Interact Analysis: most Western warehouse automation vendors fail in the Chinese market

Reasons include cost, terminology, government subsidies, and a shift from fixed to mobile automation

The majority of Western warehouse automation vendors that have entered the Chinese market haven’t been successful, and that trend is related to four basic reasons, according to a report from the consulting firm Interact Analysis.

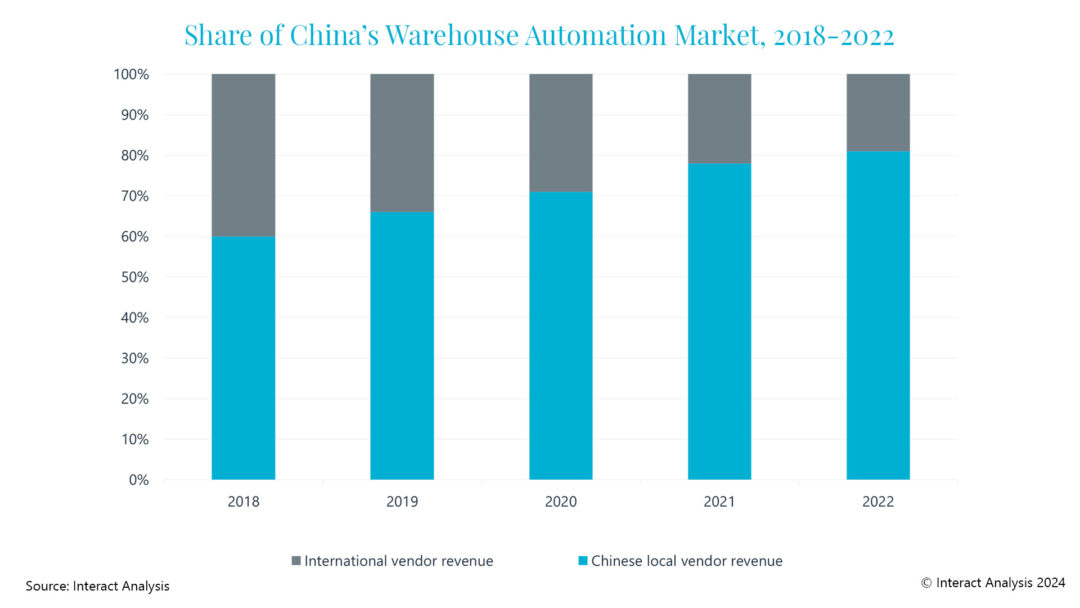

By the numbers, between 2018 and 2022, the share of China’s warehouse automation revenues generated by non-domestic system integrators declined from 40% to 19%. One of the main reasons for that result is that international vendors often don’t have a detailed and nuanced understanding of the market structure and the factors driving its growth, Interact Analysis’ senior analyst Irene Zhang said in the release.

Digging into that overall assessment reveals four specific conditions, the report said:

- International warehouse automation vendors are often far more costly than local domestic vendors

- Industry Definitions: In many cases, the Chinese warehouse automation market uses different terminology for equipment and solutions.

- Government Subsidies: Many domestic vendors make use of lucrative government subsidies.

- The shift towards mobile automation: While many international warehouse automation vendors focus on fixed automation, we’re seeing far greater demand for mobile automation solutions, which are often supplied by domestic vendors.

Western warehouse automation vendors also need to better understand the factors driving the growth of the Chinese market, the report said. In most developed countries, the growth of warehouse automation is primarily driven by two key factors: rising labor costs and the expanding e-commerce market. This is partially true for China, although while labor costs in China have seen an increase in recent years, abundant labor supply in the Chinese market has offset that impact.

Based on research involving 68 warehouse automation suppliers in China and 50 automation end customers, the report found four key factors driving the development of warehouse automation in China:

- The significant growth of e-commerce has greatly accelerated investment in warehouse automation. This expansion is not limited to e-commerce giants like Taobao, JD.com, and Vipshop, as delivery companies have also made substantial investments in warehouse automation over the past five years. Chinese warehouse automation suppliers such as Wayzim and China Post Technology have experienced rapid growth during this period.

- The swift development of the new energy industry has also led to significant investments in warehouse automation, as China accounted for over half the global market share of power battery production capacity in 2022, with six of the top 10 power battery manufacturers worldwide based in China

- Using a local supply chain allows local Chinese suppliers to lower their product prices. An increasing number of core supply parts, such as sensors and PLCs, are partly produced locally and this has led to a reduction in equipment prices which is making Chinese customers realize a return on investment in a shorter time.

- Lastly, Government subsidies have played a role in supporting industry growth. Our analysis found that on average, 20% of net profits of domestic vendors came from government subsidies in 2022, showing that the Chinese government’s focus on developing the warehouse automation industry has had a significant impact.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing