Middle East violence triggers regional freight delays

Airlines, seaports, and factories slow operations as Israel and Hamas trade blows

Companies worldwide are flexing their supply chain schedules this week to avoid potential dangers associated with a flare-up of fighting between Israel and the Palestinian militant group Hamas, triggering the latest disruptions in an unpredictable year.

The October 7 terror attack and armed retaliation has not yet shackled major international trade flows, but it has caused cancellations and delays of certain air and ocean cargo routes in the region.

According to published reports, the U.S. carriers American Airlines, United Airlines and Delta Air Lines have suspended flights to and from Israel, in addition to overseas airlines including Air France, Lufthansa, Cathay Pacific Airways, Virgin Atlantic, and KLM. FedEx and UPS likewise canceled certain freighter flights. And on the water, the Israeli shipping line ZIM has alerted its customers about possible service disruptions.

Greater impacts are being seen at land-based facilities located near the fighting, with several Israeli sea ports now operating in an emergency mode, according to an analysis by Everstream Analytics. That has slowed cargo flows, since ships approaching those ports have been monitored by the Israeli Navy, which places restrictions on the loading and the discharging of potentially dangerous goods such as flammable, explosive, or chemical loads.

Shippers and carriers could also face financial repercussions, since the conflict has been driving up insurance costs for ships heading to Israel, in moves that could add up to increased premiums costing tens of thousands of dollars in additional costs to ships operating in the immediate area, Everstream said.

Production and manufacturing activities in the area are also being disrupted since the Israeli military is maintaining a closed military zone for villages and towns around the Gaza strip, requiring most citizens to either evacuate or shelter in place, thus shutting down all production activities. The three main sectors affected by that have been medical device, pharmaceutical, and chemical suppliers, according to Everstream.

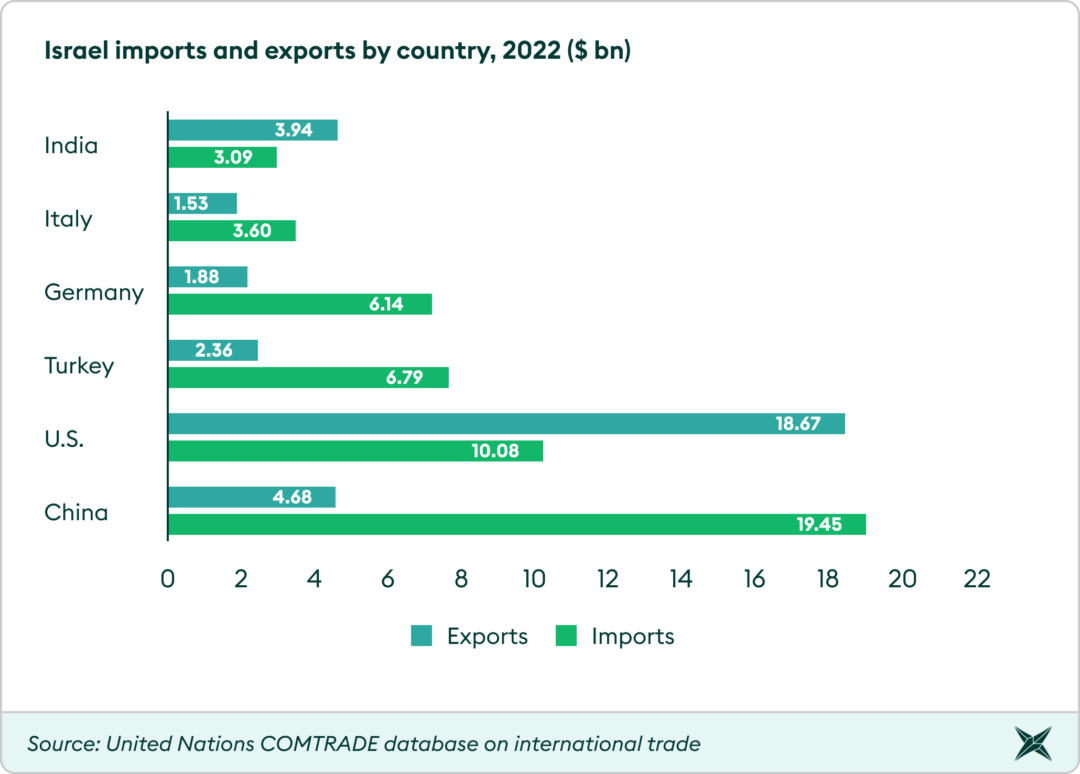

Looking farther out at potential impacts if the conflict lingers into coming weeks, other areas that could see delays include Israel's high-tech exports to China, as well as Israel's export to its other major trading partners: the U.S., Turkey, Germany, Italy, and India, according to an analysis by Container xChange. “The Israel-Palestinian conflict serves as a reminder of the uncertainties that ambitious trade projects like the India-Middle East-Europe Economic Corridor (IMEC) will face,which is perceived as a western counterpart to China's Belt and Road,” Christian Roeloffs, cofounder and CEO, Container xChange, said in a release.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing