Warehouse renters could see “significant” rate increases in 2024, Prologis says

National vacancy rate for logistics real estate remains at “very low” 4.8%

Logistics real estate remains tight in most markets around the U.S., and companies could see “significant rental rate increases” when they renew leases in coming months, according to a report from Prologis.

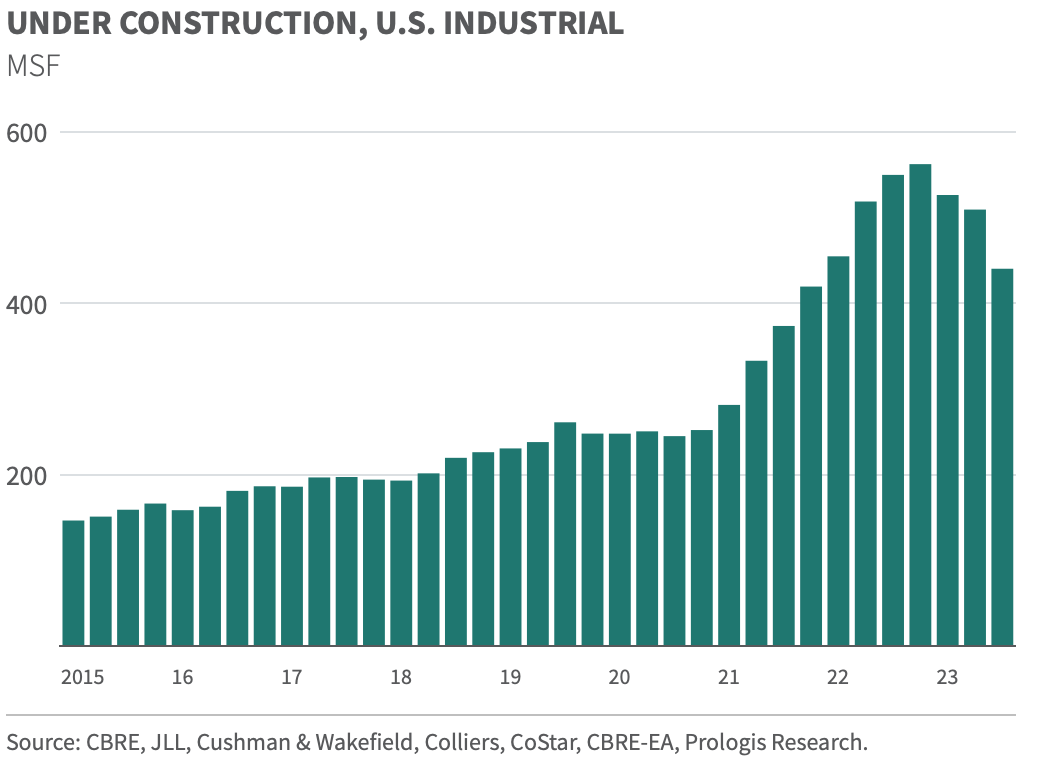

The national vacancy rate remains “very low,” stuck at 4.8% in comparison to a historical expansionary average of 6.1%, the company said. That condition continued even as the pace of new building deliveries quickened over 2023.

Because of the lack of available space, significant rental rate increases upon lease expiration will remain the norm, even as market rent growth normalizes from its blistering pace of 2021/2022. For example, U.S. rent growth totaled 85% from 2019 to the third quarter of 2023.

“As a result, we recommend that customers act quickly to take advantage of increased availabilities,” Prologis said in the report. “The U.S. logistics real estate market is under-going a ‘mini cycle’ that reflects a balance between short-term cyclical uncertainty and long-term adaptation to the future of retailing and supply chain demands. Customers are still expanding their real estate footprints, albeit at a normalized pace compared to the frenzy of 2021 and 2022. Some leasing activity is being delayed until 2024, and next year’s deliveries are poised to fall sharply, which should re-introduce scarcity to many markets.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing