50% of shippers have increased their 3PL spend in past two years

Companies seek better efficiency, reduced costs, more flexibility, Coyote survey shows.

Corporate executives are becoming increasingly logistics-savvy as they seek ways to cope with demands like fast-and-free delivery and pandemic upheaval, and that shift has led to changes in the way that shippers use third-party logistics providers (3PLs), a report from Coyote Logistics shows.

Specifically, shippers are looking for the right blend of outsourced and in-house capabilities in supply chain management areas including procurement, transportation, and warehousing operations, according to Chicago-based Coyote, which is a unit of UPS Inc. providing 3PL services.

To find the best answer, many companies are giving supply chain its own seat in the boardroom, as 29% of shippers now have a chief supply chain officer (CSCO), Coyote found in an industry survey called “Supply Chain Outsourcing for the Win: How 500 Shippers Use 3PLs.” And the figure was even higher--36%--for companies with over $800 million in annual revenue.

The survey was conducted by third-party research firm CheckMarket and examined responses from 505 supply chain decision makers who answered a questionnaire between November 2022 and January 2023. Participants were employed in the sectors of retail, consumer packaged goods (CPG), manufacturing, automotive, food and beverage, and healthcare.

As they sharpen their supply chain expertise, companies are hiring more supply chain specialists, with 43% of shippers saying they grew their supply chain team’s headcount over the past two years, compared to only 16% who decreased it.

Many of those expanded teams are looking to 3PLs for better access to scalability, capacity, and expertise, Coyote said. Over the past two years, 50% of shippers increased their spend with outsourced providers, compared to only 12% that decreased spend. Not only did shippers spend more overall, but they did so with more 3PLs — 43% of shippers expanded their provider base, compared to only 13% who decreased it.

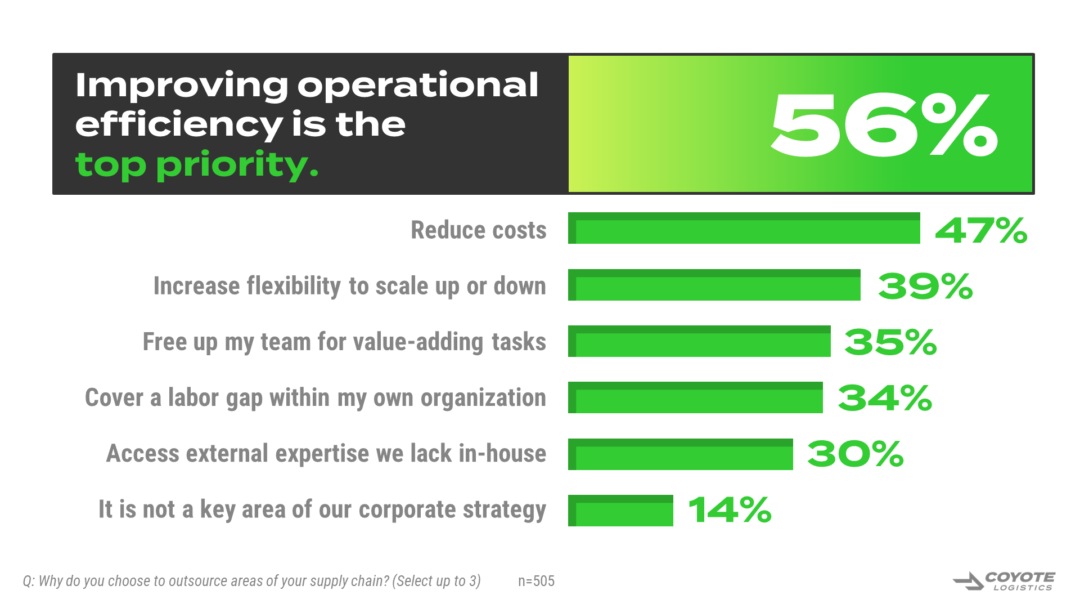

Shippers cited an array of reasons why they outsourced certain supply chain functions to 3PLs, lead by the top answer, improving operational efficiency (56%). That option was followed by: reduce costs (47%), increase flexibility to scale up or down (39%), free up my team for value-added tasks (35%), cover a labor gap within my own organization (34%), access external experts we lack in-house (30%), and it is not a key area of our corporate strategy (14%).

Related to that broad range of goals, various shippers have chosen different blends between outsourced and in-house logistics. Coyote asked respondents for their ideal balance between those two options in order to procure carriers, manage transportation, and manage warehousing, and found that only 22% handled all those tasks fully in-house. The remainder fell on a spectrum from 25% outsourced (21%) to 50% outsourced (25%) to 75% outsourced (17%) to fully outsourced (12%).

Related Articles

Copyright ©2024. All Rights ReservedDesign, CMS, Hosting & Web Development :: ePublishing