Flatbed truckload capacity tightens as construction and manufacturing loads rise

Demand could rise even further as agricultural areas enter produce season, DAT says.

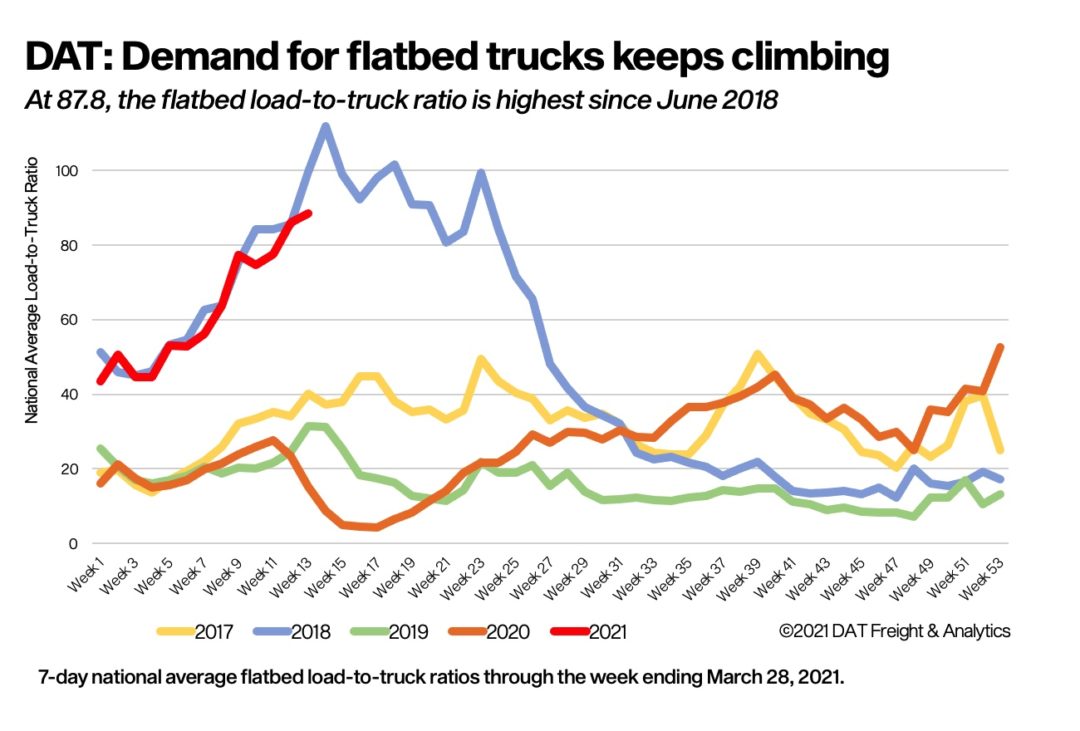

Demand for flatbed truckload services jumped to its highest point in nearly three years last week in response to rising volumes from shippers in construction, manufacturing, and other industrial markets, according to load board network operator DAT Freight & Analytics.

At the same time, flatbed capacity remained tight, as drivers tend to shift toward the higher pay, better per-mile rates and comparatively lower physical demands of hauling freight through van and refrigerated (reefer) modes, DAT said. As a measure of that tightness, the national average flatbed load-to-truck ratio was 87.8 last week, meaning there were nearly 88 loads on the DAT network for every available truck, the highest ratio since June 2018.

And looking ahead, flatbed capacity is forecast to become even more scarce as produce season looms around the corner, the Beaverton, Oregon-based firm said.

Counting other types of vehicles as well, the overall demand for trucks on the spot market continued to level out during the week ending March 28, DAT said. The total number of van, reefer, and flatbed loads posted was up 2.5% while the number of trucks fell 1%.

Comparing prices, the national average spot rate for flatbeds for the week was $2.75 per mile (19 cents higher than February), while the rate for vans was $2.66 per mile (24 cents higher) and for reefers was $2.94 per mile (25 cents higher), DAT found.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing