Home » Logistics economy contracted in November

Logistics economy contracted in November

Monthly Logistics Managers Index fell 7 points from October, driven by a rush to sell off inventory ahead of the holidays, industry researchers said.

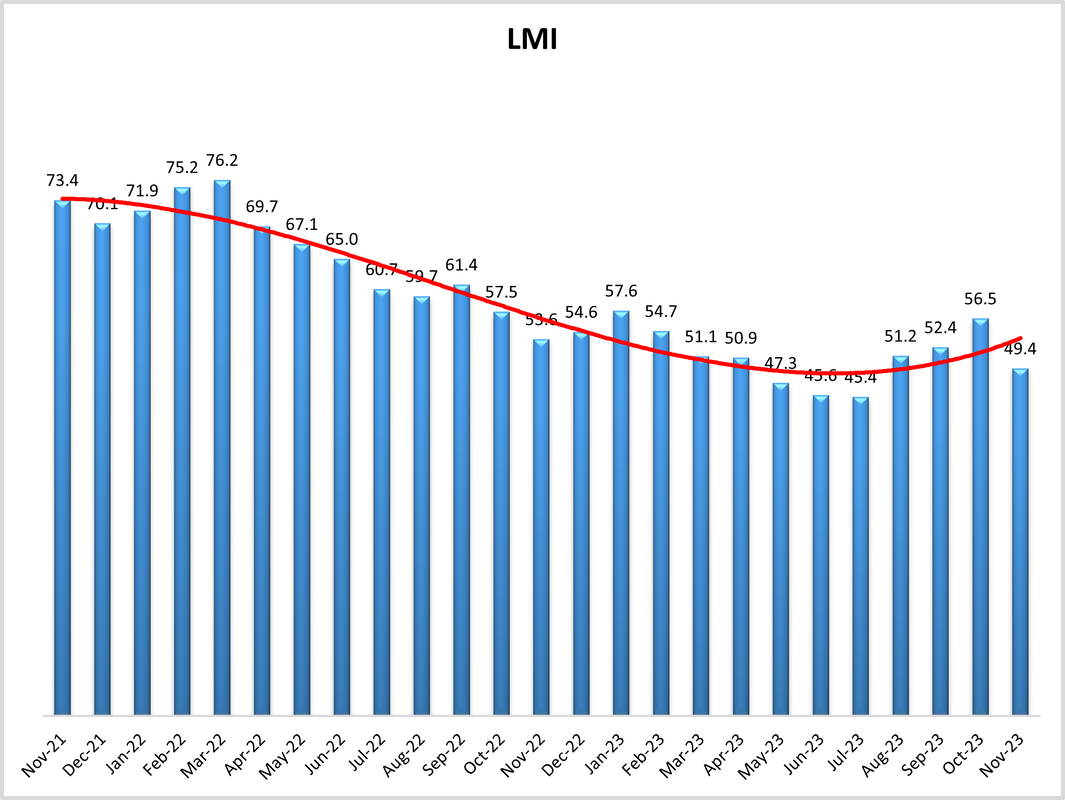

Economic activity in the logistics industry fell in November following three months of steady increases, according to the latest Logistics Managers’ Index report (LMI), released today.

LMI researchers attributed the slowdown to a decline in inventory levels due to fourth-quarter holiday sales and subsequent loosening of warehousing and transportation capacity as well as slowdowns in transportation and warehousing utilization. The LMI dipped seven points to a reading of 49.4 in November, just below the 50-point mark indicating growth across warehousing and transportation markets.

The LMI contracted for the first time in its history this past May and slid to an all-time low reading of 45.4 in July before returning to growth in August.

The researchers characterized the November contraction as mild and said logistics managers surveyed for the report remain optimistic about industry conditions over the next 12 months.

Inventory levels began to contract in the spring, although they expanded in October before falling 9 points to a reading of 44.3 in November. The trend reflects retailers’ and others efforts to better balance inventory over the past year-and-a-half, according to the report.

“Several large retailers, including Dick’s, Walmart, and Target, have purposely kept inventories low,” the researchers wrote, noting that Target’s inventory was down 14% year-over-year at the end of the third quarter. “This seems to be further evidence for the move toward JIT [just-in-time] strategies that we have discussed for the last several months in this report, as well as an explanation for the declining inventories we saw in November. Retail sales are expected to be up slightly from last year, so it remains to be seen whether cuts to inventory were too deep and will lead to missed sales, or if they are exactly what the doctor ordered after the inventory boondoggle many firms faced in 2022."

The LMI’s Future Conditions Index registered 57.4 in November, down slightly from what logistics managers predicted last month but still above what the industry has seen most of this year.

The LMI is a monthly survey of logistics managers from across the country. It tracks industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).

Publications & Associations Supply Chain StrategyKEYWORDS LMI LMI - Logistics Managers' Index

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing