Logistics industry growth slows in July

A slowdown in the transportation market drives cooling conditions, but inventory and warehousing metrics remain in high-growth mode, latest LMI report shows.

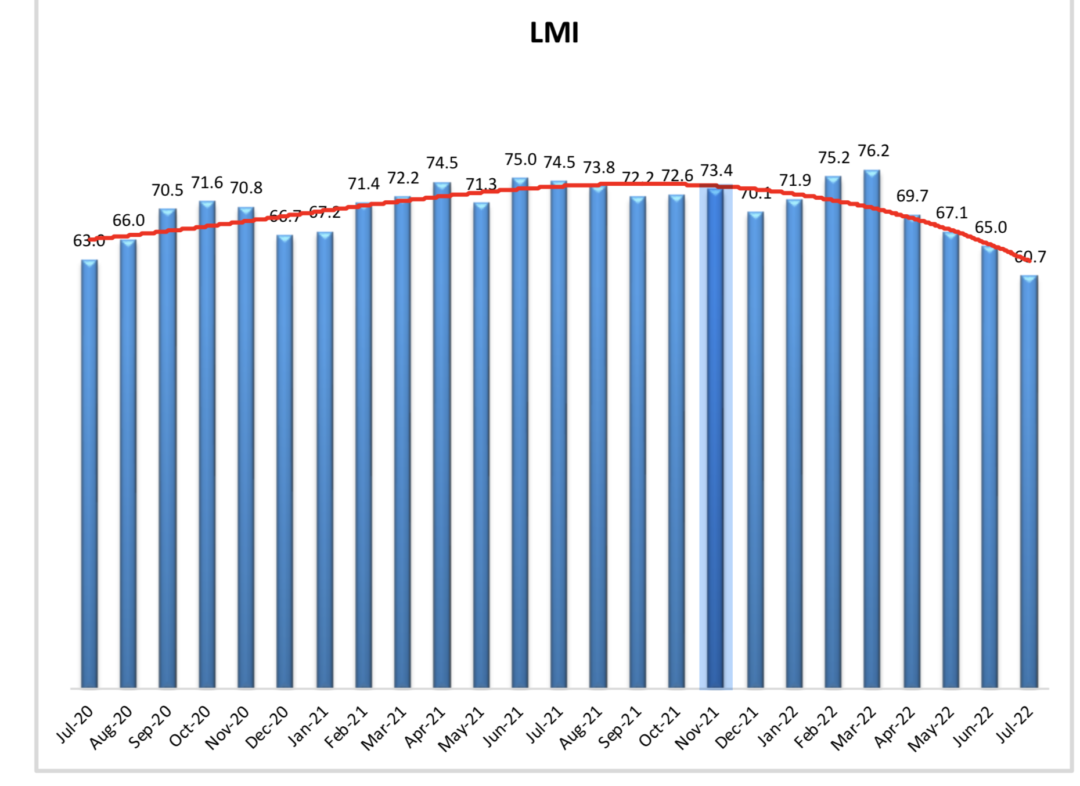

Logistics industry growth slowed for the fourth straight month in July, continuing a cooling trend that began in April and that has been driven by a slowdown in transportation metrics. That’s according to the latest Logistics Manager’s Index (LMI) report, released this week.

The monthly index registered 60.7, down more than four points from June and down more than 15 points from its all-time high reading of 76.2 in March. Despite the drop, the July reading still indicates a healthy rate of growth across the industry. An LMI reading above 50 indicates growth, and a reading below 50 indicates contraction.

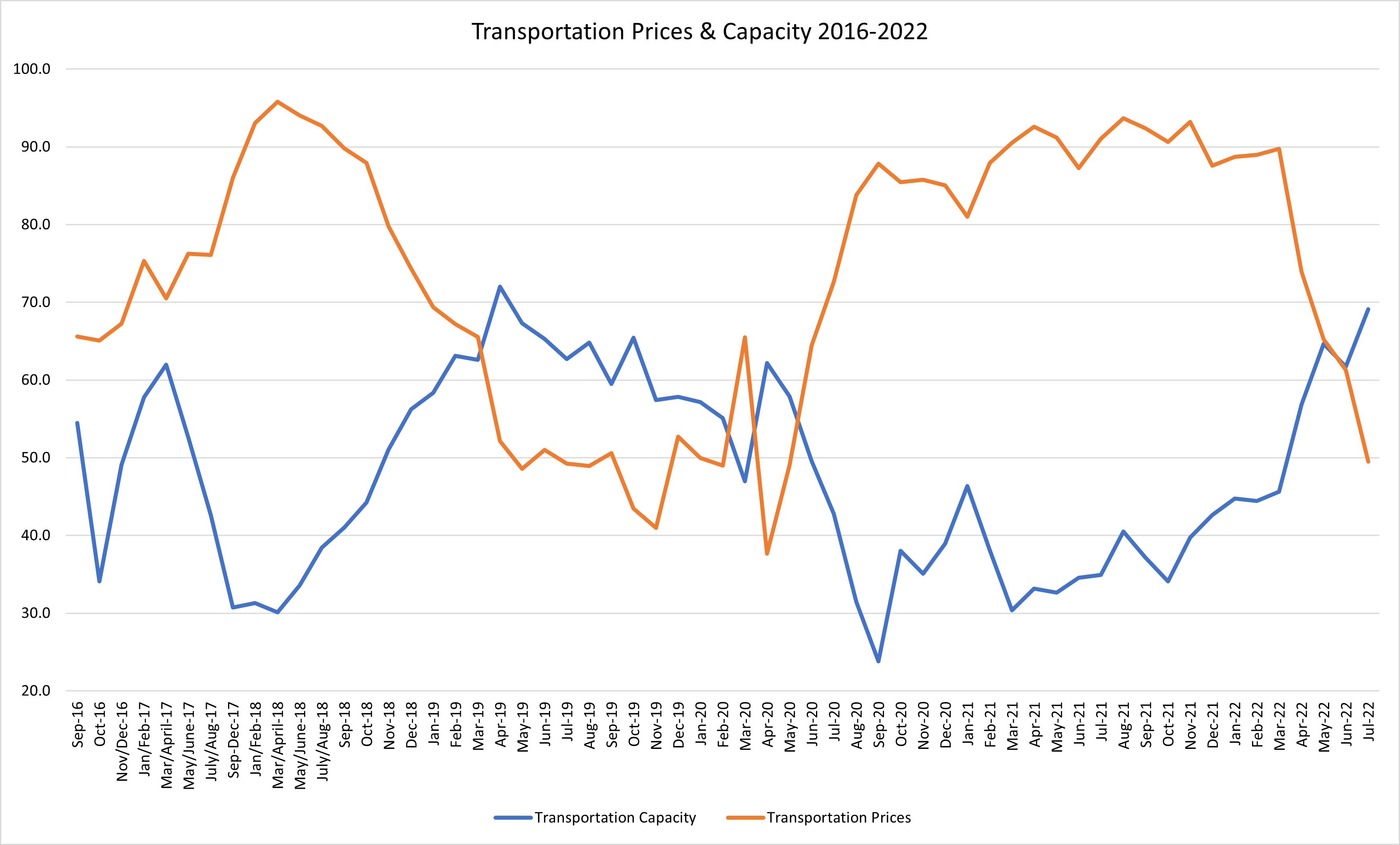

Transportation metrics continue to be the driving force behind the downward shift. The LMI’s Transportation Prices Index contracted for the first time in more than two years last month, registering 49.5. The deceleration was fueled by growth in transportation capacity, which soared to a reading of 69.1 from 61.7 in June, a level not seen since April 2019, when the freight sector experienced a recession. Prolonged price contraction and capacity expansion could signal another freight recession, but LMI researcher Zac Rogers said the industry is not there yet, and that a potential recession may be more targeted this time around.

“The difference between now and 2019, I think, is that a freight recession will be worse if you’re a smaller carrier—because gas prices are so high,” he said, noting that a large number of small carriers entered the market in 2021, capitalizing on strong freight demand and high prices. As gas prices remain elevated and demand slows, those carriers will be the first to suffer, Rogers added.

“What we’re seeing in trucking in 2022 is similar to what we saw in housing in 2008–small players paid way too much for assets,” he said. “The big players are doing fine … they are somewhat insulated. The real change is for smaller carriers who are reliant on high prices and a freight market that is skewed [toward] more demand than supply. They are all way overleveraged.”

Economic growth in logistics, overall, continues to be bouyed by warehousing and inventory metrics. Inventory Levels remain high and warehouses continue to struggle to hold and manage the volume. The LMI’s Inventory Levels index was 68.8 in July, down three points from June and well below March’s all-time high reading 76.2, but still in solid growth territory. The Warehousing Capacity index remained below 50–coming in at 47– continuing contraction that began in August 2020.

Logistics managers surveyed for the July report said they expect economic activity in the industry to remain in growth territory over the next 12 months. The Future Predictions index registered 62.1, in line with what managers predicted in June, according to the LMI report.

The LMI tracks logistics industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP). Visit the LMI web page for information on participating in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing