Canadian Pacific Railway bids $29 billion to buy Kansas City Southern

If approved by regulators, combined rail maps would create a U.S.-Mexico-Canada rail network just as three nations emerge from pandemic, prepare for USMCA trade boost.

Rail industry analysts are cheering yesterday’s news that Canadian Pacific Railway plans to buy Kansas City Southern for $29 billion as a smart way for both railroads to tap into a predicted industrial and commodity market rebound as the coronavirus pandemic begins to recede and the USMCA trade agreement takes effect.

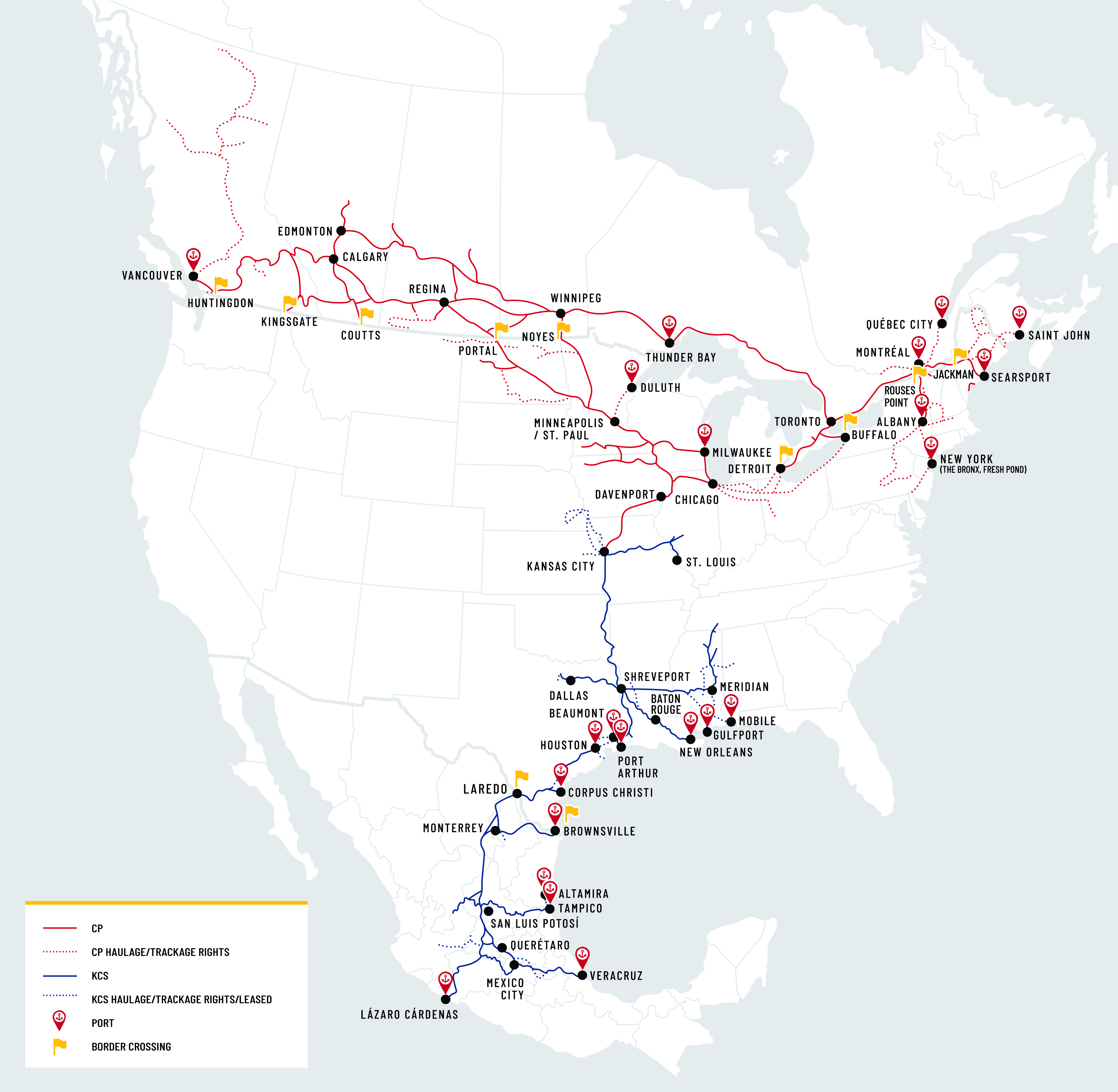

If approved by industry regulators at the U.S. Surface Transportation Board (STB), the deal would link two sprawling rail maps at their single point of contact—Kansas City, Missouri—creating the first U.S.-Mexico-Canada rail network and connecting ports on America’s Gulf, Atlantic, and Pacific coasts.

The new entity will be named Canadian Pacific Kansas City (CPKC) and be led by Canadian Pacific’s current president and CEO, Keith Creel. CPKC will make its global headquarters in Calgary, and designate Kansas City as its U.S. headquarters. The Mexico headquarters will remain in Mexico City and Monterrey, while Canadian Pacific’s current U.S. headquarters in Minneapolis-St. Paul will remain “an important base of operations.”

While still the smallest of six U.S. Class 1 railroads by revenue, the combined company would operate some 20,000 miles of rail, employ close to 20,000 people, and generate revenues of $8.7 billion based on 2020 financial results, Canadian Pacific said.

In addition to serving a rejuvenated domestic economy as the U.S. emerges from covid lockdowns, the merger would also benefit from an expected swell of international trade driven by the USMCA Trade Agreement between the U.S., Mexico, and Canada, Canadian Pacific said.

Specifically, the new line will focus on its customers in the grain, automotive, auto-parts, energy, intermodal, and other shipping sectors, saying its combined network will offer increased efficiency and simplicity, spurring greater rail-to-rail competition and supporting customers in growing their rail volumes.

“This transaction will be transformative for North America, providing significant positive impacts for our respective employees, customers, communities, and shareholders,” Creel said in a release. “This will create the first U.S.-Mexico-Canada railroad, bringing together two railroads that have been keenly focused on providing quality service to their customers to unlock the full potential of their networks. CP and KCS have been the two best performing Class 1 railroads for the past three years on a revenue growth basis.”

“The new competition we will inject into the North American transportation market cannot happen soon enough, as the new USMCA Trade Agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before,” Creel said.

Rail industry experts agreed, saying the proposed merger would likely gain STB approval, although that move might take longer than the timeline of mid-2022 predicted by Canadian Pacific. “We view this transaction as a strategically right-minded long-term play on improving the competitive position of the two smallest and arguably most growth-oriented Class I rails,” Bascome Majors, a transportation sector analyst for the investment firm Susquehanna Capital Group, said in a statement. “Zooming out farther, we also view this favorably as a levered mid-term play on an inflationary backdrop for the North American economy and many of the industrial and commodity end markets that KSU and CP serve.”

Likewise, another rail analyst said the timing of the deal matched up well with broader industry trends. “Today’s announced acquisition of KSU by CP is the largest industry deal in decades and would create a compelling U.S.-Mexico-Canada rail network. Rails broadly should continue to benefit from a cyclical recovery in carload growth and the longer-term opportunity to leverage PSR-enabled service improvement and cost advantages of the more environmentally friendly transportation mode into freight market share gains,” Garrett Holland, a senior research analyst with Baird Equity Research, said in a release.

In terms of its ability to operate the expanded network, Canadian Pacific noted that both companies already operate under “precision scheduled railroading” (PSR) principals, and that they would save additional time and money by avoiding the arduous freight interchange process now required for loads forced to change networks as they move through Kansas City.

That streamlined procedure will also allow the combined company to compete for freight loads now moved by trucks, thus shifting vehicle traffic off crowded U.S. highways, yielding in lower emissions and infrastructure upgrades. “Rail is four times more fuel efficient than trucking, and one train can keep more than 300 trucks off public roads and produce 75% less greenhouse gas emissions. CP is committed to sustainability and is currently developing North America’s first line-haul hydrogen-powered locomotive,” Canadian Pacific said.

Today we have entered into a merger agreement with Kansas City Southern that would join two historic railroads to create the first rail network connecting the U.S., Mexico and Canada.https://t.co/irU5Kzqdjo pic.twitter.com/P4yC1dbyLz

— Canadian Pacific (@CanadianPacific) March 21, 2021

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing