CBRE: number of mega-warehouse leases dropped in 2023

Pandemic inventory rush recedes from 2022 peak, but demand remains historically high

Softening demand for industrial & logistics warehousing space resulted in fewer mega industrial leases of 1 million square feet or more in 2023, according to a report from CBRE.

The number of 1 million-square-foot lease signings fell to 43 in 2023 from a record 63 in 2022, as economic uncertainty and changing inventory management practices weighed on demand for big-box warehouse facilities.

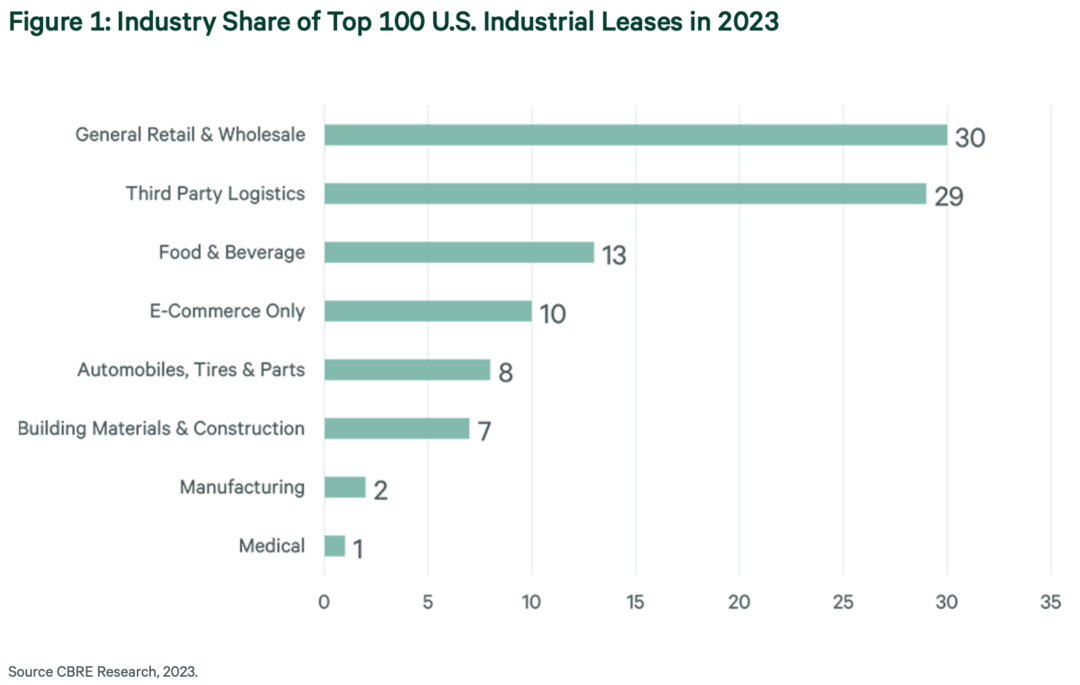

The users of those mega-warehouses is also shifting, as traditional retailers and wholesalers — previously leasing industrial space at a rapid clip — signed just 30 of the largest 100 leases last year, down from 53 the year prior. And meanwhile, third-party logistics (3PLs) companies responded to continued e-commerce growth by signing 29 of the top 100 leases in 2023, up from 11 in 2022.

Those 3PLs are seeing growth as they operate logistics and warehousing operations for multiple companies simultaneously, improving supply chain reliability and efficiency for many customers who may be seeking supply chain scale, CBRE said.

“Throughout the pandemic and shortly thereafter, many occupiers were forced to shift from a ‘just-in-time’ to a ‘just-in-case’ inventory management approach,” John Morris, president of Americas Industrial & Logistics for CBRE, said in a release. “This helped boost demand for warehouse space. While demand has now receded moderately, it remains historically strong. However, we do not expect as many mega industrial leases in the near and mid-term as we saw in 2022.”

By geography, the Pennsylvania I-78/81 Corridor led all markets with 17 of the top 100 leases, followed by Dallas-Fort Worth (DFW) with 11. Memphis was the top emerging market with nine of the top 100 leases, up from four in 2022. DFW led the nation for industrial leases of 1 million sq. ft. or more with eight, followed by the Inland Empire with seven.

Looking to the future, demand for mega-distribution centers is expected to rise in 2024 as the economy and rental rates stabilize, CBRE said. The large increase in construction last year will provide more opportunities for expansion, particularly in markets with the highest rates of speculative development: DFW, Atlanta, Phoenix, Indianapolis, and Columbus.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing