Logistics industry growth slowed in April

Inventory levels continued their downward trend, pushing the broader industry back toward more seasonal growth patterns, monthly business index shows.

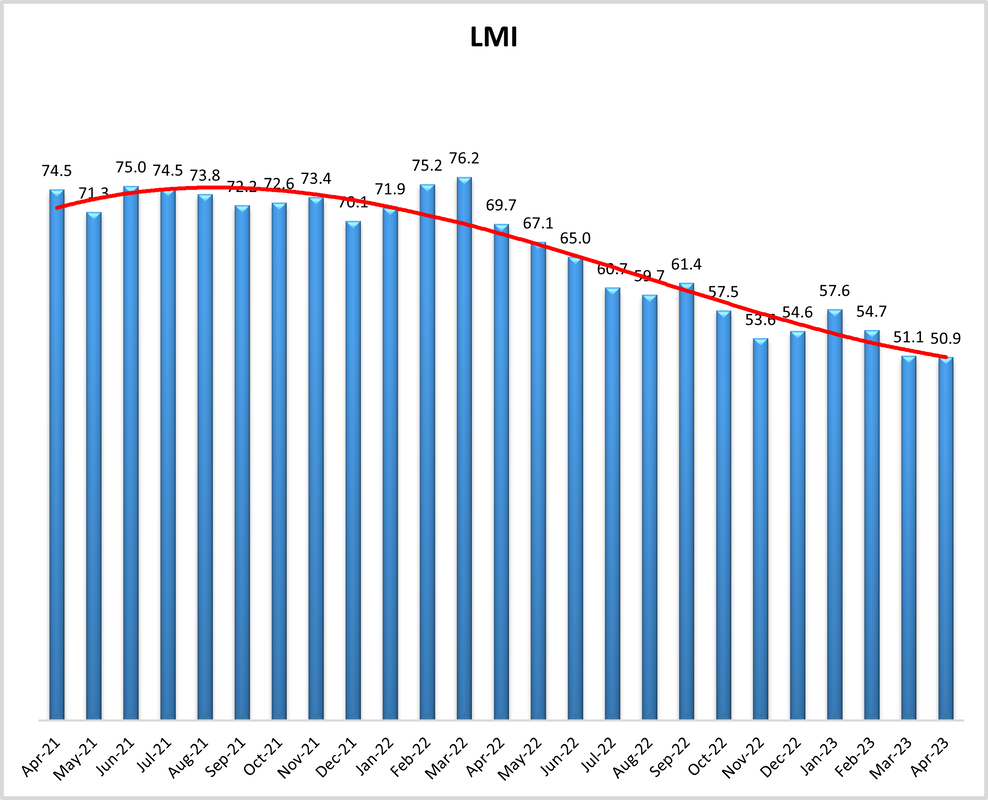

Logistics industry growth slowed to an all-time low in April, driven by a continued drawdown of inventories across the supply chain, according to the latest Logistics Managers’ Index (LMI) report, released this week.

The April LMI registered 50.9, down slightly from March and marking the lowest reading in the report’s six-and-a-half year history. Despite the drop, the index remained above the 50-point mark indicating expansion across logistics and transportation—a factor that may signal a return to normalcy after nearly three years of burgeoning demand for logistics services, driven by the pandemic.

LMI researchers said the April results indicate that logistics managers are getting closer to properly balancing their supply of goods and working through the glut many have been saddled with over the past year.

“In some ways, we are where we were hoping to be all through 2022 for inventory,” said LMI researcher Zac Rogers, assistant professor of supply chain management at Colorado State University. “Stuff is moving.”

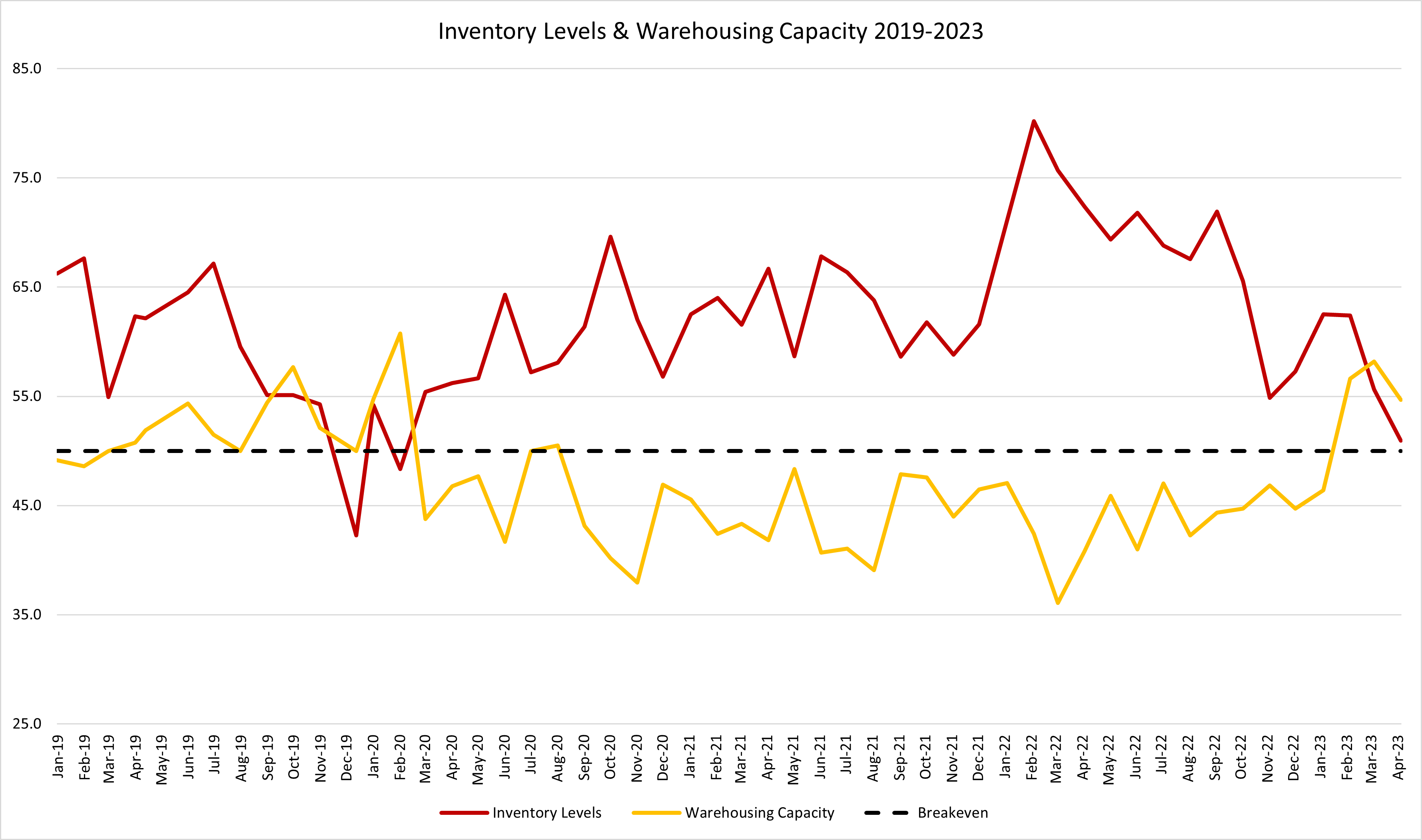

The drop in inventories led to a nearly 10 point drop in warehousing utilization, which in turn dragged down warehousing prices—particularly for downstream firms, including retailers. The warehousing prices index dipped below 70 for the first time since August of 2020. This follows a similar reduction in inventory costs, which dropped below 70 for the first time in two years in March.

An LMI reading at or above 70 indicates strong growth.

“The key takeaway is that inventories are moving back toward seasonality, which, in turn, is pushing warehousing back to earth,” Rogers said. “I think what that shows is that we’re getting more breathing room in the storage part of the supply chain.”

A slowdown in transportation markets continued in April. Transportation capacity continued to expand, remaining at a reading above 70. Transportation utilization edged up, and the prices index continued to contract, measuring 36.8. This reflects an economy driven by strong consumer spending on services and weaker spending on bulky goods such as cars and furniture, which fuel B2B shipping.

“Unfortunately for carriers, there are no signs of recovery yet [upstream], meaning that those that rely on moving larger, bulkier goods are still seeing large parts of their fleets sit idle,” the LMI researchers wrote. “The freight recession continues, even as several other sectors of the economy demonstrate resilience.”

The LMI is a monthly survey of logistics managers from across the country. It tracks industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP). Visit the LMI website to participate in the monthly survey.

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing