Container imports wind down for the year, NRF and Hackett say

Most imported holiday season merchandise is already in retailers’ stores and DCs

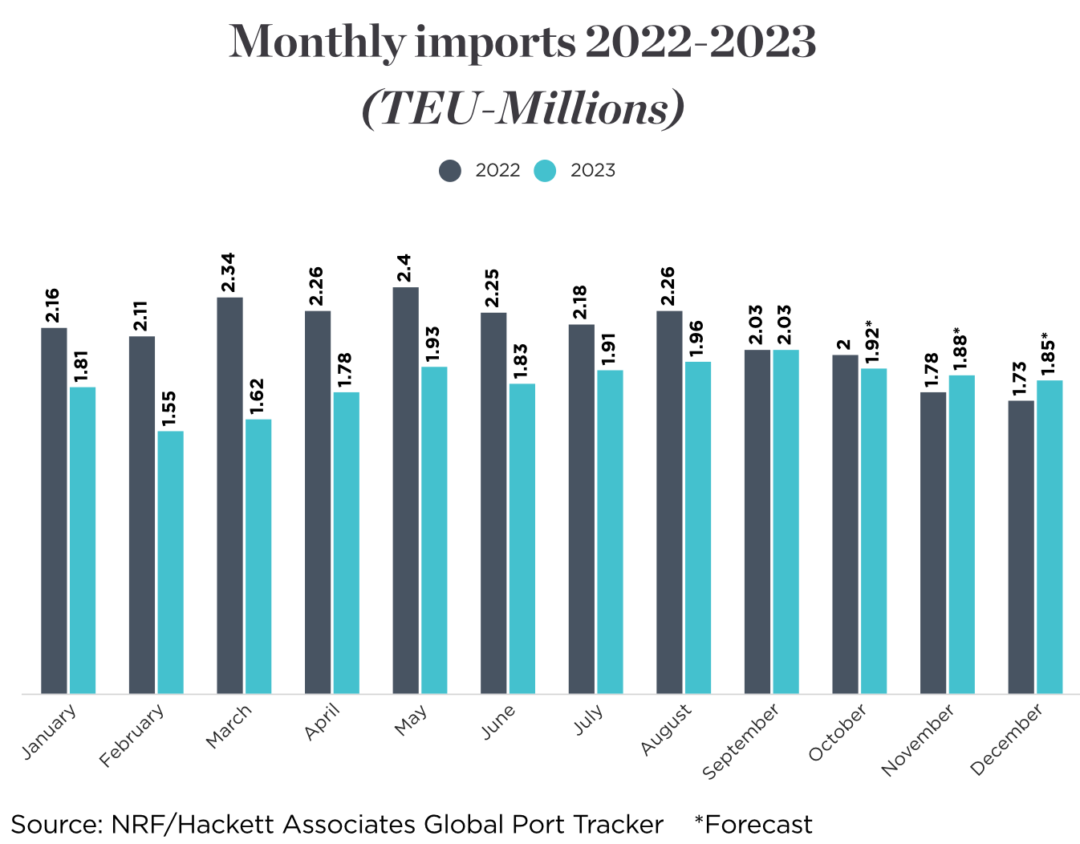

Inbound cargo volume at the nation’s major container ports is expected to slow during the remainder of 2023, since most imported holiday season merchandise is already here, according to the “Global Port Tracker” report released last week by the National Retail Federation (NRF) and Hackett Associates.

“Retailers expect record-setting sales during the holiday sales season this year, and they have their shelves stocked to meet demand whether it’s in stores or at distribution centers to fulfill online orders,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Port, railroad and delivery service labor contract issues that caused worries earlier in the year are behind us, and the supply chain is running smoothly. Shoppers should have no trouble finding what they want this year.”

NRF is forecasting record holiday sales and growth between 3% and 4% over last year. That’s in line with pre-pandemic holiday growth rates. And the expected total of between $957.3 billion and $966.6 billion would easily top the record of $929.5 billion set last year.

Even as imports wind down on a strong economic year in the U.S., Hackett Associates Founder Ben Hackett said economic conditions in the United States are better than Europe and Asia. A decline in consumer demand brought on by recessions in both regions has left shipping companies with excess capacity on new vessels built in response to the cargo surge of the past few years.

“U.S. consumers stand out in the global economy as they continue to benefit from job and wage growth and are still able to dip into savings accumulated during the pandemic,” Hackett said in a release. “While U.S. consumers are doing well, a global recession in cargo trade could potentially affect the supply chain.”

The numbers show that U.S. ports covered by the report handled 2.03 million twenty-foot equivalent units (TEUs) in September, the latest month for which final numbers are available. That was down 0.2% from the same time last year but up 3.5% from August. It was the first time imports have reached the 2 million TEU mark since October 2022. And by topping August’s 1.96 million TEU, it became the busiest month of the year so far and should go down as the peak of the holiday shipping season.

The report provides historical data and forecasts for the U.S. ports of Los Angeles/Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami and Jacksonville on the East Coast, and Houston on the Gulf Coast.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing