in e-commerce spending at multiple times the rate of overall spending.

However, unpredictable changes in trade policy could have an impact on those conditions in the near term, especially since tariffs could impact critical consumer spending levels.

"As the world faces a new decade, eyes will be on policy developments—fiscal, monetary and trade—as well as the health of consumers, the key pillar of the economic engine moving forward. Both global and North American economic growth moderated in 2019, and more moderation in North America is expected in 2020," Cushman and Wakefield said in the report.

Geographically, those trends are playing out in five main markets, which top all other regions in terms of both industrial real estate demand and the supply of new space: Dallas/Forth Worth; the "Inland Empire" of California; Atlanta; Chicago; and Pennsylvania's I-81/I-78 corridor.

Will #industrial remain on top? Does the market still demand more space? Find out in our North American Industrial Outlook -> https://t.co/TvMV7QousE @CushWakeUS #logistics #cwresearch #warehouse #economy #trade pic.twitter.com/UHiDTHK76T

— Cushman & Wakefield (@CushWakeINDSTRL) January 27, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing