Report: Warehouse construction, automation spending to rise in 2024

Analysts see light at the end of the tunnel following an expected 25% decline in warehouse construction this year.

A recent slowdown in warehousing construction and related demand for automation projects is expected to hit bottom this year, with both markets expected to return to growth in 2024, according to a report from market research firm Interact Analysis, released this month.

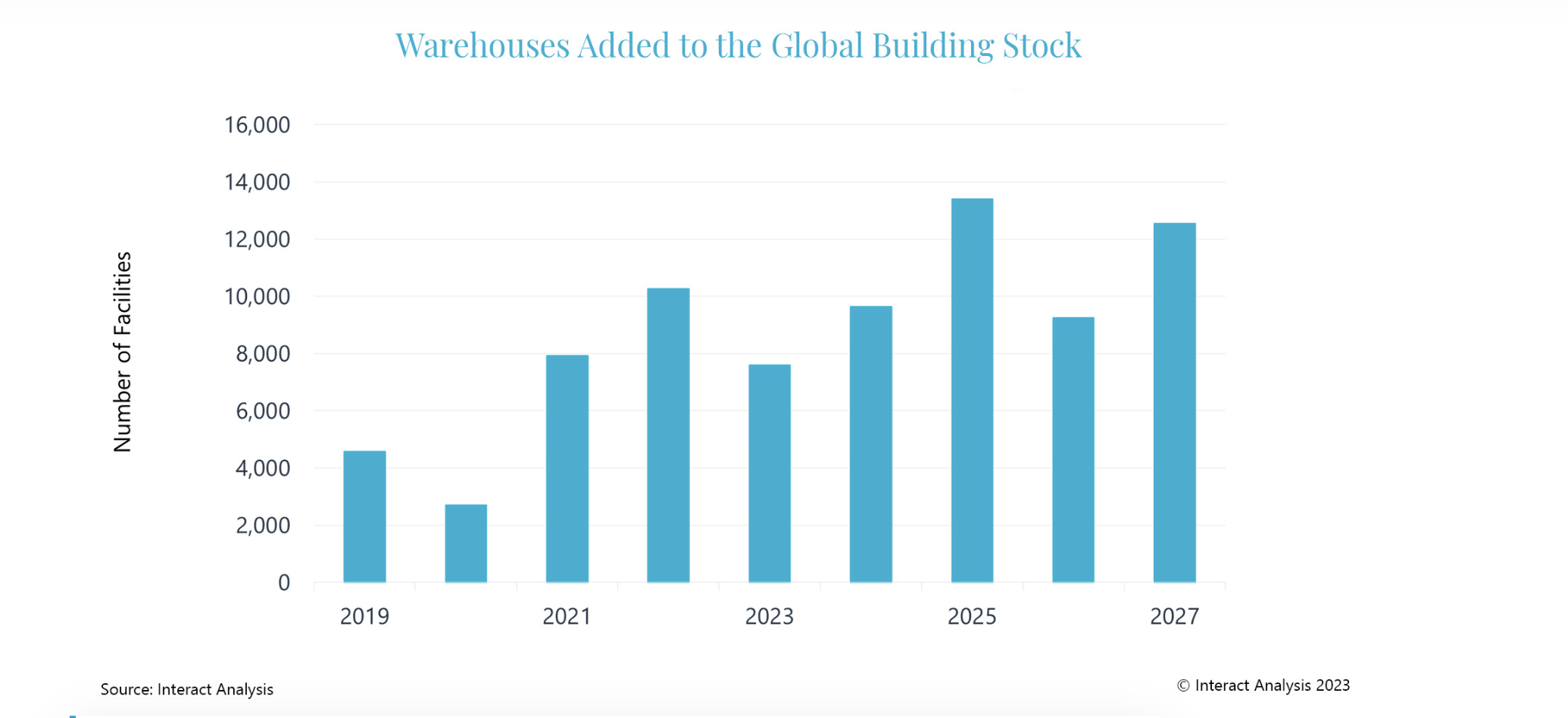

The post-Covid construction boom—which was driven by unprecedented demand for e-commerce—slowed over the past 12 months thanks to declining e-commerce activity and rising interest rates. As a result, warehouse construction is expected to decline 25% year-over-year in 2023, according to Interact Analysis' Warehouse Automation Report mid-year update. But the report’s author, Reuben Scriven, says the “green shoots of recovery” are starting to come through, as e-commerce activity has begun to stabilize and companies look to boost inventory levels to deal with supply chain uncertainties.

“With e-commerce at the tail end of the post-Covid correction, coupled with the trend away from just-in-time inventory management toward just-in-case supply chains, warehouse construction is forecast to return to growth from the end of this year, fueling demand for automation solutions during 2024 and into 2025, particularly in the U.S.,” Scriven wrote in the July update.

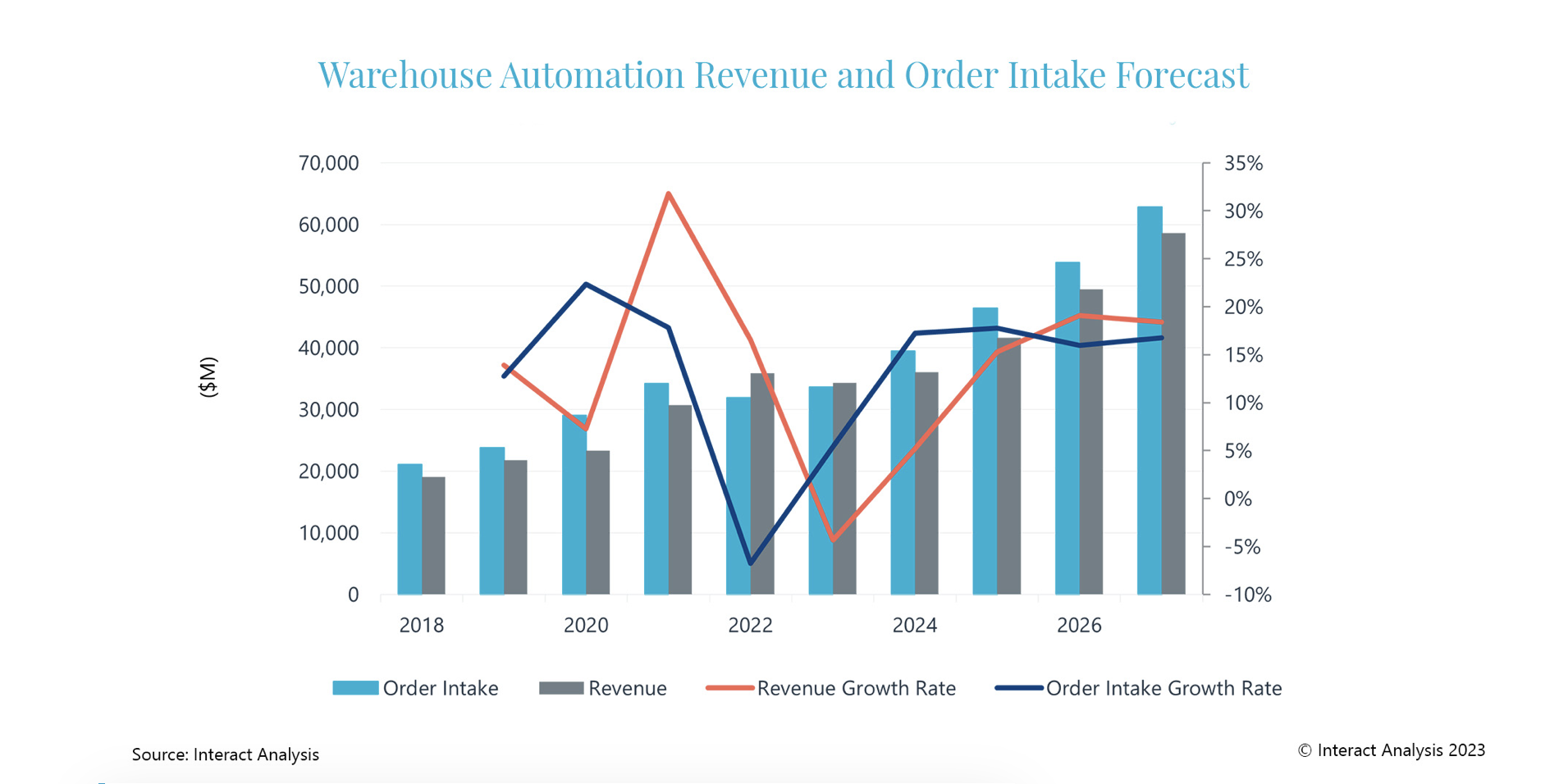

The report predicts that warehouse automation orders will start to grow toward the end of this year, continuing into 2024 and reaching double-digit growth in 2025. That growth is linked to the development of greenfield warehouse sites, which Scriven says are set to rise in 2024 following a sharp decline this year.

Companies expected to invest heavily in warehouse automation over the next two years include American e-commerce giants Amazon, Walmart, and Target, along with European brands Aldi, Adidas, Carrefour, and John Lewis, as well as U.S.-based Albertsons. The report says Germany’s Aldi has become one of the largest global investors in warehouse automation.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing