Order in the court

The latest yard management systems are using computer vision and mobile apps to marshal incoming trucks and trailers into an orderly parade, then move them through the yard efficiently and get drivers right back on the road.

A warehouse yard can be a messy, raucous place. Trucks loaded with freight sometimes arrive earlier or later than expected. New arrivals may have to wait their turn if all of the dock doors are occupied. Facilities sometimes lack enough workers to unload the trucks and reload them with outbound freight due to the nationwide labor shortage. And there may not be any space to slot the incoming goods if operations inside the distribution center are backed up.

Those complications happen every day, but the right yard management system (YMS) can bring order to the chaos, creating an optimized flow of goods that minimizes backups and wasted time. And that’s good news for all three parties with a stake in the operation: the truck drivers hauling the goods, the warehouse operators handling them, and the retailer or manufacturer who owns the inventory and is eagerly waiting for it to reach its destination.

There’s more than one way to get the job done. Just as a judge might pick a gavel of a specific size or shape to restore order to a fractious court, DCs can choose from a variety of YMS products with differing capabilities.

TECH TO THE RESCUE

A key tool for taming the chaos of a warehouse yard is vision sensor technology, according to supply chain software developer Blue Yonder. The company recently introduced its own YMS product—one that’s enabled with outdoor cameras, computer vision technology, and machine learning—and announced that Penske Logistics had become the software’s first user.

As a logistics service provider (LSP), Penske was looking for a way to track and monitor the trailers and containers in its yards, as part of its overall mission to work with shippers and carriers to optimize shipments, reduce miles, cut transportation costs, and improve asset utilization, according to the company.

Blue Yonder’s computer vision-based YMS supports those goals by automatically checking in trucks as they arrive at the gate and identifying the incoming trailers so users know what shipments are in the yard and where the trailer or container is parked. The YMS also automatically checks the trailers out as they leave the yard, providing time stamps to record their exit time.

Automating the process provides benefits on many levels, according to Ann Marie Jonkman, vice president for industry strategies at Blue Yonder. For starters, the system eliminates manual errors, logs precise times instead of estimates, helps mitigate detention fees, and improves safety by reducing the need for employees to walk around the yard searching for missing trailers, she says. It also boosts freight processing speed by coordinating trailer movements with orders in the facility’s warehouse management system to determine which trucks to unload first.

And crucially, adopting that kind of data-based approach strengthens accountability, heading off the disputes that can arise when, say, a DC claims a truck arrived late but the driver insists it was on time.

“It’s like when an e-commerce order is delivered to your home, and your doorbell camera records the time,” Jonkman says. “[With our YMS,] you get driver accountability: ‘What time did they arrive, when did they leave, was there idle time?’”

PLAYING WELL WITH OTHERS

Like Blue Yonder, software developer Manhattan Associates considers tracking and monitoring to be key capabilities for any YMS. But the company believes there’s more to it than that, arguing that it’s also critical that the yard management platform be able to orchestrate with other software products. For that reason, Manhattan sells its YMS only in combination with its warehouse management system (WMS) or transportation management system (TMS), not as a standalone product, says Blake Coram, the company’s director of product management.

“Our edge is [that we offer] a unified solution. That allows each component to inform and be informed by the others. We see the yard as a great opportunity for that approach because it’s the physical contact point between WMS and execution,” Coram says.

Instead of using automated cameras to record truck arrivals, Manhattan Associates relies on a mobile app that generates a quick response (QR) code that truck drivers can show to the guard when they enter and exit the yard. “The mobile app is scan-and-go, so when [truck drivers] arrive, they theoretically don’t even have to say anything to the gatekeeper,” Coram notes. “They just hold up their phone and the guard scans it.”

Among other advantages, the scanning system forestalls disputes over the yard’s recordkeeping practices. “The possibility of detention fees can be contentious; drivers might ask, ‘When did you start the clock?’ or ‘Why did you start the clock?’” Coram says. But with an automated system, that’s not an issue. “The TMS ‘informs’ the process by tracking the carrier, the trucker, the shipment, the [purchase order], and the shipment pickup. So there are fewer lookups by guardhouse or clerical staff.”

The integrated system also helps minimize drivers’ “time on yard” to get them in and out as swiftly as possible. It does that by making dynamic decisions based on real-time arrival estimates sent when trucks are still on the road to ensure that a warehouse door is available when they arrive.

Because it’s linked to the WMS, the system can also speed up truck turnarounds by directing each trailer to the dock door closest to where its cargo needs to go inside the building. “You need put-away optimization because everything you unload off the trailer needs to be put away. And the YMS can do that because it has access to data on the SKUs [stock-keeping units], quantities, and license plates [identifying numbers assigned to each pallet or containment unit]. Then that is fed into the WMS, which knows the location of the inventory,” Coram says. “So then we can turn more trailers overall, and therefore, get the drivers out faster and increase throughput at the dock.”

THERE’S AN APP FOR THAT

Getting drivers in and out of the yard quickly is key to maintaining peak yard efficiency, agrees Scott Hebel, solutions director at software developer Kaleris, which also offers a YMS product.

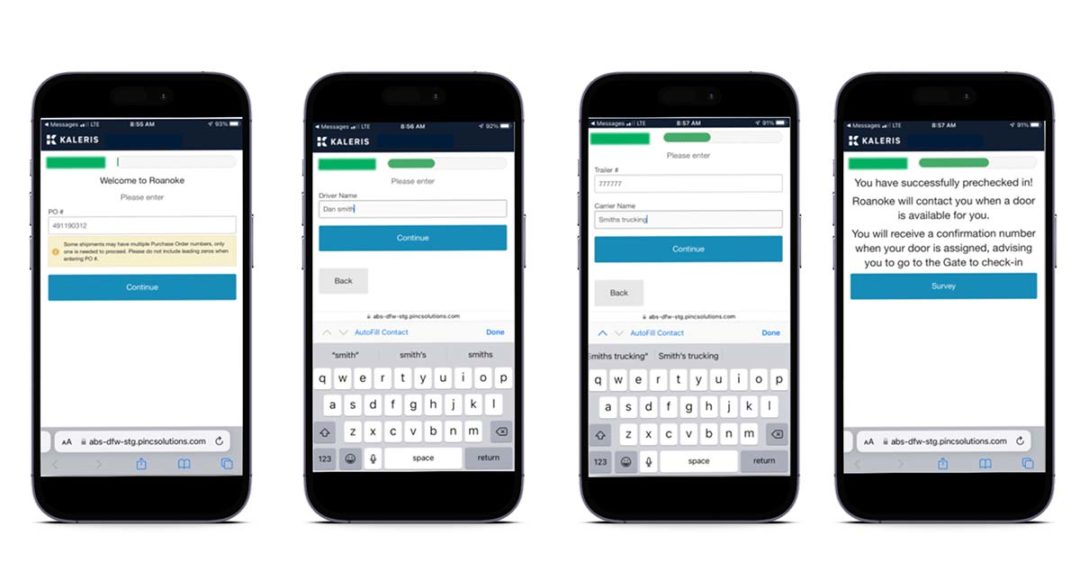

To help streamline drivers’ journey through the yard, Kaleris’s YMS app includes a “driver pre-check-in” feature that allows drivers to use their mobile phones to notify a facility they’re on their way, enabling the warehouse to prepare for their arrival.

“As the driver completes app check-in, the YMS reserves a dock door or parking spot and queues drivers for arrival appointments to reduce gate congestion, which is understandably a major source of frustration for drivers. The driver then receives a QR code to scan for entry at the gate, along with in-app instructions on how to proceed to their assigned location,” Hebel says.

Kaleris says its app reduces check-in time by over 80%, which accelerates gate velocity. And because the app supports two-way communications, drivers can remain safely in their cabs and receive regular status updates from the facility.

“Once a driver is in the gate, the clock is ticking [to ensure that drivers have] a wonderful experience [at the facility]. The best shippers strategically plan operations to avoid putting drivers in ‘hurry up and wait’ [mode],” Hebel says. “YMS technology fills in the gaps created by manual operations. Those gaps—lack of communication, safety issues, unclear instructions, and long wait times—negatively impact the driver experience and yard efficiency. The great news for today’s shippers is that these challenges are easily solved with a YMS.”Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing