Truck fleets order new trailers in record numbers as covid recovery strains freight capacity

Trucking sector enjoys hot demand due to “intense stress” in consumer goods supply chain, but second virus wave looms, FTR and ACT say.

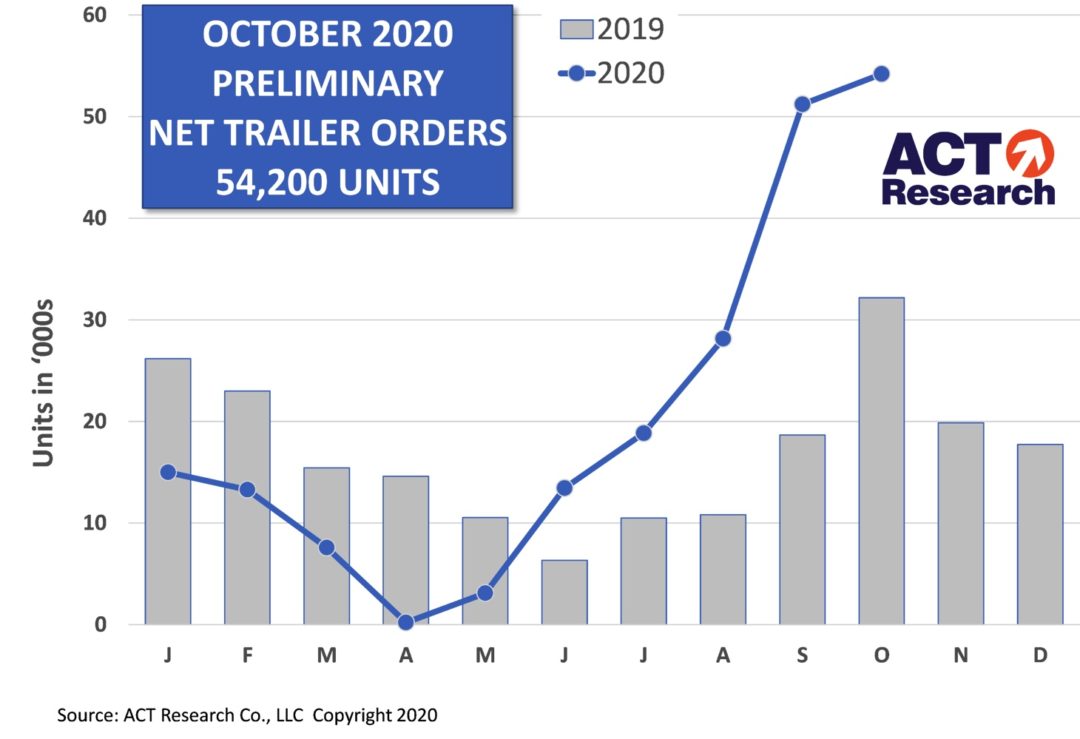

Trucking fleets continued a sharp rebound from pandemic recession conditions, ordering so many new trailers in October that the U.S. trailer industry recorded its third best month in industry history, according to a pair of reports.

The sector booked 54,200 net orders for the month, up 6% from September and more than 68% better than the same month last year, Columbus, Indiana-based ACT Research found in its “State of the Industry: U.S. Trailers” report.

“September’s rank as third-best month in industry history was short-lived, as October activity now takes that title,” Frank Maly, director of CV Transportation Analysis and Research at ACT Research, said in a release. “Fleet commitments over the past two months have now pushed industry backlog to the highest level since June of last year. Increases in both freight volumes and rates, along with capacity challenges, have influenced fleets to aggressively enter the market.”

The figures were similar to statistics released by the Bloomington, Indiana-based transportation analysis firm FTR Transportation Intelligence, which found that preliminary U.S. net trailer orders for October set an all-time record at an “astounding” 56,500 units, pushing that month’s orders up 9% over September and up 68% over the same period last year.

FTR pointed to three reasons for the boom in orders, saying first that the surge in consumer-based freight continues to strain capacity and boost freight rates. In addition, those healthy fleet profits are resulting in large trailer orders for replacement of older dry vans and reefers and also for expansion due to the chaotic freight environment. And finally, carriers are utilizing more drop-and-hook runs to compensate for the current driver shortage.

The growth comes as the pandemic has disrupted the supply chain and some essential components are having trouble making it through the pipeline fast enough, Don Ake, FTR’s vice president of commercial vehicles, said in a release. But even though the firm expects that bottleneck to be resolved over the next few months, conditions could still worsen if the current rebound in coronavirus infection rates continues to swell before a vaccine arrives.

“There are still significant risks due to the increase in positive Covid-19 tests,” Ake said. "The industry powered right through the summer despite rising infections. There is strong positive momentum right now, but it remains to be seen if possible new health restrictions will slow down the growth of freight. This industry is known for wild demand swings and we’ve gone from record low orders to record high orders in just seven months.”

Those same factors helped create strong freight rates, pushing FTR’s Trucking Conditions Index (TCI) for September up to its third highest reading since January 2010, rising to 10.69, up 2 points from August, the firm said.

The TCI tracks the changes representing five major conditions in the U.S. truck market: freight volumes, freight rates, fleet capacity, fuel price, and financing. It combines those metrics into a single index, calculated so that a positive score represents good conditions and numbers near zero show a neutral market.

Despite the encouraging signs of a strong freight sector, FTR warned that several other parts of the economy remained wobbly as the U.S. struggles to emerge from a coronavirus-triggered recession. For example, much of the demand now driving up freight rates comes from consumer spending, whereas an industrial recovery would support broader growth in freight volume, said Avery Vise, FTR’s vice president of trucking.

“We envision trucking conditions remaining strong for a while – probably well into 2022 – although we could see some near-term softness once we normalize retail inventories,” Vise said in a release. “Robust spot rates already are starting to push up rates in the much larger contract arena, and constraints on the driver supply stemming from the pandemic likely will maintain that pressure. However, continued strong economic recovery is not secured given the latest surge in COVID-19 infections and a political environment that likely makes further relief and stimulus more difficult. The road ahead is still not crystal clear.”

All-Time Record: Preliminary U.S. Net Trailer Orders at an Astounding 56,500 Units. View the full details here: https://t.co/YzsW5RLld7 #TrailerOrders #Trucking #SupplyChain #CommercialVehicle #Logistics #Transportation pic.twitter.com/NFxzhnwEM5

— FTR (@FTRintel) November 13, 2020

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing