Airfreight rates in May skidded to their lowest level since March 2020

Shippers are the dominant players in the market right now, as freight forwarders and airlines launch price wars for scarce cargo, Clive Data Services says.

General airfreight rates fell in May to their lowest level since March 2020 as restless airlines and freight forwarders went in search of volumes even as the calendar rolls toward the weaker summer months, according to a report from Clive Data Services.

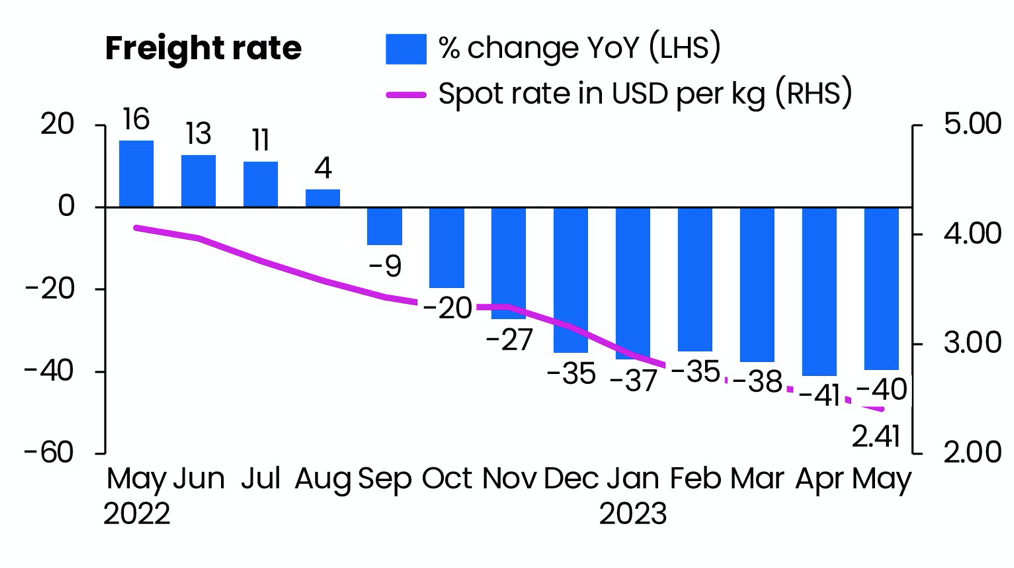

The global airfreight spot rate fell 40% in May from a year earlier, reaching its lowest level in over three years of $2.41 per kilogram, just days after IATA predicted airline cargo revenues and yields could fall by more than 31% and 29% respectively in 2023.

Air cargo demand actually saw a less severe year-over-year drop of just 1% in chargeable weight in May—the smallest monthly decline in the past 12 months—but cargo rates were tanked by the influx of belly capacity for the peak summer leisure travel market, which added a 14% increase in global air cargo capacity in May.

The other factor causing a drop in rates is fierce competition for scarce cargo volumes, said Niall van de Wouw, chief airfreight officer at Clive’s parent company, Xeneta. “There are a lot of ambitious forwarders in the market that want to grow – but they cannot grow with their current customer bases because the airfreight demand is not there, so, as we highlighted in April, they are looking to take a bigger share from someone else,” van de Wouw said in a release.

“At the same time, we see a lot of shippers going to market now because they want to refresh their rates and benefit from the different conditions to 3-6 months ago. Challengers for their business – not the incumbent freight forwarders – smell a chance to buy volumes and are going in and offering low rates. And, whether they get the business or not, the overall rates drop because shippers often stick with their current provider but expect them to adjust their rates accordingly to this lower market level,” he said.

The air cargo sector had a brief window of opportunity in May to capture freight from ocean routes, when several U.S. west coast ports shut down due to dockworker protests over labor contract negotiations and when the Panama Canal instituted weight limits on passing ships due to low water levels. But ocean freight demand is also slumping, so that dynamic will have little meaningful impact at a global level, Clive said.

“Shippers are the dominant players in the market right now, as freight forwarders and airlines are nervous of missing/losing the volumes that are actually offered in the market,” van de Wouw said. “It’s a time of ‘stick or twist’ for airlines and forwarders. Do they become more short-term driven and flick the ‘let’s-just-buy-the-volumes’ switch or do they sit it out? Do they take drastic action or hold their course? If companies become trigger happy in using such tactics, we could see more downward pressure on the air cargo market than the actual changes in demand/supply.”

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing