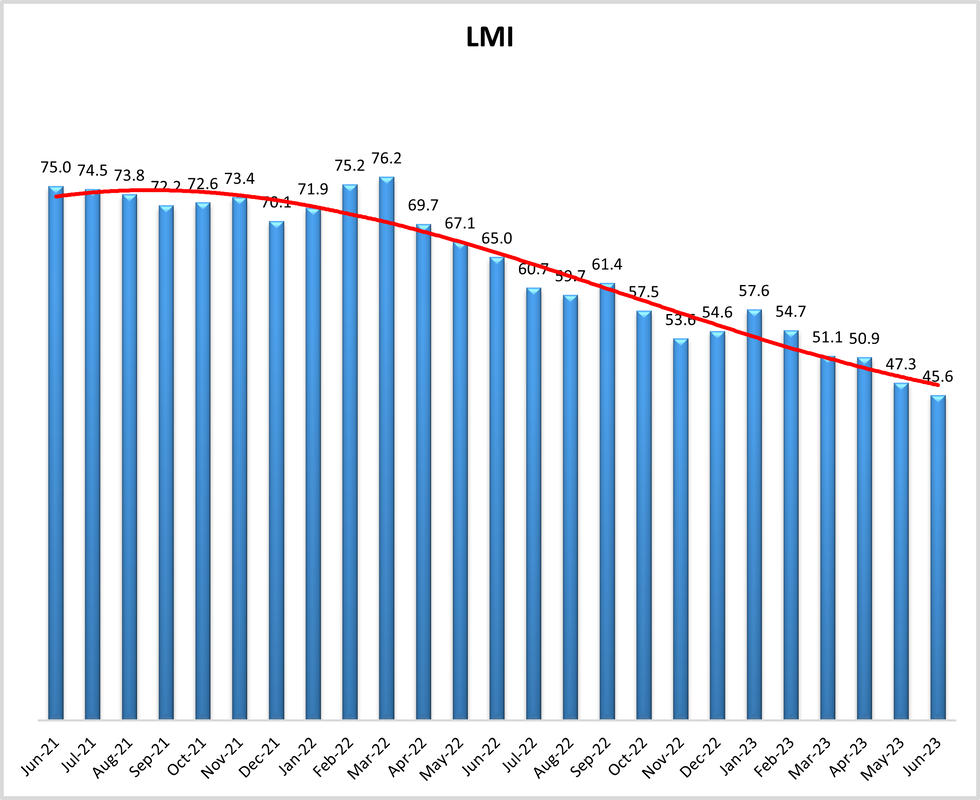

LMI continues downward trend

The monthly Logistics Managers’ Index contracted for the second straight month in June, driven by declining inventory levels.

Economic activity in the logistics industry contracted for the second straight month in June, continuing a slowing trend that began earlier this year, according to the latest Logistics Managers’ Index (LMI) report, released this week.

The monthly LMI registered 45.6 in June, an all-time low and only the second time the index has contracted since its inception in 2016. The LMI polls logistics managers nationwide each month to gauge economic activity across transportation and warehousing industries. A reading above 50 indicates expansion and a reading below 50 indicates contraction in the market.

June’s reading was down 1.7 points from May, which was the first time the LMI dipped below 50.

Inventory metrics are the driving force behind the monthly decline, according to LMI researchers. The LMI’s inventory levels index fell nearly seven points to a reading of 42.9, the fastest rate of decline in the history of the index. The inventory costs index remained in expansion mode but continued to slow from elevated levels over the past two years, falling more than seven points to a reading of 57.1. The dip in inventories has led to an increase in warehousing capacity and transportation capacity—up nearly seven points and two points, respectively—both of which contributed to the decrease in the overall LMI.

Transportation utilization and transportation prices continued to contract in June, but at slower rates compared to May, according to the report.

Declining inventories may represent a “rightsizing” following a glut of inventory across supply chains in 2022, but there is some concern that a build-up of inventory for peak shipping season this fall has yet to materialize, according to the report.

“Inventory metrics were the big movers in June. Inventory levels continued their downward movement, dropping (-6.5) to 42.9, which is the second-lowest reading in the history of this metric,” the researchers wrote in the June report. “Seasonality would suggest that this value should come up soon, but there are some signals that that might not happen.”

Those signals include sluggish conditions in Chinese manufacturing and lower container imports compared to the highs seen in 2021 and 2022. Import cargo volume nationwide remains down year-over-year, according to data from Global Port Tracker, a separate industry report released Friday by the National Retail Federation (NRF) and Hackett Associates. Import volume at U.S. ports covered in the monthly report was up 8.5% consecutively in May (the latest month for which data is available) but down more than 19% year-over-year. The group said it expects to see improvement leading up to the holiday shipping season—with an anticipated peak in August imports—but levels will nonetheless remain lower than 2022.

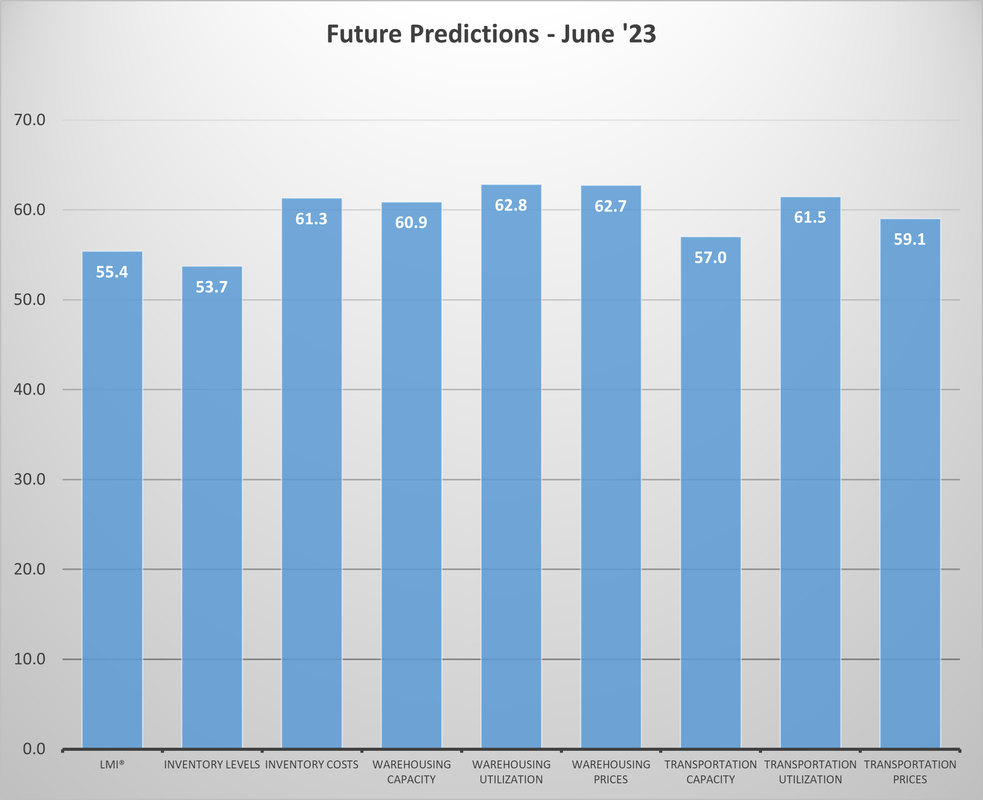

Looking ahead, the LMI indicates a potential return to more normal industry conditions over the next 12 months.

“Expectations have been trending toward things ‘going back to normal’ for most of 2023, [and] that trend became even more pointed in June as all future metrics read in between 53.7 and 62.8—all of which we would consider to be healthy levels of expansion,” the LMI researchers wrote.

The LMI is a monthly survey of logistics managers from across the country. It tracks industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing