ACT: trucking volume spike in August hints at turning point in the freight cycle

Retailers may be nearly done destocking excess pandemic inventory, turning back to fresh freight demand

Retailers may be nearing the end of a long effort to destock the excess inventory they accumulated during the pandemic recovery, and beginning to generate higher trucking demand as they seek to obtain new goods, according to a study from transportation analysis firm ACT Research.

However, analysts cautioned observers against too much optimism that the statistics heralded an end to the ongoing freight recession, saying it was too soon to say if they indicated a true turning point or just a “head fake.”

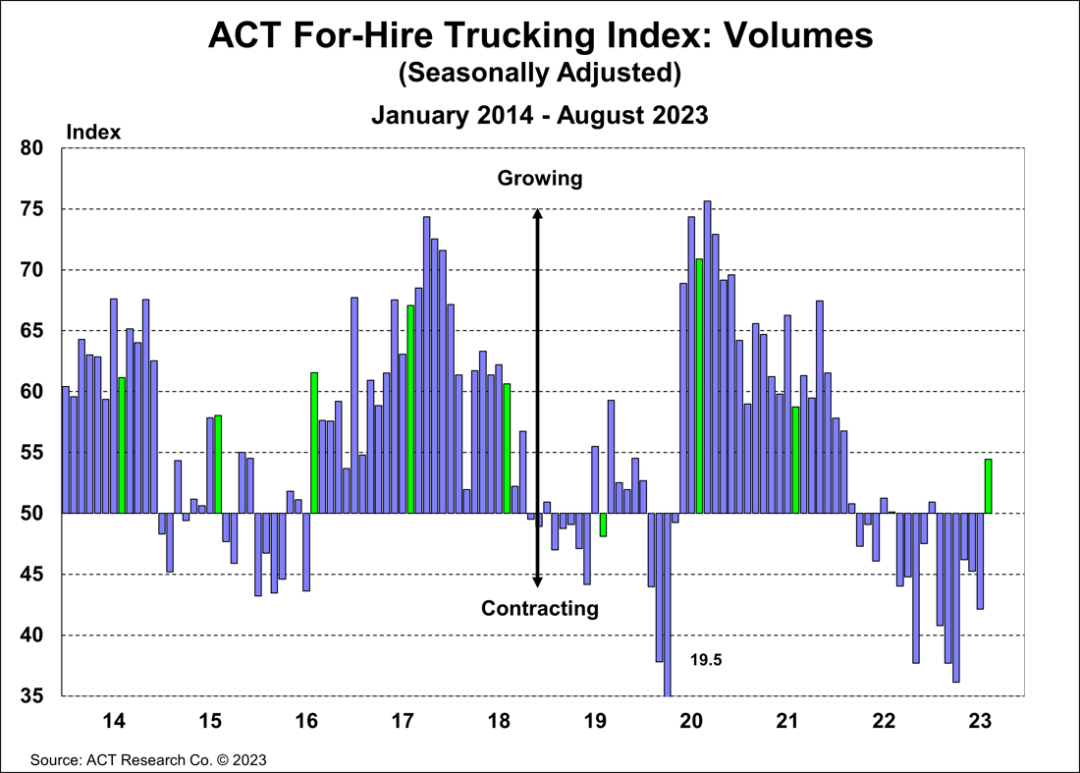

Columbus, Indiana-based ACT said the September version of its For-Hire Trucking Index suggests an approaching turning point in the freight cycle, but perhaps not as quickly as for-hire fleets would prefer.

The index measures monthly balances of volume, pricing, capacity, productivity, and drivers. Among those variables, the Supply-Demand Balance surged to 55.6, seasonally adjusted (SA), in August from 42.2 in July, in the first result above the neutral 50 level in 18 months. And the Volume Index notably jumped 12.3 points in August to 54.4, seasonally adjusted, from 42.1 in July.

“This is the highest result in 18 months, but our diffusion indexes measure the breadth of a signal, not the strength. This month’s number indicates volumes picked up for a big number of fleets in our survey, but it wasn’t necessarily a large increase. So, we wouldn’t suggest this means the freight downturn is over, but it is a considerable ‘green shoot’ that suggests the retail inventory destock is playing out,” said ACT’s vice president & senior analyst, Tim Denoyer.

While that’s an encouraging signal, the increase may not be indicative of a market turning point just yet, he said. “New Class 8 tractor sales are still near record levels, so while we observe capital discipline among for-hire fleets, we also think private fleets continue to grow. Driver availability also remains extraordinarily good for the diverse group of for-hire fleets in our survey. In our view, this probably isn’t enough yet to turn the tide in the spot market, but the market rebalancing is progressing and this should be a good leading indicator of better times ahead,” Denoyer said.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing