Rise in logistics applications drives global robot sales, IFR says

Growth factors include smart factories, warehouse e-commerce, and medical logistics.

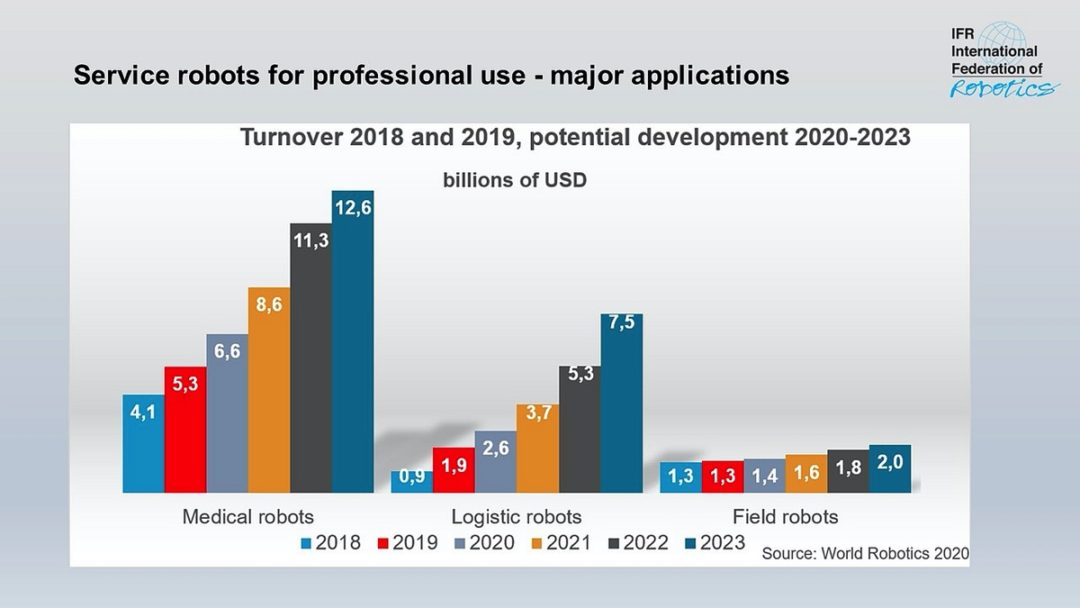

The sales value of professional service robots increased by 32% from 2018 to 2019, led by red-hot growth in logistics applications as compared to medical or field use, according to the International Federation of Robotics (IFR).

Counting all categories of use cases, global robot sales reached $11.2 billion in that period, setting the stage for continued growth under pressure from the Covid-19 pandemic, which is driving high demand for robotics disinfection solutions, robotic logistics solutions in factories and warehouses, and robots for home delivery, Frankfurt, Germany-based IFR said.

Measured by value, medical robot sales had the largest share, accounting for 47% of the total professional service robot turnover in 2019. Sales rose 28% to reach $5.3 billion, largely because robotic surgery systems are the most expensive type in the segment, according to IFR’s “World Robotics 2020 – Service Robots” report.

But logistics bots are growing much faster, jumping 110% to $1.9 billion worth of goods sold or leased over that period. Autonomous mobile robots (AMRs) have initially been used in warehouses but are swiftly catching on in smart factories, which could drive a continued strong turnover growth of 40% or more per year, the report found.

Another factor driving the sector’s strength is the robotics-as-a-service (RaaS) business model, which lowers the hurdle for customers to automate with robots by removing traditional requirements for capital expenditure, IFR said. In addition, the use of logistics systems in non-manufacturing industries has been supported by warehouse solutions for major e-commerce companies and by hospitals running medical logistics operations.

“The investment in service robots for logistics in manufacturing processes is amortized rapidly,” IFR President Milton Guerry said in a statement. “Assuming 24 hour operation, the investment in service robots for logistics may be repaid within 2‐3 years and often much quicker. Given a 15 year lifetime, operating costs are around 5% of the annual investment. Highly developed systems often provide operational availability in the 98% plus range.”

Looking at robotic applications in other segments, field robotics used for agriculture, dairy, and livestock farming saw their sales value increase by 3% to $1.3 billion. And service robots used for personal and domestic use, such as household bots for vacuuming, floor cleaning, lawn-mowing, and entertainment, recorded a rise of 20% $5.7 billion. Finally, service robots providing assistance for elderly or handicapped persons saw an increase of 17% to $91 million.

SERVICE ROBOTS Record: Sales Worldwide Up 32% – International Federation of Robotics reports https://t.co/K4e2I378rq #WorldRobotics2020 #servicerobots pic.twitter.com/D8YJ6AUnTM

— IFR Robots (@IFR_Robots) October 28, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing